Updated April 10, 2022 at 10:30pm: Minor typos fixed. Bus order size for eBuses by TTC corrected. Reference to use of pantographs for charging on TTC buses corrected.

Updated April 18, 2022 at 2:50 pm: Note that the GHG savings cited in the TTC’s chart below are off by a factor of 1,000 because they mixed up kilos and tonnes partway through the calculation. See also TTC eBus Errata: Tonnes and Kilos Are Different.

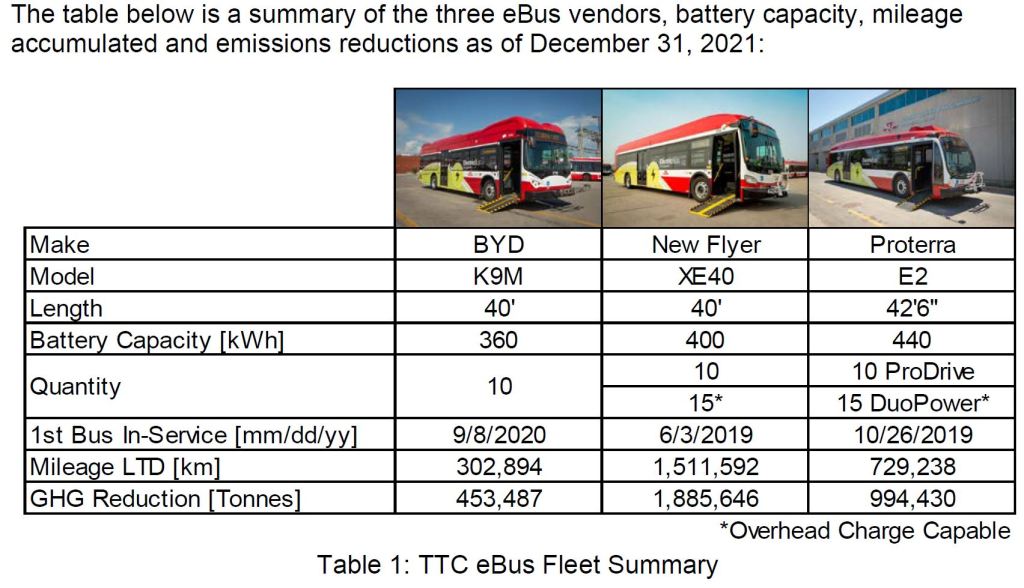

Since June 2019, the TTC ran head-to-head trials of three manufacturers’ battery-electric buses with a fleet of 60 vehicles:

- New Flyer models SR2304 (10) and SR2382 (15)

- Proterra models Catalyst 40 E2 RR Pro Drive (10) and DuoPower (15)

- BYD model K9M (10)

Nova Bus was not part of the trial because, when it was launched, they did not have a vehicle with sufficient range to meet the specifications. However, their hybrid diesel-electric bus, of which the TTC has many, was used as a comparator for the trial.

The low number of BYD buses was due to their inability to supply vehicles even though their lobbyists had engineered, through Deputy Mayor Minnan-Wong, a “deputation” at a TTC Board Meeting that turned into a full sales pitch clearly hoping to short-circuit the procurement process. This was not a high point in TTC history, and the move to a green fleet was launched under very dubious circumstances.

There is also bitter irony for those who remember TTC history. Three decades ago, the TTC opted for the allegedly-green technology of Natural Gas buses as a replacement for trolley bus system expansion. The CNG buses are long gone from Toronto, and the TTC now plans to move completely to electric transit. Lobbyists are good at selling things – whether they work or not is a secondary consideration.

The 102 page report TTC’s Green Bus Program: Final Results of TTC’s Head-to-Head eBus Evaluation goes into great detail of Toronto’s experience with their trial fleet and sets out many “lessons learned” and “must haves” for any large-scale procurement. This article is organized somewhat like the report with an overview followed by some of the technical background. The “lessons learned” have been consolidated at the end. Interested readers should consult the full report.

The clearly superior vehicles in the trial were the New Flyer buses. There were severe problems with reliability and maintainability in both the Proterra and BYD fleets, and some of the “must haves” would exclude them from consideration even if both vehicles and manufacturers had performed better.

Whether this technical outcome will be coloured by another round of lobbying remains to be seen. There will be a lot of money sloshing around as governments rush to “buy green”, but running transit requires a fleet that delivers reliable service, not just publicity photos. Toronto cannot afford to tie the future of its bus fleet to a manufacturer whose political connections outweigh their ability to deliver good products.

The TTC has funding in place from various governments to cover the purchase of about 600 vehicles. These will meet its replacement and growth needs from 2022 to 2025. In February 2022, the TTC ordered 336 buses for delivery by the end of 2023:

- Nova Bus LFS Hybrid 40′ (134)

- New Flyer Xcelsior Hybrid 40′ (134)

- New Flyer Xcelsior Hybrid 60′ (68)

These will be the last buses with diesel propulsion for Toronto, and they would be due for replacement in the mid 2030s completing the conversion to an all-electric bus fleet.

An RFP (Request for Proposals) was issued on April 4, 2022 for a large purchase (at least 240 vehicles) of eBuses with contract award planned for the third quarter of 2022. This lands in the middle of the municipal election campaign, and the authority to award will be delegated to TTC management by the Board. Bids will close on June 17, and the successful vendor(s) would be notified in July with execution of agreements in August. (The last scheduled TTC Board meeting is on July 14, 2022.)

The specification for these buses was developed jointly by the TTC with other agencies:

The TTC is engaged with other peer transit agencies in the province, including Brampton Transit, Mississauga Transit, York Region Transit, and others through the Ontario Public Transit Association on the first interagency co-operative procurement of eBuses. The aim of this collaboration is to develop a single zero-emissions bus procurement specification with the immediate benefit of reducing cost through economies of scale. The long-term benefit is through the optimization and standardization of customer experience and, operations and maintenance throughout the GTHA and beyond.

TTC Report at p. 4

The potential quantity of buses is considerably higher with options for both the TTC and other agencies.

In parallel to its migration to an electric fleet, the TTC must convert its bus garages including the provision of charging infrastructure for hundreds of vehicles at each location. At a previous meeting, the Board authorized an agreement with Ontario Power Generation and Toronto Hydro for the charging infrastructure. The utilities will build, own and maintain this as an extension of their distribution system.

Although the specification includes a requirement for on-route charging using stationary charging points, the TTC has not yet determined if or how such facilities would be used. There is no consideration of “in motion” charging using conventional trolleybus infrastructure to avoid the need for buses to lay over to recharge during their revenue service hours.

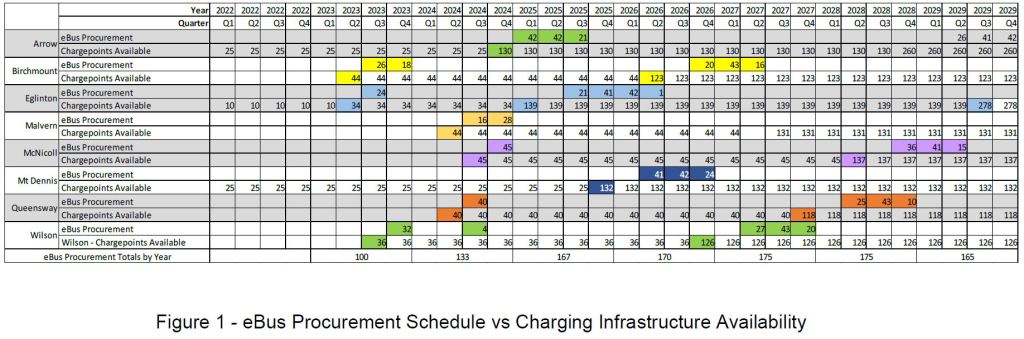

The overall plan for both buses and charging infrastructure is shown in the table below grouped by garage. This accounts for 1,085 buses, about half of the existing fleet. The first 240 buses planned in the contract award this year would take the TTC into early 2025. The program is not funded yet beyond that point. As and when more money appears, the TTC would extend its order.

Note that there are two phases to the installation of charging facilities at garages as the roll out of electrification works its way through the system. This allows some routes from each garage to operate with eBuses earlier in the program than might be practical if the conversion went garage-by-garage over the next decade.

The two-step scheme would also allow for a tactical change in charging strategy to move more of this to enroute facilities such charging stations at terminals. Although the TTC report is mostly silent on any charging technique beyond garage-based plug-in systems, there is a reference in “lessons learned” to a conversion to pantograph charging as a cure for problems with charging cables.

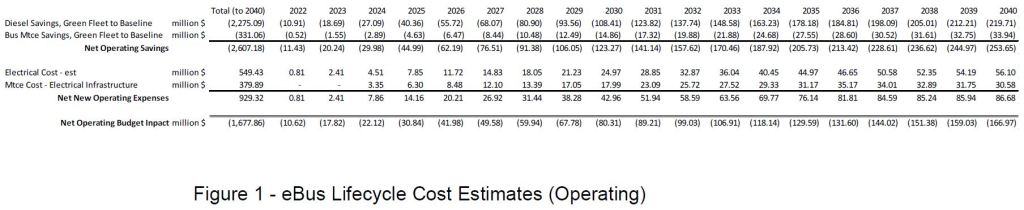

The TTC projects that life cycle costs for an electric fleet will be lower than for the diesels and hybrids it will replace because both energy and maintenance costs will go down. By 2040 this would save about $167 million annually. These estimates are sensitive to the future price of diesel fuel compared to electricity, but the TTC has not shown a range of values to indicate what the effect might be.

An 18-Year Design Life

Although the TTC report does not mention this, the actual RFP includes an interesting specification for fleet longevity. This signals a return to 18-year lifespans for the bus fleet after a retreat to 12 years in current fleet planning. If this can be achieved, it will offset the higher capital cost of the vehicles compared to hybrids or diesel buses.

1.1.1 The Bus shall have an 18-year design life and be equipped with a long life structure in accordance with Specification Section 1.8, made from full stainless steel in accordance with Specification Section 3.0, have a body with a maximum overall length of 12.8 m (42ft.) including a stowed Bike Rack , 2.59 m (8 ft.-6 in.) in width and a maximum overall height of 3.4 m (134 in.).

