To no great surprise, Ontario’s budget for 2015 included a lot of transit spending, although the degree to which this is new money rather than old repackaged announcements is a tad vague.

The transportation portion of the budget, “Moving Ontario Forward”, begins on page 42 of the main budget document (which is page 74 of the linked pdf). The financial information can be confusing because projects are grouped in various sections depending on their source of funding.

To support Building Together, Ontario’s long-term infrastructure plan, investments of more than $100 billion over 10 years are underway, including $50 billion for transportation infrastructure. This is above the commitment to make $31.5 billion in dedicated funds available through Moving Ontario Forward.(p. 38)

In other words, there are now two pools of funding: the original $50b announced for the first parts of The Big Move, and a further $31.5b for recently green-lit projects. The original $50b is going toward various projects including:

- UP Express

- Mississauga Transitway

- vivaNext Rapidways

- Eglinton Crosstown LRT

- Finch and Sheppard LRT projects.

On the Finch and Sheppard projects, the Budget has this to say:

The Finch West and Sheppard East LRT projects, which will provide reliable and improved transit service on these busy corridors. The Finch West LRT will run along Finch Avenue between Humber College and Keele Street, and the Sheppard East LRT will run along Sheppard Avenue from Don Mills Station to Morningside Avenue. The procurement process for the Finch West LRT project is expected to begin later in 2015. (p. 39)

Additional investments not tied to specific project groups of funding streams include:

- The PRESTO fare card.

- Region of Waterloo’s ION LRT/BRT rapid transit project.

- Ottawa’s Confederation LRT line.

- Toronto’s streetcar fleet renewal.

- The Scarborough Subway Extension.

- Various highway projects. (pp. 40-41)

Moving Ontario Forward: Asset Optimization and Dedicated (Redirected) Taxes

This process began with the 2014 budget and, basically, involves land sales to fund infrastructure costs. In 2014, the target amount was $3.1-billion, but this has now been increased to $5.7b. The projects supported from this source include:

- Accelerate service enhancements to the GO Transit network, which will lay the foundation for Regional Express Rail (RER);

- Launch a new Connecting Links program, which provides funding for municipal roads that connect to provincial highways;

- Develop a new program to expand the natural gas network, which would help more communities generate economic growth; and

- Enhance regional mobility by investing in Metrolinx’s Next Wave projects of The Big Move, such as the Hurontario–Main Light Rail Transit project in Mississauga and Brampton, and rapid transit in Hamilton. (p. 43)

A further $25.8b (unchanged from the 2014 budget, see list on pp. 44-45) comes partly from tax revenues that are explicitly directed to the Moving Ontario Forward program. Some of this money is not yet in hand, notably contributions expected from the Federal Government.

A big chunk of Moving Ontario Forward is the GO Regional Express Rail (RER) scheme that has already been announced. The map in Chart 1.7 (at page 47) shows RER service to Oshawa, Unionville, Aurora, Bramalea and an unnamed point somewhere east of Hamilton, as well as service improvements on the Milton and Richmond Hill lines, plus the portions of the Stouffville, Barrie and Kitchener corridors beyond the RER limits. This is similar to information in the recent RER announcement, but with a notable difference regarding electrification:

The Province is also enhancing train service on all lines, including fully electrifying the Barrie, Stouffville and Lakeshore East corridors. (p. 47)

The description of RER service is also intriguing:

Regional Express Rail will deliver electrified service, at about 15-minute frequencies, along the following routes:

- Lakeshore East and Lakeshore West corridors, between Oshawa and Burlington;

- Union Station to Unionville on the Stouffville corridor;

- Union Station to Bramalea on the Kitchener corridor, including UP Express; and

- Union Station to Aurora on the Barrie corridor. (p. 47)

Given that the UPX will itself operate on a 15-minute headway, I hope that this description is merely a drafting error that has conflated two separate services in one corridor.

The Budget goes on to say that beginning in 2015-16, trains will be added on all corridors during various periods. This is an operating cost, not (in the main) a capital cost, and it is unclear whether this is coming from the “Moving Ontario Forward” pot or from general budgetary allocations to Metrolinx/GO.

Funding Partnerships

The budget is quite clear that Ontario is not going to build every project solely with provincial money.

The GO system, strengthened by the Province’s investments in RER, including on the Stouffville and Kitchener lines, will provide the backbone for a regional network. This network will also be the foundation for the SmartTrack proposal in the City of Toronto. Additional funding is needed to support key elements of this proposal, such as new stations along the route and an extension along Eglinton to the busy airport area. The SmartTrack funding proposal entails contributions of about $5.2 billion in new funding from partners, including the City of Toronto and the federal government. (p. 49)

At this point, Queen’s Park is not getting into a technology debate about the Eglinton West branch of SmartTrack and still describes this line as an airport service. However, as we will see later, the “Eglinton Extension” has been hived off as a separate budget item, and it is to be entirely funded with “partnership” money.

Another role for “partnership” funds lies in improvements to the Richmond Hill corridor with flood mitigation. It appears that Queen’s Park regards this as part of the larger bundle of projects that relate to core area capacity relief that should have money from more than one government. Whether Ontario would contribute anything is uncertain, and probably the subject of a future budget announcement if others come to the table.

