At its meeting on October 22, the TTC Board will consider a report setting out plans to purchase new buses, streetcars, subway trains and Wheel-Trans vans in coming years.

TTC Fleet Procurement Strategy and Plan

In an important departure from typical practice, the City is setting out its position including what can be achieved with already-committed City funding without waiting for confirmation of contributions from other governments. Both the provincial and federal governments will face voters sometime in the next few years, and this, in effect says “come to the table”.

The plan has many strong points although some important details are missing. Key to this plan is that it is a system plan, not a scheme for one tiny chunk of the network nor a flavour-of-the-day announcement from one politician.

Overview

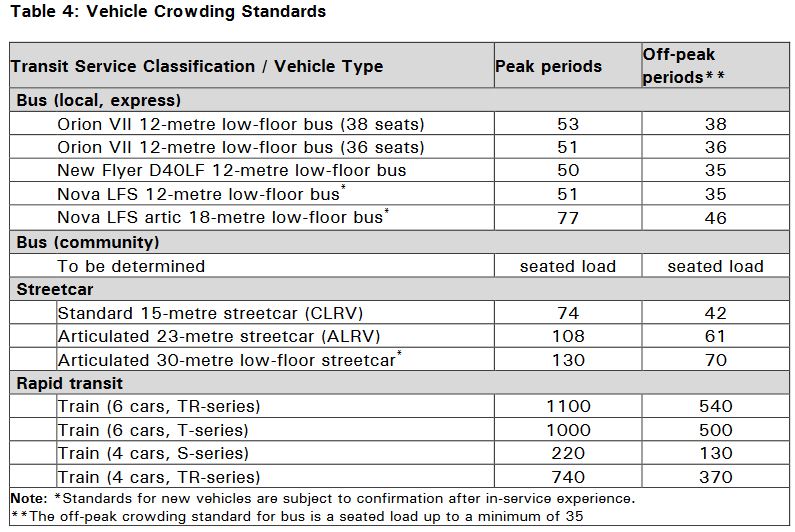

The TTC proposes acquisition of hundreds of new and replacement vehicles over the coming years:

- From 13 to 60 new streetcars from Bombardier to be delivered between 2023 and 2025.

- Approximately 300 hybrid-electric buses for one or both of the two qualified suppliers to be delivered between 2022 and 2023.

- Pending outcome of technical evaluation and product comparison work now underway, approximately 300 all-electric long-range buses in 2023 to 2025.

- 70 Wheel-Trans buses for delivery in 2022 and 2023.

- 80 subway trains to replace the existing fleet now used on Line 2 and to provide for future service improvement with ATC (automatic train control).

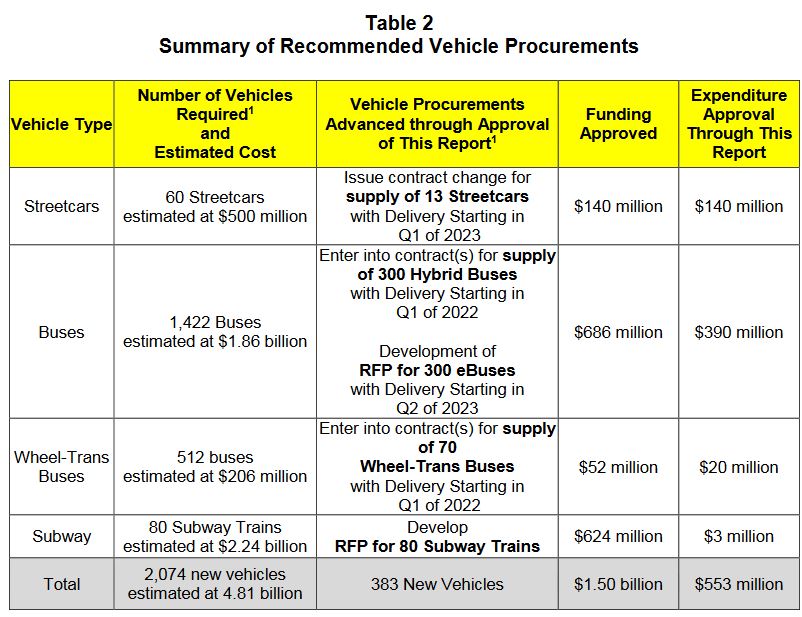

That list is only part of a larger scheme shown in the table below.

The “ask” for funding on these projects is based on the full quantity of vehicles (column 2 above) as opposed to what the TTC can achieve with only the City’s contribution (column 3).

A political problem for the TTC is that they are seeking funding for the ten year plan within the next few years even though some of the spending is in the latter part of the decade.

For example, the buses are unlikely to be contracted on one big purchase that would lock in a single supplier, and a new contract would be tendered two or three times during the decade. Similarly, the quantity of Wheel-Trans buses represents far more than one fleet replacement (as of June 30 there were about 280 WT buses). Part of this funding would not be required until late in the decade when the next purchases would be at end-of-life.