RFP Technical Requirements Section 1, Page 6

Later in the RFP:

1.8 SERVICE LIFE

Buses shall be designed for a minimum service life of 18 years or 1,610,000 km (1,000,000 mi.), under severe operating conditions similar to revenue transit operation in the City of Toronto.

RFP Technical Requirements Section 1, Page 19

And in more detail:

The vehicle design life shall be validated by successful completion of a simulated 12-year average New York City duty cycle service life. The test program shall be designed around input measurements taken from a vehicle configured similarly to the test vehicle while it’s being operated over a known severe route. The New York City B.35 route or an approved equivalent (i.e., the Queens Q.44 route is now reportedly used by New York City), shall be used for a simulated 800,000 km (500,000 mi.) to demonstrate Bus longevity. This is generally considered to be the equivalent of 16 to 18 years operating life at all

RFP Technical Requirements Section 1, Page 20

other transit properties.

“Must Have” Specifications

An important outcome of the trial has been the development of a “must have” list, and certain aspects of any new fleet are not negotiable. Toronto has a history with every type of vehicle (subway, streetcar, bus) where pervasive problems have hobbled fleet performance and availability.

TTC’s next large-scale eBus procurement includes ‘must have’ requirements that are informed by the head-to-head evaluation and focus on ensuring longevity of the bus structure and high system reliability through a proven platform (e.g. stainless steel structure, doors, HVAC, suspension, etc.).

TTC Report at p. 2

These requirements are:

1. Altoona and shaker table testing has been successfully completed;

TTC Report at p. 24

2. A full stainless steel structure with a minimum of six years of in service experience;

3. A minimum usable battery capacity of 400 kWh;

4. A maximum overall bus length of 12.8 m (42 ft.) including a stowed bike rack;

5. A maximum overall height of 340 cm (134 in.) including any roof-mounted equipment;

6. Ability to charge via roof mounted pantograph charging interface, capable of accepting a minimum charge rate of 300kW (400 ADC) at 750 VDC or greater via SAE J3105/1; and

7. Two rear-mounted charging ports capable of accepting a minimum charging rate of 150 kW (200 ADC) at 750 VDC or greater via SAE J1772.

Requirement 3 conflicts with statements elsewhere in the report where a maximum length of 40 feet is cited so that buses will fit within existing garage designs and operations. The difference appears to be in whether the bike rack counts toward the total, but it is not clear whether the Proterra bus would meet this requirement.

Physical Compatibility: The industry standard bus length is 40-feet (12 metres). This standard was used to design storage facilities in the TTC’s existing bus garages.

The Nova HEV, BYD, and NFI buses meet this standard. Proterra buses are 42.5 feet long, but also offers the highest seating and standee capacity. Based on our bus garage layout, procurement of additional Proterra buses would result in a loss of storage capacity of approximately 10% at four of eight garages. The remaining four bus garages could accommodate this additional length. However, this would impose a significant operational constraint that would prevent movement of buses between garages.

TTC Report at p. 15

A maximum bus length specification of 40 feet is required in order to preserve bus storage density at existing maintenance facilities; …

TTC Report at p. 16, also p. 28, under “Lessons Learned”

It is not clear whether the TTC is prepared to accept buses over 40 feet long, and what position they will take about Proterra vehicles on that account. Other issues with that vendor, notably bus reliability, might knock them out of the running regardless of bus length.

An additional requirement applies to the contract itself rather than to the buses, and it addresses the City’s equity goals:

In support of the commitment to diversity, equity, and inclusion, the Contractor must agree, as a fundamental component to the Contract, to meet the Procurement Equity Requirements, by applying a percentage of the Contract Price in respect of the Diverse Business Enterprise Requirement and a specified number and percentage, as stated in the Proposal, in respect of the Equity Hired Requirement.

TTC Report at p. 7

This is a contrast to recent provincial actions to back away from equity and community benefit components in contracts.

Technical Review

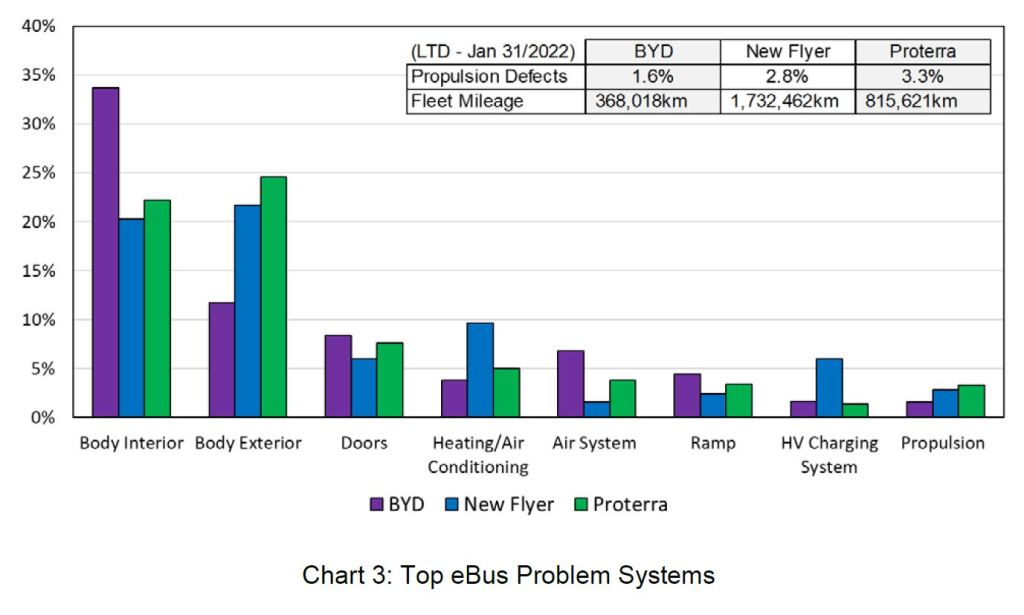

Vehicle Reliability

Of particular interest in the review of three electric fleets, the majority of problems lay not with the propulsion and charging systems, but with the physical bus and subsystems that are common to all vehicles such as doors. This suggest that the primary skill for a vendor is simply being able to build a vehicle that does not fail physically, as opposed to one with whatever the latest technology might be.

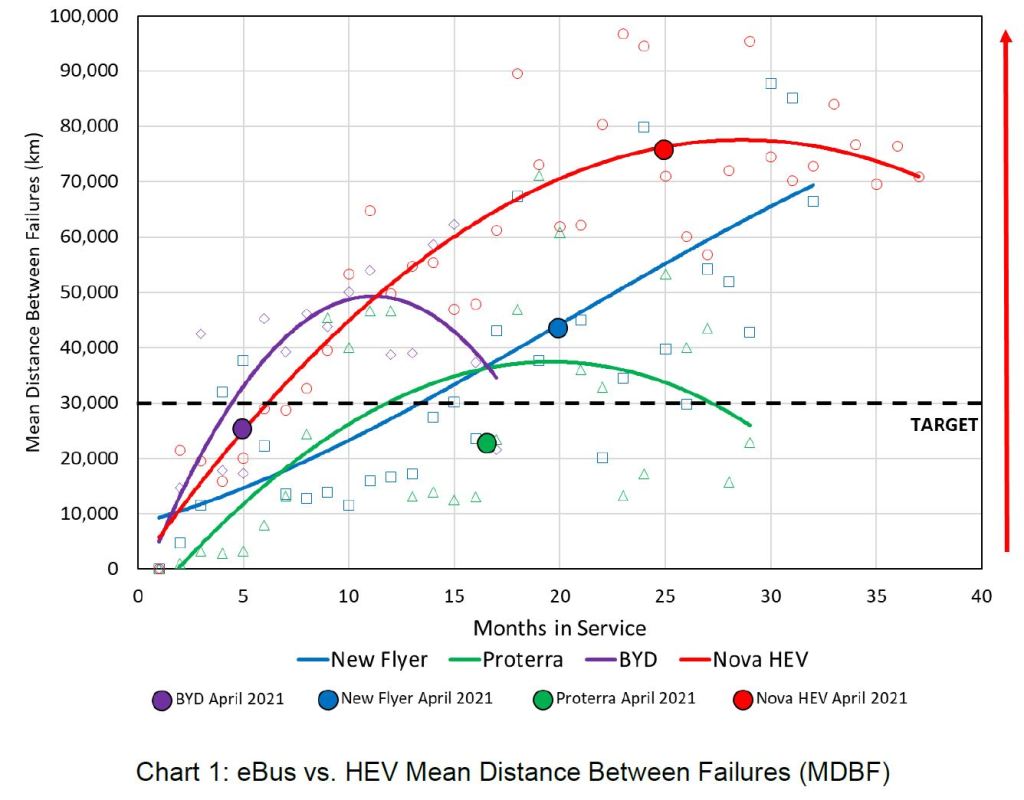

The mean distance to failure typically starts out low with new vehicles thanks to problems that only appear in revenue service, but then should build up to better results. Note that a “failure” is defined as a fault that requires a bus to go out of service and/or causes a service delay of five minutes or more.

The chart below compares performance of the NOVA Hybrid Electric buses now in service with the three electric fleets. Note that data for each fleet are constrained by the point when vehicles were first available for service with BYD bringing up the rear. Flyer vehicle stats continue to improve while BYD and Proterra are on a downward trend. None has reached the level attained by the Hybrids, although Flyer is headed into that territory.

The RFP for new eBuses specifies a target of 30,000 km MDBF. The higher the number actually achieved, the less time buses spend in the garage for repairs and the fewer vehicles are required to provide maintenance spares.