The Next Wave

The Metrolinx “Next Wave” includes several projects that have not proceeded beyond lines on the map, but for which the province will continue planning and design work:

- Dundas Street Bus Rapid Transit, linking Toronto, Mississauga, Oakville and Burlington;

- Durham–Scarborough Bus Rapid Transit;

- Brampton Queen Street Rapid Transit;

- Toronto Relief Line; and

- Yonge North Subway Extension. (p. 51)

Moreover:

In addition to RER, the Province will work with related municipalities to move towards implementation of the Hurontario–Main Light Rail Transit project in Mississauga and Brampton, and rapid transit in Hamilton. (p. 51)

Exactly what “rapid transit in Hamilton” might be is not specified.

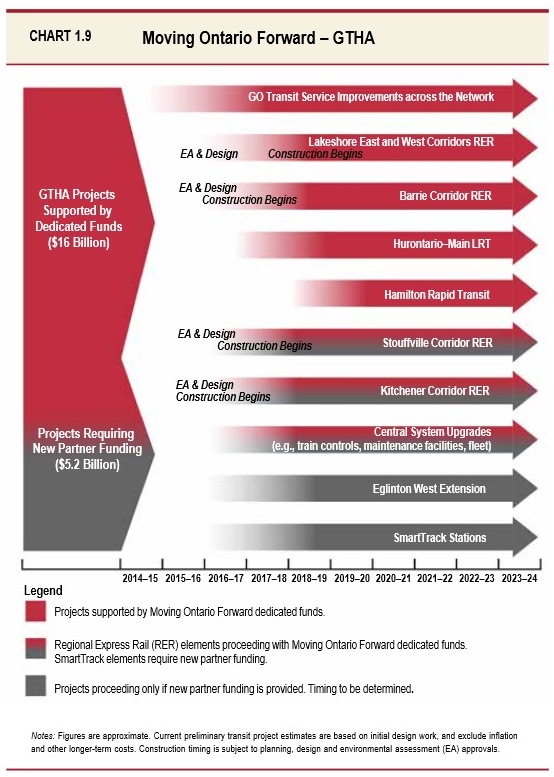

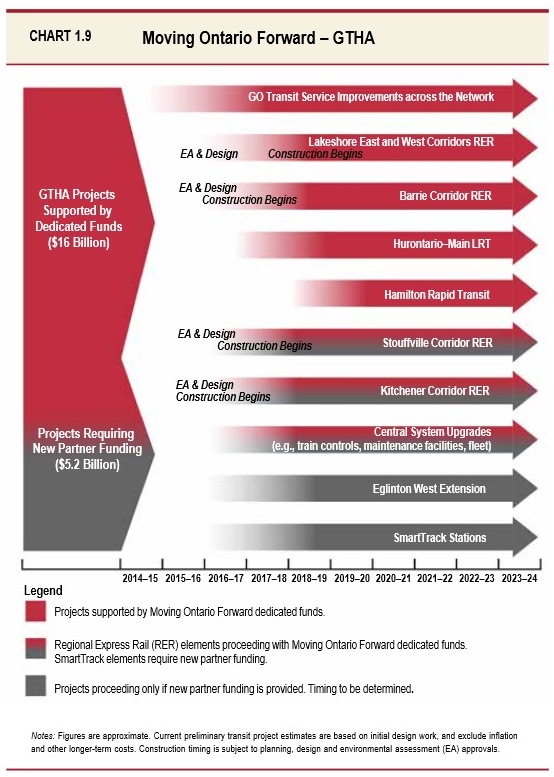

The status of various projects is summarized in the following chart (p.52).

As noted above, the SmartTrack elements of this plan at a cost of $5.2b are left for others to finance, and the Eglinton Extension is shown separately with 100% “new partner” requirements. An obvious place where Mayor Tory might save substantially would be to return to the Eglinton Crosstown LRT option for this segment, but we are unlikely to see any shift in his position until evidence from studies now underway shows just how impractical his SmartTrack scheme is in this regard.

What’s In and What’s Out

Notable by its absence is any reference to Waterfront transit which appears to be left in Toronto’s (or the tripartite Waterfront Toronto’s) hands. There is a generic reference to the proposed works at the mouth of the Don River, but nothing specific.

The status of route and technology selections in Scarborough is not touched both because this is a hot potato, and because legitimately Queen’s Park can point to studies now in progress that will sort out the potential role of various lines. Any move away from the subway option will not happen without a shift in Toronto Council’s position, and that is only likely if the project’s cost escalates well beyond the currently projected level.

Further enhancements to GO, notably on the Milton and Richmond Hill corridors, are topics for another day. In particular, Richmond Hill is unlikely to get serious attention until Queen’s Park and Metrolinx wrestle with the combined issues of routes serving the core area from the north and which infrastructure improvements make the most sense as a package.

No other Toronto rapid transit schemes are listed including perennial pet projects such as the Sheppard West and Bloor West subway extensions, nor is there any talk of enhancing the ongoing funding via gas tax revenue that contributes, in part, to the operating subsidy. Moreover, the question of funding accessibility is still clearly in Toronto’s hands.

The Budget doesn’t give Toronto everything it wants, and puts the City on notice that it has to come up with its own funding to address various problems, even if there might be a bona fide call on Queen’s Park for some areas.

At a minimum, there is more definition to what the government claims it will do in coming years. The challenge will be actual delivery, something for which the Liberals at Queen’s Park don’t have a good track record.