Commitments that far off are unlikely to be made by either the provincial or federal governments both of which would face at least one if not more elections in the meantime.

A further issue is that there are many more projects in the TTC’s long-range capital plan than the ones listed here, and there is no sense of relative priority for things like ongoing infrastructure maintenance. If the vehicles program soaks up all available funding, other projects could find that the cupboard is bare.

Missing from this report is an overview of the cash flow requirements for each project and the point at which money for each component must be secured. Projects with long timelines such as ATC installation need early commitment even though they would not finish until late in this decade or possibly longer. The same does not apply to the cyclic renewal of the bus fleets and some of the associated infrastructure.

To support the electric vehicle purchases, the TTC together with Toronto Hydro and Ontario Power Generation (OPG) are working on plans for the charging infrastructure that will be required to move to a zero emissions fleet by 2040 in regular buses, Wheel-Trans and non-revenue vehicles.

The subway train order will likely grow because Metrolinx would piggy-back the needs of the Yonge North extension to Richmond Hill and the Scarborough extension to Sheppard for economies of scale and consistency of fleets on the two major rapid transit lines. However, the cost will be on Metrolinx’ account because these are now provincial projects. There is a danger that if future provincial funding is constrained, the provincial projects could elbow aside requests for local projects.

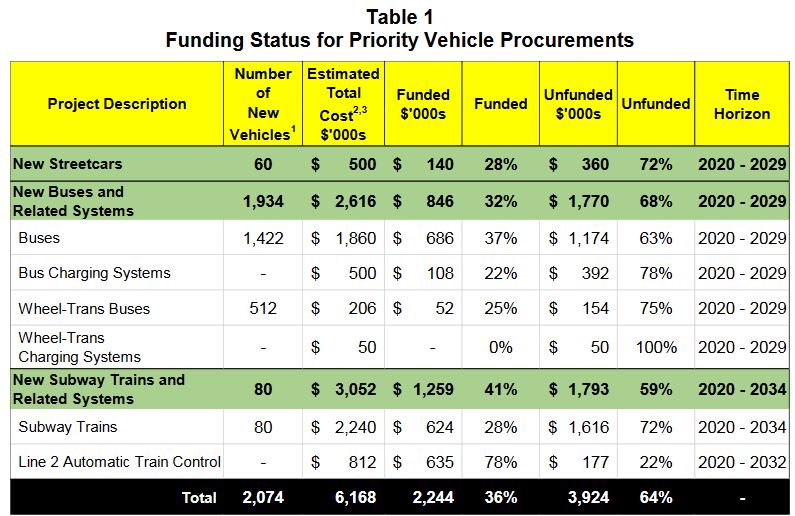

The committed and required funding amounts are set out below.

1: Number of Vehicles reflects the current fleet plan as described under the Comments section of the report.

2: Estimated Total Costs includes the following: (1) vendor contract payments for vehicle design, production, delivery and commissioning of vehicles; and (2) delivery costs including procurement, project management, engineering, quality assurance, and project contingency

3. Total Estimated Cost has been revised from $5.84 billion (Class 5) to $6.17 billion (Class 4).

The City’s share is provided by the City Building Fund, a supplementary property tax introduced in the 2020 budget, together with funding that had been allocated to a planned rejuvenation of the Line 2 subway fleet for an additional decade of service. Now that those trains will be replaced, the money set aside to refresh the old fleet is available for this project.

| City Building Fund Project | $ millions |

| Bloor-Yonge Station Expansion | $500 |

| Line 1 Capacity Enhancement | $1,490 |

| Line 2 Capacity Enhancement | $817 |

| Line 2 Automatic Train Control | $623 |

| Other Critical Subway State of Good Repair (Note 1) | $160 |

| New Vehicles and eBus Charging Systems | $1,140 |

| Total City Building Fund | $4,730 |

The vehicle procurements are funded on the City side by a combination of CBF monies (see above) and the previous allocation for renovation of the Line 2 fleet of T1 trains.

| Project | $ millions |

| 80 New Subway Trains | $ 623 |

| T1 Overhaul and Maintenance to 2030 | $ 74 |

| Procurement of Buses | $ 686 |

| eBus Charging Infrastructure | $ 64 |

| Wheel-Trans Buses | $ 22 |

| New Streetcars | $ 140 |

| Total | $1,609 |

| Existing Approved Funding (T1 Life Extension) | $ 474 |

| City Building Fund | $1,140 |

| Total | $1,614 |

Combining the $1.61 billion above with the Line 2 ATC funding brings the City’s total to about $2.2 billion. The TTC and City invite their partners at the provincial and federal levels to make up the difference of just under $4 billion between City allocations and the total required for this portion of the overall capital plan.

The City’s strategy is to start spending its $2.2 billion and hope that the other governments will come in for their share. There are elections at both levels that could provide some leverage, but there are also problems with Toronto’s appetite for capital compared to other parts of Ontario and Canada.

Continue reading