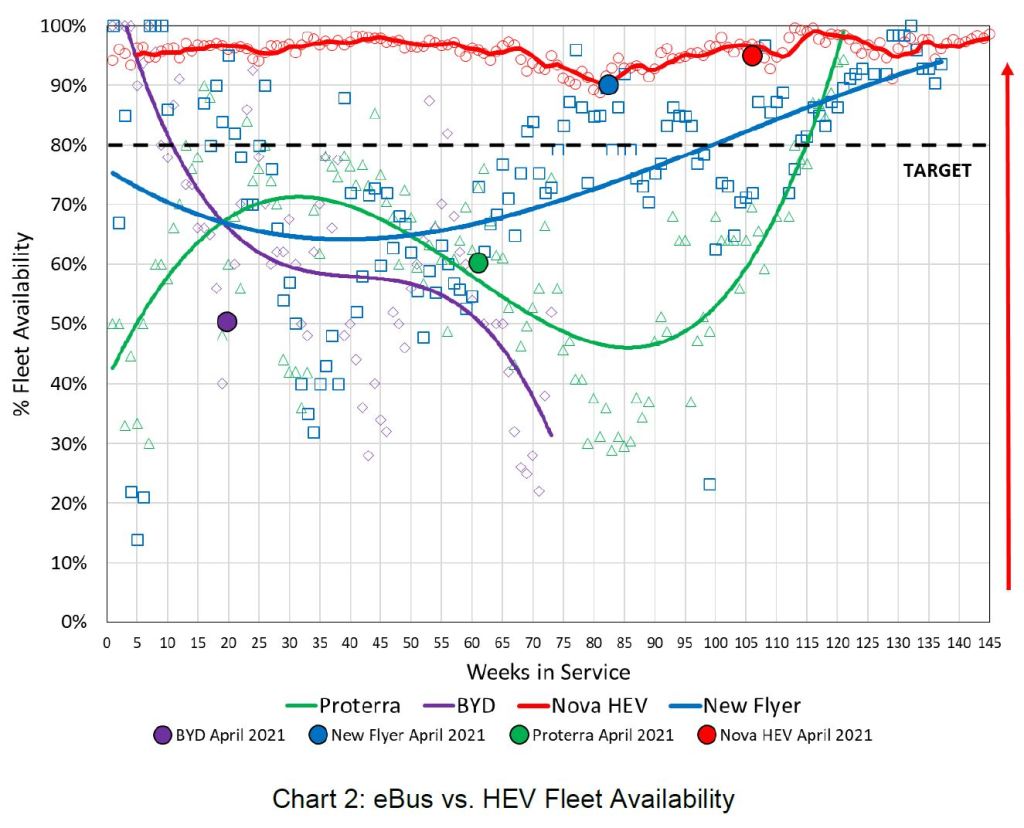

“Availability” is defined as a bus being available for service rather than being offline for manufacturer repairs/fixes under warranty. BYD’s stats were particularly affected by long lead times for supply of replacement parts, and some buses were out of service for extended periods.

Note that an “available” bus might still not be in revenue service because it is in a routine maintenance cycle. This metric reflects vendor behaviour and vehicle reliability during the acceptance and warranty period.

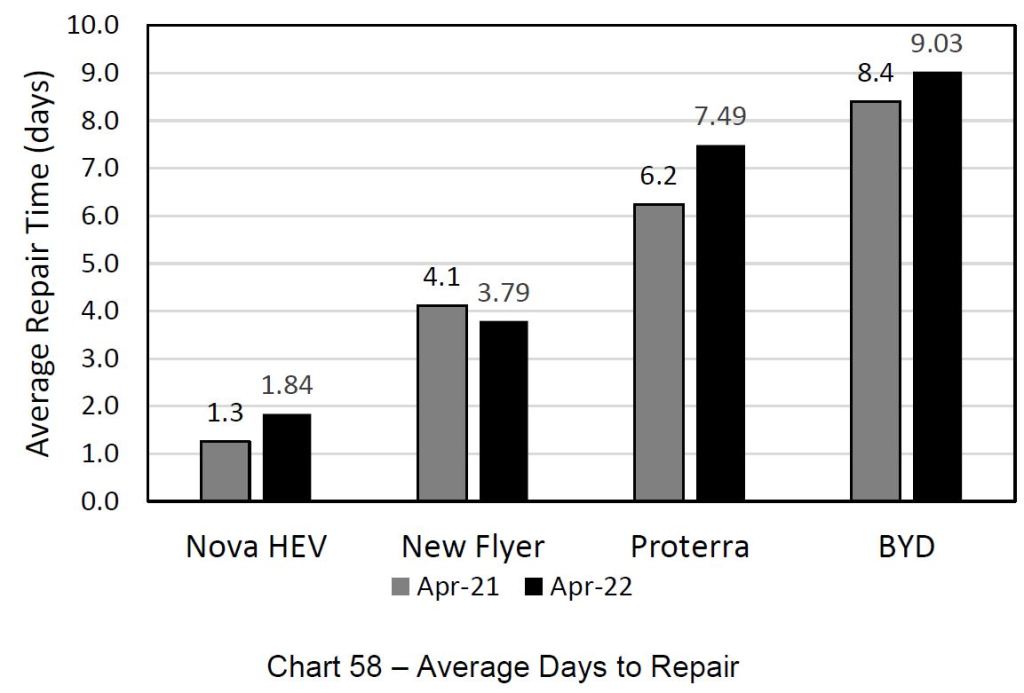

A need for repair, whether it be counted towards a service disruption as above, or simply as a problem noticed in the garage, is not simply an incident, but a period of time a bus is out of service. The longer this time, the greater the overhead of carrying spare buses, and the added need for garage space while a vehicle is repaired. The lack of available spare parts was a big issue on this account.

Vehicle Range and Energy Consumption

An essential component of fleet and operational planning is the range of a vehicle. This is not an issue for subways and streetcars which do not have an onboard energy source and could run indefinitely. Buses (except for trolley buses that have not been used in Toronto for three decades) must be refuelled either for diesel or for electricity before they exhaust onboard capacity. The full theoretical capacity cannot be assumed for service planning because consumption rates differ from route to route, are affected by traffic conditions and weather, and can even be influenced by an operator’s driving behaviour. All of this is well-known to anyone familiar with automotive fuel consumption.

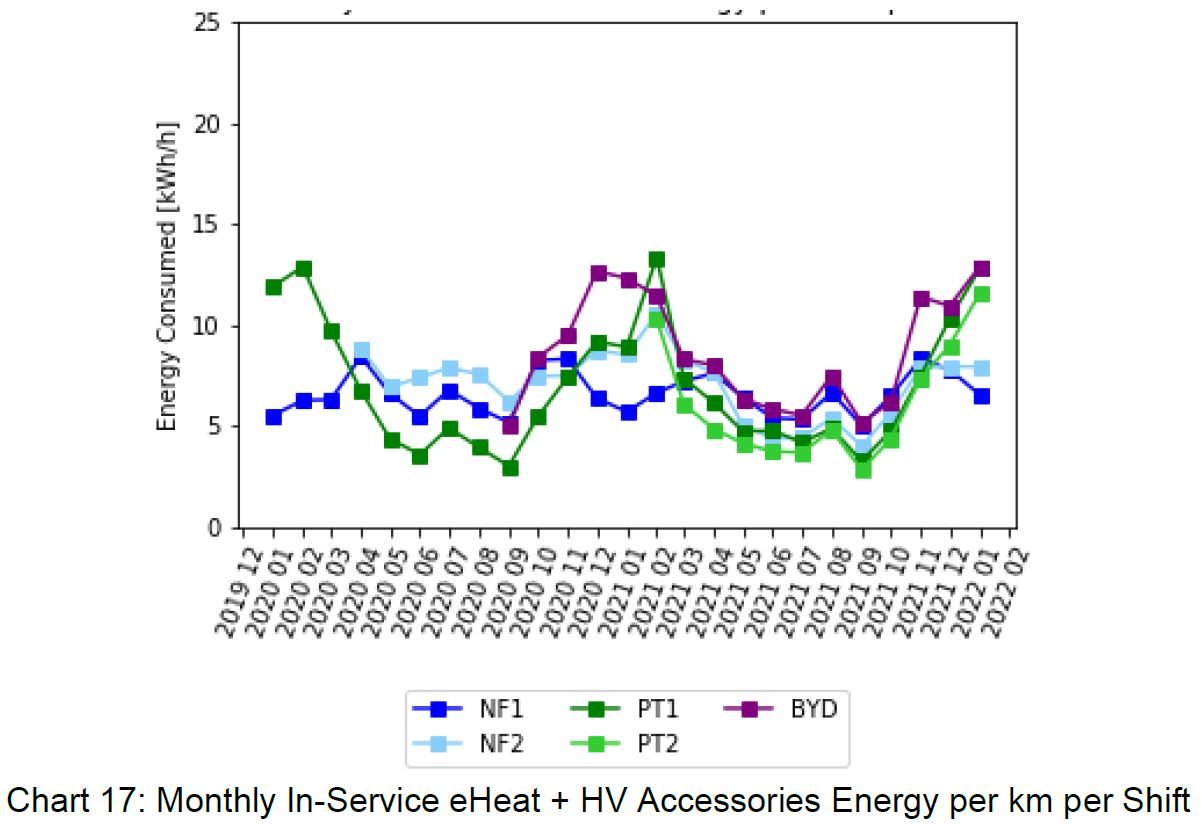

A further issue lies in energy demands beyond simply moving the vehicle, notably the operation of heating and cooling both for passengers and for onboard equipment. This is a substantial additional draw particularly in winter.

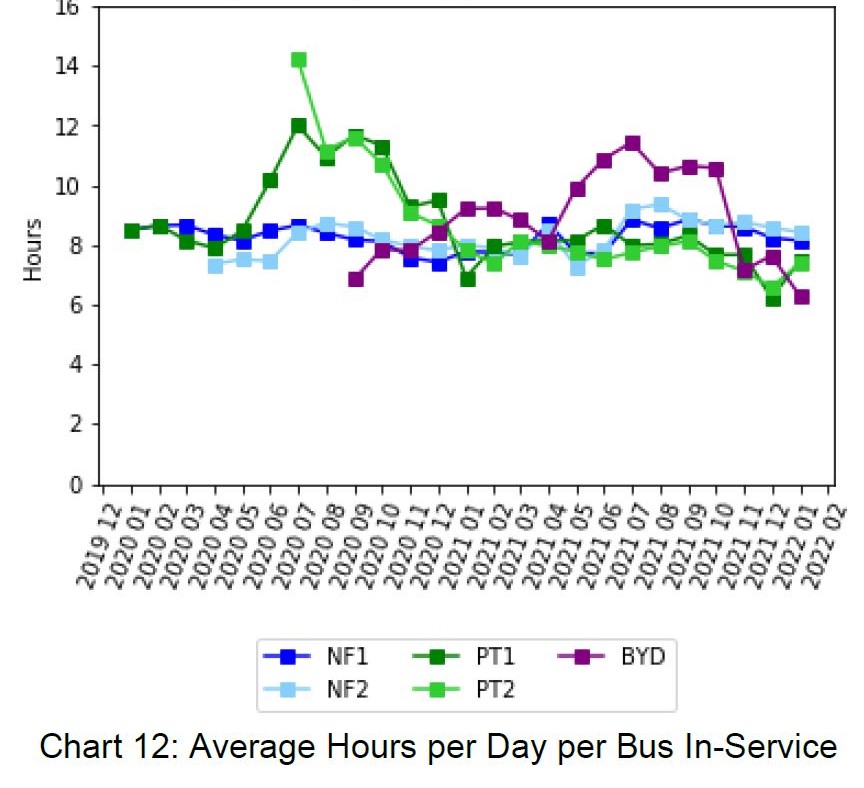

If schedules must take into account the need to refuel midway through a shift, this adds to complexity and to the non-productive hours for vehicles and their crews. The situation is different in Toronto where a large proportion of the bus fleet remains in service all day compared to a system which primarily exists for peak demand and sees most buses back at the garage where they can be “topped up” if need be.

(In January 2020 on pre-pandemic schedules, mid-day and early evening bus requirements were about 2/3 of the peak period levels. In March 2022, the ratio is even higher.)

This is generally not a problem for the diesel or diesel/hybrid fleets except, possibly, for buses that stay out for 24 hours from a morning peak through night service, and it can be avoided by scheduling. The situation for electric buses, with a smaller and variable range is quite different.

There is a need for TTC operations to accurately determine the expected range of the buses. This is difficult given how many factors influence the efficiency and range of an eBus. The TTC attempted to estimate the range based on the in-service data through correlating the State of Charge (SoC) used per km and extrapolating to the full SoC range available. It must be noted that this is an oversimplification to estimate the range and SoC is a calculated value from the OEMs that we have found to not be entirely accurate. However, this simple calculation can be used to highlight the variation in range due to seasonal changes as well as to the large variation in efficiency as a result of the factors mentioned above.

TTC Report at pp 52-53

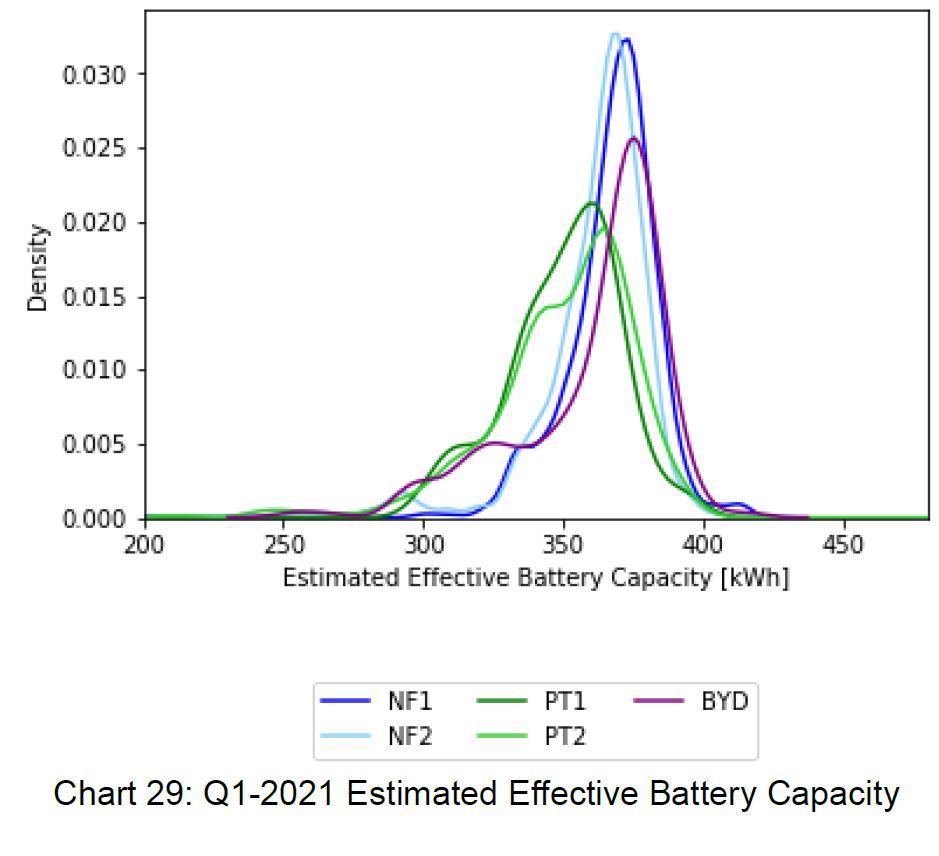

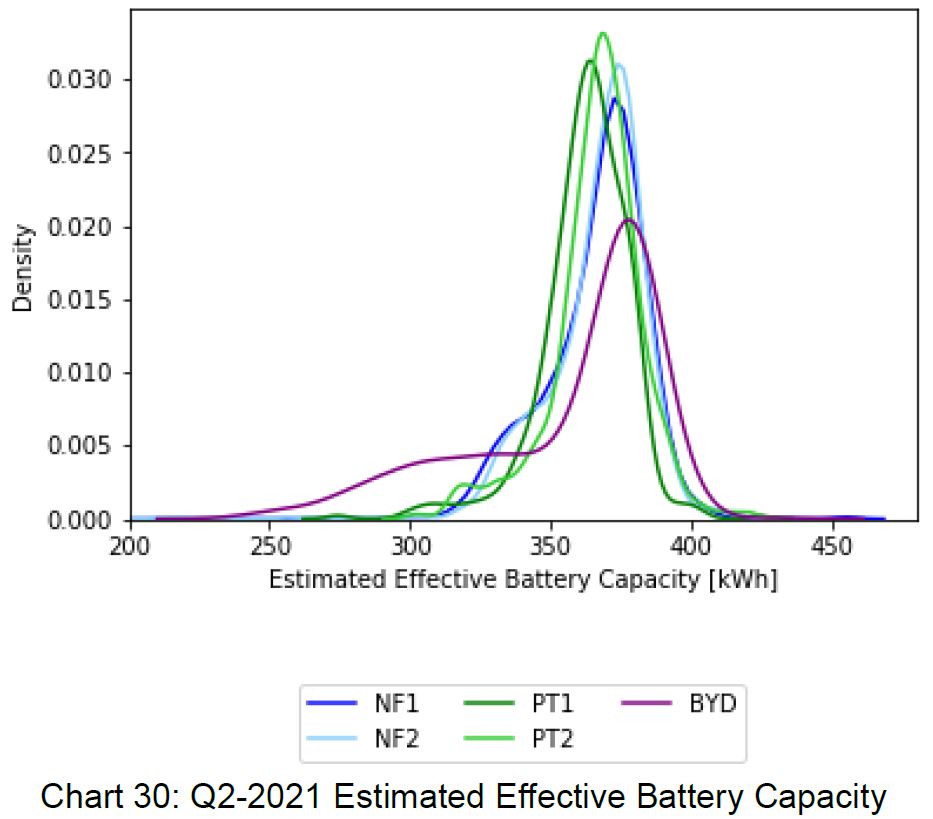

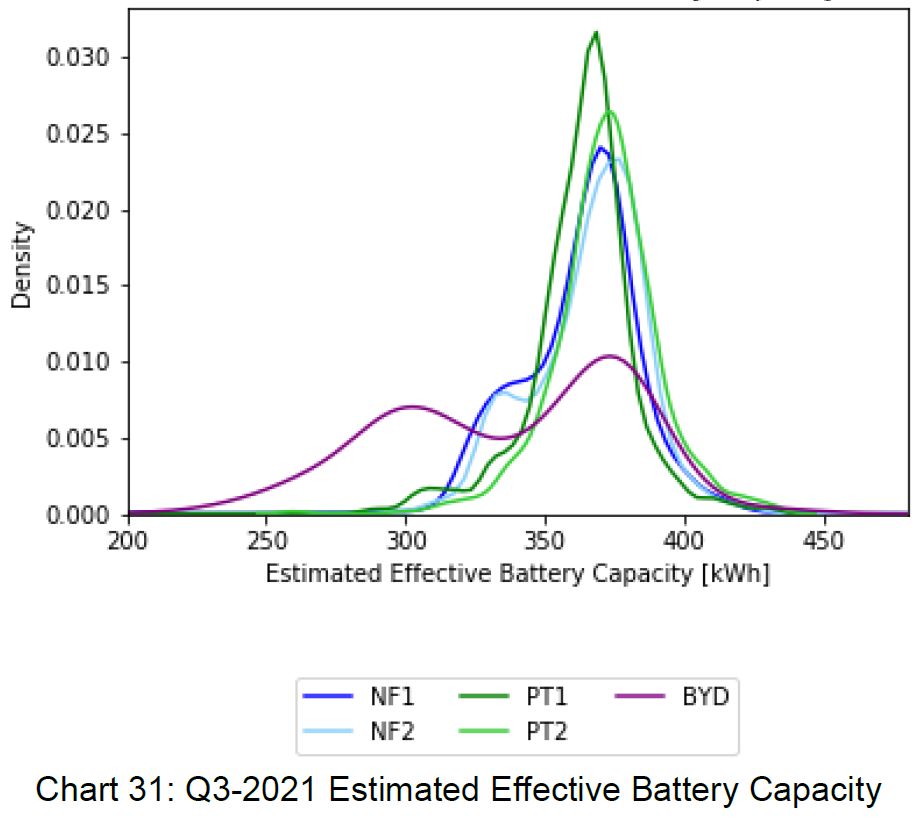

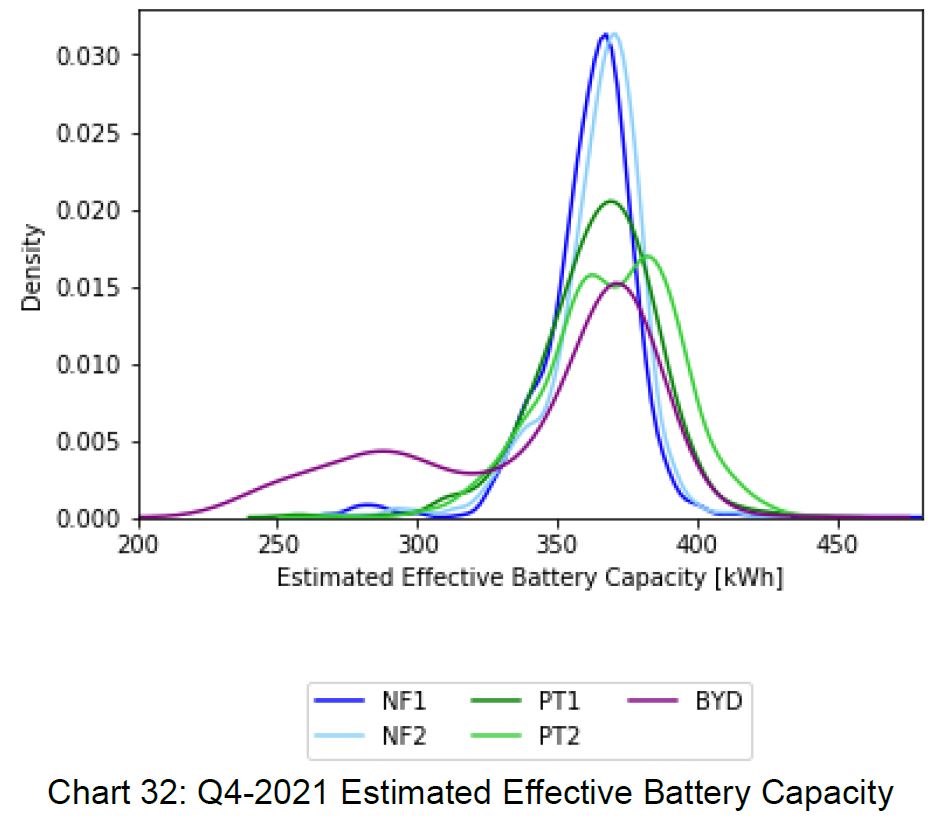

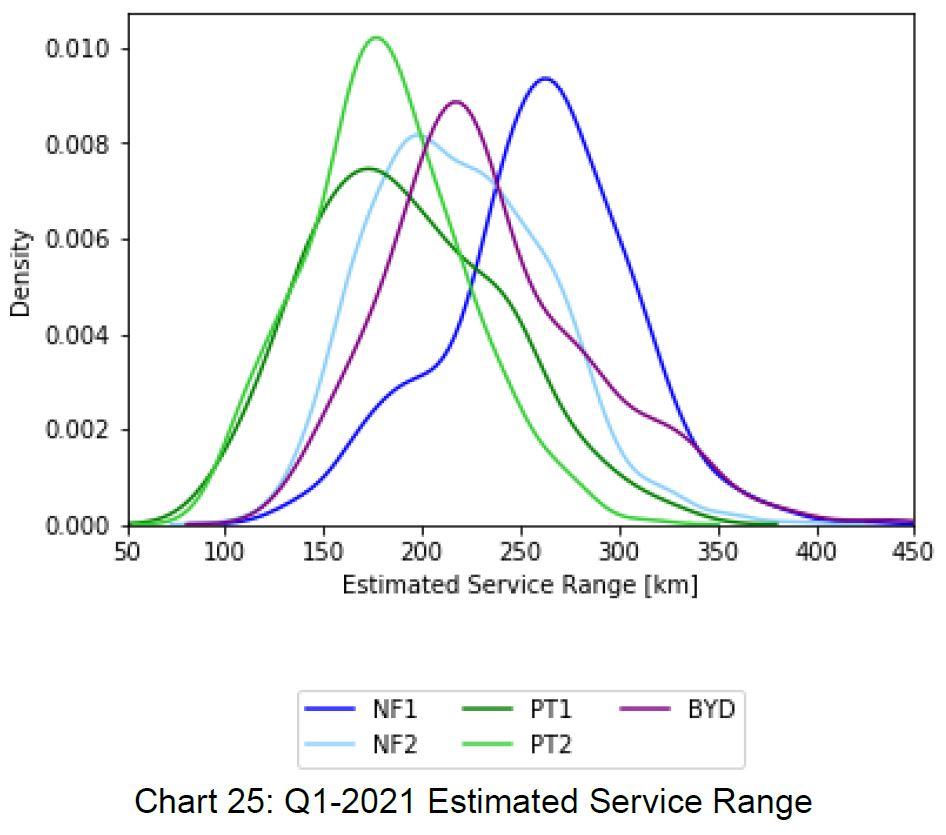

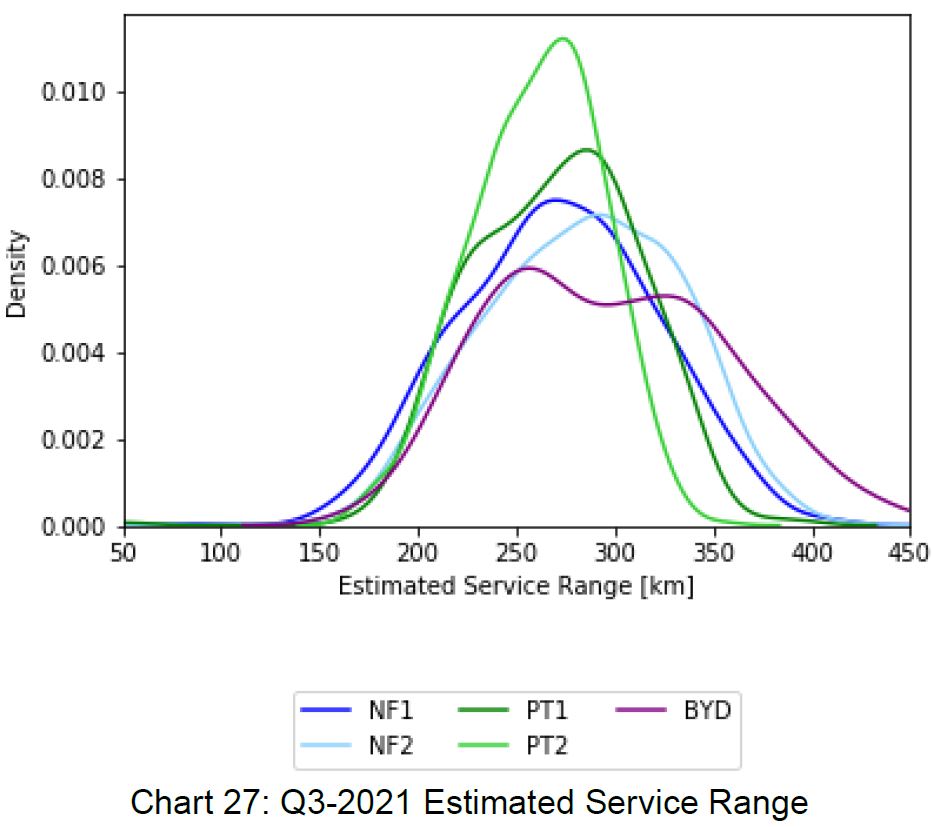

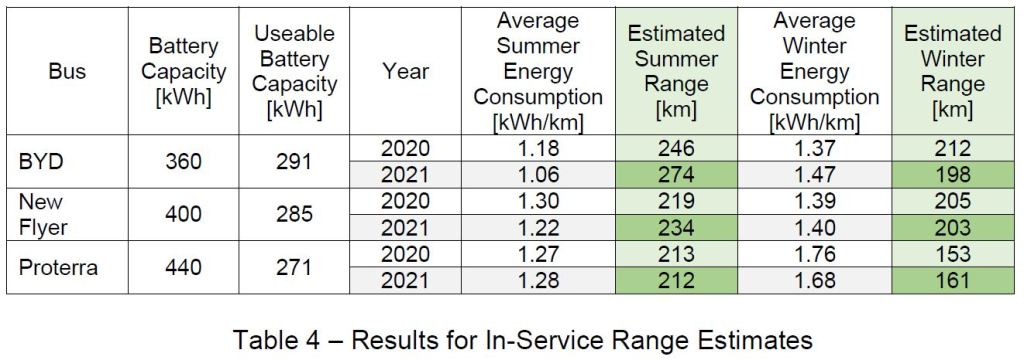

Energy consumption varies both by bus model and by season. The charts below show the distribution of values for effective battery capacity (the energy that can actually be used on one charge) and the service range based on battery capacity and energy consumption characteristics. (Click on a chart to open each series in a gallery to step between each seasonal chart.) From a planning point of view, a consistent range is preferable across seasons so that the TTC does not need separate “winter” and “summer” schedules.

The data are summarized in the table below the charts. Note that these values are well below manufacturers’ claims for their products.

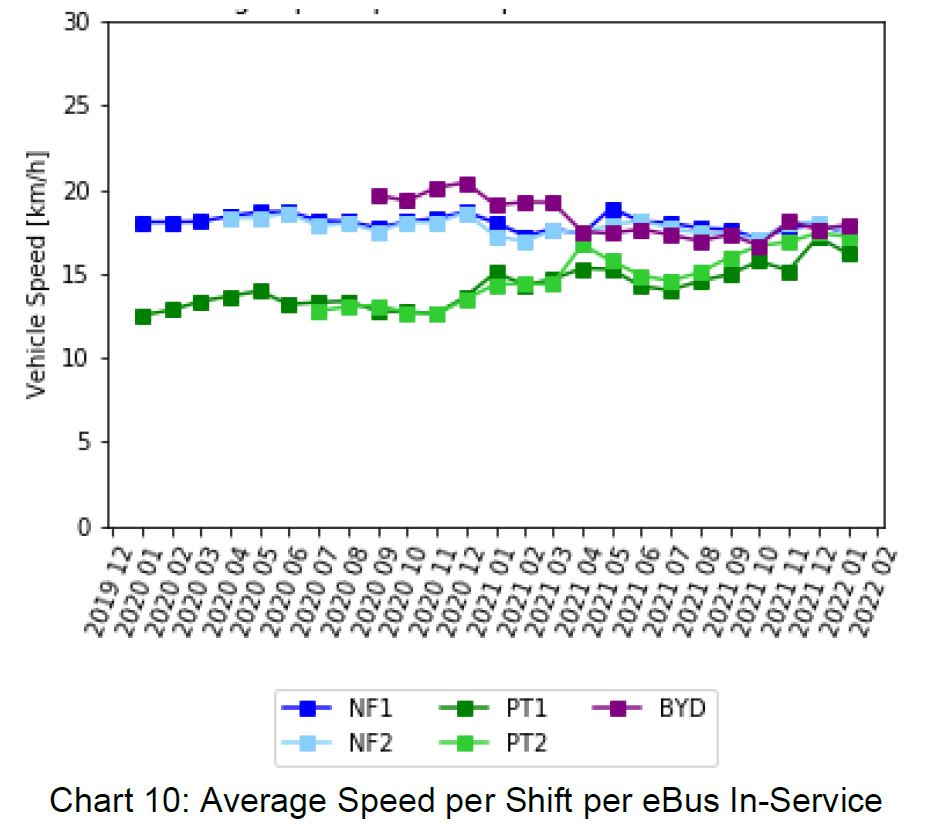

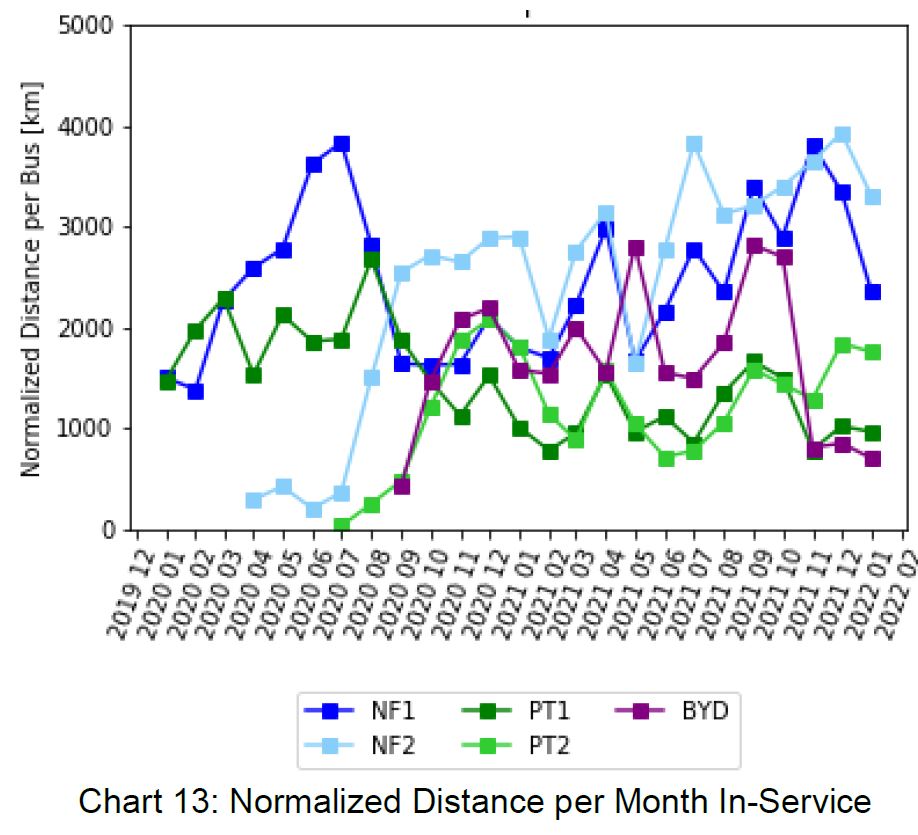

Energy consumption is affected by route characteristics like speed, stop spacing, grades and passenger loads. The available range coupled with vehicle reliability can lead to buses having different operational stats depending on the routes that they serve. These factors must be teased apart to isolate geographic factors from inherent performance of the vehicles. (A similar problem has existed for years in comparisons of bus vs streetcar and trolleybus operations that tended to overstate relative electric vehicle costs because of the routes on which they were used.)

The Proterra fleet was based at Mount Dennis Garage which disproportionately serves inner city routes with lower operating speeds compared to Arrow Road (New Flyer) and Eglinton Garages (BYD). Although the Proterra buses ran comparable or better hours/day than the other vendors’ buses, they accumulated less mileage because they operated at a lower average speed.

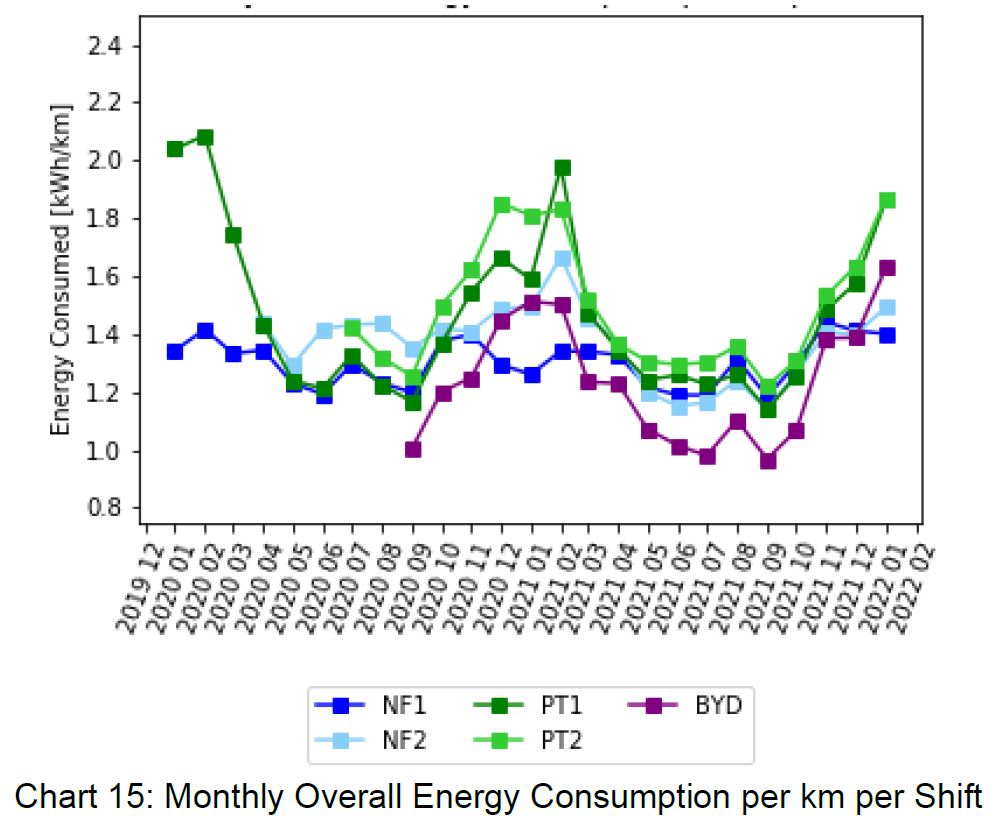

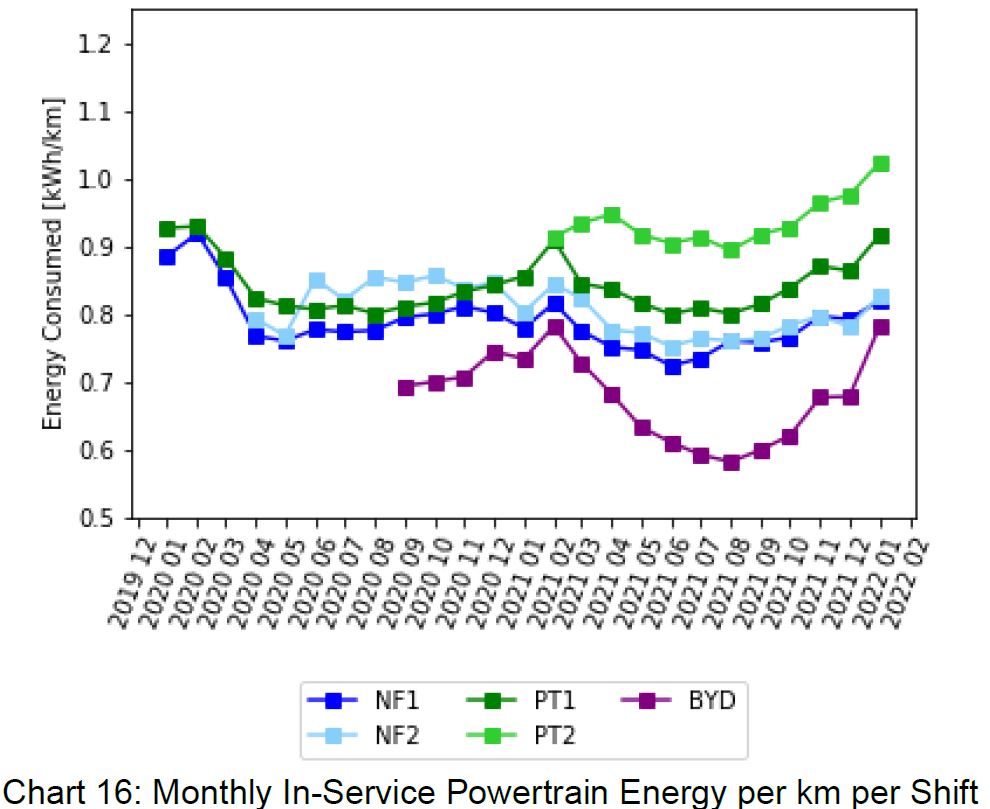

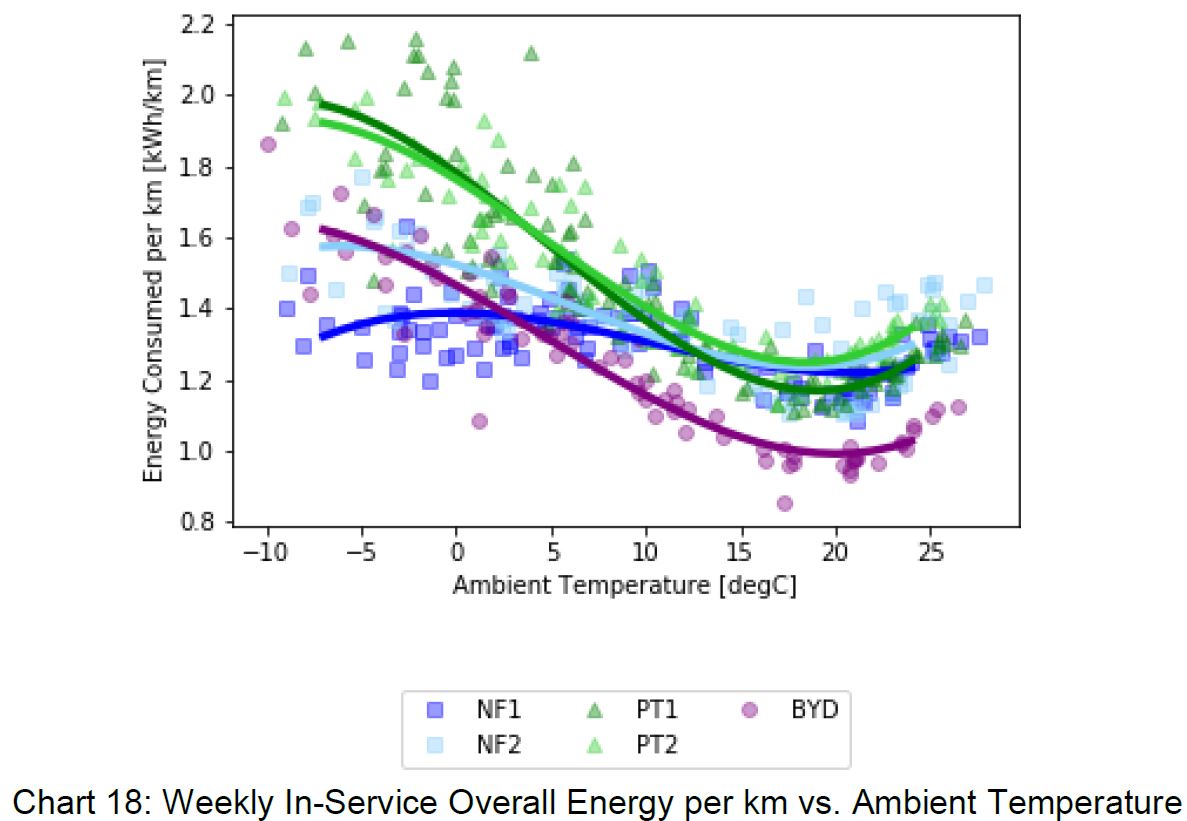

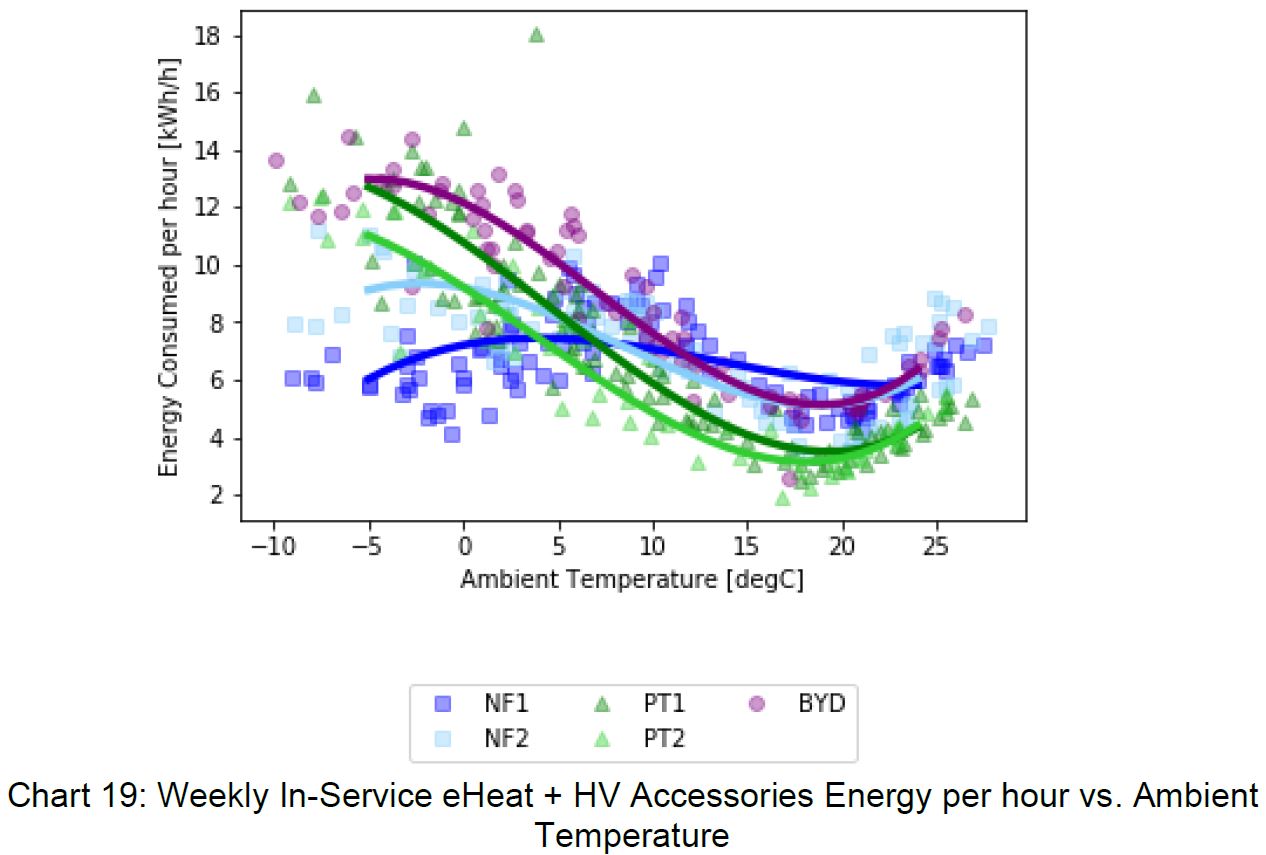

Energy consumption was affected by the routes each fleet operated on and also by the seasonal heating and cooling loads. When the powertrain energy is broken out from the total, clear peaks due to vehicle heating in winter months are obvious. This is not an issue for New Flyer because it uses an auxiliary diesel generator for heating power rather than drawing on the batteries. This engine is much smaller than those used for propulsion in diesel or diesel-hybrid buses, and it is not subject to the stress of acceleration cycles.

The energy consumption is sensitive to the ambient temperature for BYD and Proterra buses, but not for New Flyer. This contributes to a more reliable vehicle range over the seasons. This is obviously a larger issue in cities with highly variable climates such as Toronto.

The effect of the different approach to heating in the New Flyer eBuses is clear in the chart of diesel consumption during the winter season. Diesel consumption was higher because this subsystem provided vehicle heating, but the offsetting benefit was that battery capacity was more predictable.

One note about this, however, is that the vehicle specification calls only for enough diesel capacity to operate the heating system for eight hours. This could compromise the range of a bus during cold weather even if the battery had sufficient capacity.

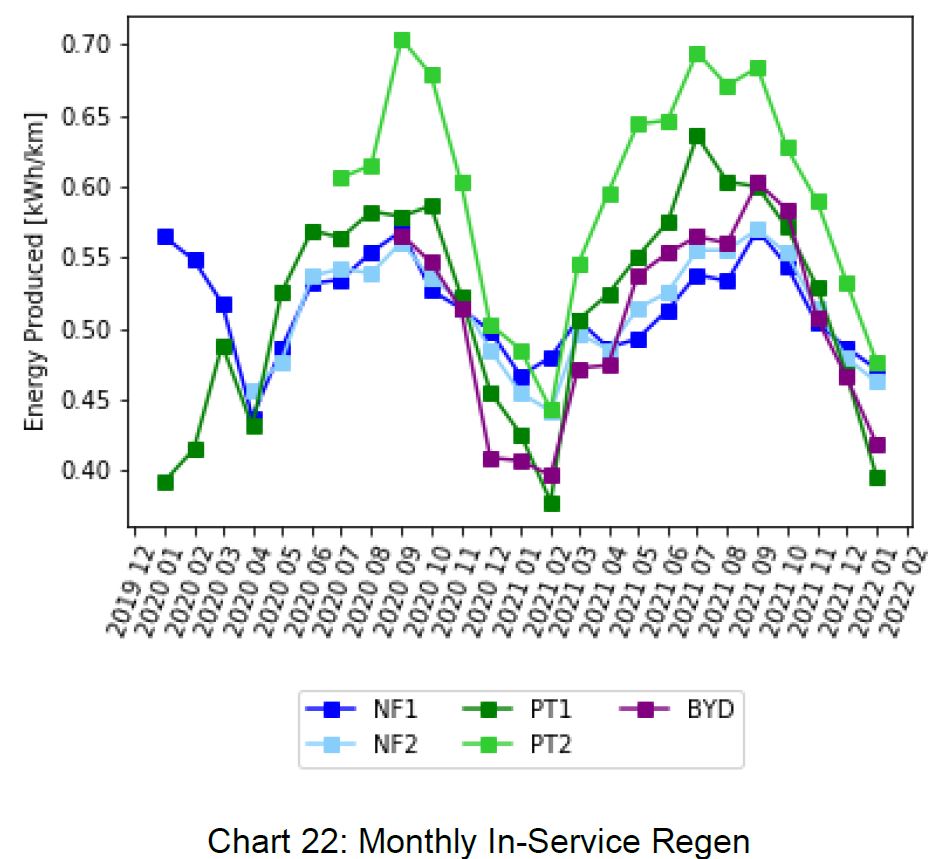

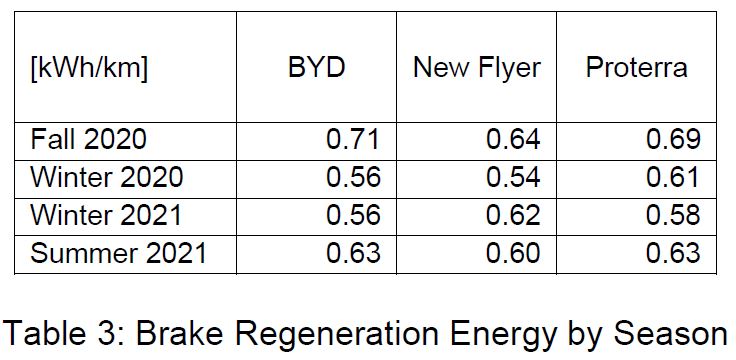

Like all modern electric vehicles, the eBuses use power regeneration during braking to recapture kinetic energy from the vehicle. This has been common on subway trains and streetcars for decades, and it is not a new technology. The regenerated power shows a seasonal variation especially for Proterra and BYD because in the winter, that power goes into the heating system rather than back into the batteries.

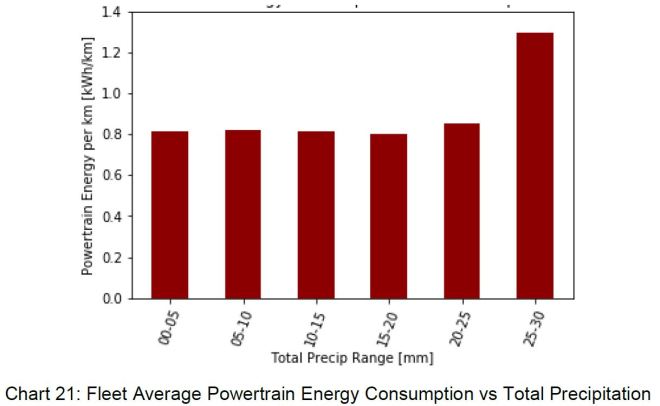

Finally, there is some interaction between precipitation and energy consumption, although this is likely due to driving conditions during periods of heavy precipitation. Nonetheless, it is a consideration that during periods of very bad weather, vehicle range could be lower than normal.

Charging Systems

The chargers used for New Flyer and Proterra eBuses at Arrow and Mount Dennis Garages were ABB DC Fast Chargers. At Eglinton Garage, BYD AC chargers were used, although this will not be the case for any future orders that BYD might supply.

At all three sites chargers had an availability above 98%. The majority of failures were caused by cables either being run over by buses (ABB) or small wires breaking from repeated flexing (BYD, since replaced with better wiring). A variety of other problems are detailed in the report.

Of note is a remark under “lessons learned” that:

Cable management needs to be improved and included in future charging cables. The switch to pantograph charging will alleviate this issue for the eBus fleet.

TTC Report at p. 82

The use of “will” implies that the TTC contemplates a move from cable based to pantograph based charging at garages. This begs the question of whether this will occur as early as possible in the provision of new charging infrastructure and, indeed, if cable-based charging will disappear. This would simplify garage operations and consolidate charging technology for both garage and on route locations.

Passenger and Employee Response

The report includes sections on responses from both passengers and employees to the new buses. This text is edited and condensed from the TTC Report for brevity.

For passengers, the major points in bus design are:

- Overall, 70% of riders are satisfied with current TTC bus design.

- Almost two-thirds of riders prefer more seating capacity, flexible (flip-up) seating and forward-facing seating.

- There is very strong support at 90% for seating capacity as an important factor.

- Hygiene and comfort were ranked as important, although there are tradeoffs between fabric and plastic seats on these counts.

- Over 60% of riders prefer a dedicated area for strollers and other large items.

- More than half prefer more stanchions (vertical poles) to overhead handholds.

- Almost half ranked digital screens as the most important technology compared to Wi-Fi at roughly one in six.

- In an online survey, customers reported being satisfied with the three types of buses at different rates with New Flyer highest (91%), then BYD (83%) and Proterra close behind (79%).

For operators, the response to the eBuses varied

- Over two thirds of the Mount Dennis operators were dissatisfied with the Proterra eBus when compared to a diesel bus. Operators at New Flyer and BYD garages were not strongly dissatisfied with those vehicles.

- The BYD electric buses were the most favoured in the surveys completed, scoring high in seven categories: noise level, ergonomics, visibility/sightlines, ride comfort, acceleration, steering/manoeuverability and night driving. The only low score was for braking. The most common write-in comments were:

- Dissatisfaction with the braking systems;

- Glare/reflection on the front windshield during night driving; and

- The location of the cup holder.

- The NFI electric buses scored high in two categories: noise level and braking. However, approximately 40% were dissatisfied with six categories: ergonomics, visibility/sightlines, ride comfort, acceleration, steering/manoeuverability and night driving. The most common write-in comments were:

- Braking and acceleration pedal locations, size and adjustment;

- Small size of the driver’s compartment; and

- Small size of the driver’ shield/barrier

- The Proterra electric buses scored poorly in four categories: ergonomics, visibility/sightlines, ride comfort, steering/manoeuverability. They did score satisfactory in two categories: noise level and acceleration. The most common write-in comments were:

- Small size of the driver’s compartment;

- The turning radius of the bus; and

- The bus ramp kneeling issues.

For maintenance staff:

- A high proportion of maintenance workers at Arrow (NFI) and Eglinton (BYD) were either positive or neutral about their fleets. At Mount Dennis (Proterra) about 15% were dissatisfied as compared to other buses at this garage.

- At Eglinton (BYD), about 20% were dissatisfied with the following: diagnostic tools, maintenance manual content and navigation, parts manual content and navigation and layout of maintenance components. About 30% were satisfied with: noise level, visibility/sightlines, ride comfort, acceleration and steering/manoeuverability.

- Arrow Road (NFI) had the most favourable responses scoring high in all the categories.

- At Mount Dennis Garage (Proterra) high positive or neutral scores were found in four categories: noise levels, visibility/sightlines, ride comfort and acceleration, and for the remaining categories. The remaining categories also scored well, but not at quite as strong a level: steering/manoeuverability, diagnostic tools, maintenance manual content and navigation, parts manual content and navigation and layout of maintenance components.

Lessons Learned and Next Steps

Text in this section has been copied directly from the TTC report, but is consolidated here to pull all sections together. There are inconsistencies between the first instance of some of these points in the main report and the version in the technical appendix.

For example, the main report does not mention the maximum 42 foot bus length including the bike rack, but the appendix does. Many sections in the appendix are not carried over to the main report.

Corrosion Resistant Frame Structure (pp 16-17)

- A maximum bus length specification of 40 feet is required in order to preserve bus storage density at existing maintenance facilities;

- Bus specifications to require DC charging capability using SAE interface and communication standards to allow for maximum charge rates, competitive procurement, and interoperability between buses and chargers across all maintenance facilities; and

- Stainless steel frame structure negates the need for, and associated risks of, annual rust-proofing maintenance programs.

Updates:

- A maximum bus length specification of 42 feet including a stowed bike has been specified as part of the procurement pre-qualification criteria;

- DC charging capability using SAE interface and communication standards has been specified as part of the procurement pre-qualification criteria; and

- A stainless steel frame structure with a minimum of six years of in-service experience has been specified as part of the procurement pre-qualification criteria.

Distance Between Repairs

This section exists only in the appendix, not in the main report. It duplicates requirements that are under “Fleet Availability” below.

Fleet Availability (p 20)

- Continue to monitor eBus availability performance, mature product with vendors and prioritize retrofit campaigns that will yield reliability and availability improvements.

- BYD to hire a second field service technician in Q2 2021.

- Include availability metrics to be achieved by the eBus OEM in future procurement contracts. Failure to meet the availability targets will result in liquidated damages.

Updates:

- Second field service technician for BYD fleet support started working in Q3-2021; however, fleet availability continues to trend downward.

- A minimum fleet availability target with associated liquidated damages has been incorporated into the next bus procurement contracts.

Duration to Final Acceptance (p 21)

- Through a comprehensive review of commercial terms against industry peers and across modes (i.e. bus, subway and streetcar), the TTC is restructuring its milestone payments. Included in this restructure is a higher milestone payment percentage due at FAC in order to motivate vendors to improve quality and responsiveness during the acceptance process.

Updates:

- The TTC has restructured its milestone payments for the next bus procurements as an approach to provide greater incentive for successful/on-time issuance of Final Acceptance Certificates. For the hybrid-electric bus procurement, TTC has moved away from a high percentage due upon delivery (75%) to the following:

i. From 0% to 20% upon Contract Award (notice to proceed)

ii. From 75% to 10% upon Preliminary Acceptance Certificate (PAC)

iii. From 20% to 50% at Final Acceptance Certificate (FAC)

iv. From 5% to 20% upon achieving the 30-Day Reliability requirement

30-Day Reliability (p 22)

- The TTC is restructuring its milestone payments. Included in this restructure is a larger percentage due upon achievement of the 30-Day Reliably requirement.

Updates:

- The TTC has restructured its milestone payments for the next bus procurements. The percentage due upon achievement of the 30-Day Reliability requirement has been increased to 20% from 5%.

Energy Consumption (p 52)

This section exists only in the technical appendix.

- Predictable and reliable range is more important than achieving the lowest energy consumption.

- Exploring defroster programming opportunities to further alleviate winter energy consumption concerns.

- For future procurements, the TTC will avoid a pure-electric defroster unit without fully understanding the energy efficiency performance.

- For future procurements, the TTC will continue to specify a diesel-fired heater requirement until heat pump technology is viable.

Updates:

- Proterra has completed a campaign to retrofit a convector in the operator area to improve winter energy consumption.

- A requirement for a non-electric defroster unit has been included in the next battery electric bus procurement specification.

- A requirement for a diesel fired auxiliary heater unit has been included in the next battery electric bus procurement specification.

In-Service Range Estimates (pp 55-56)

This section exists only in the technical appendix.

- Optimizing acceleration characteristics of eBuses can further reduce energy consumption.

- Develop a range estimating model that accounts for all factors that affect efficiency using real-time telematics and incorporates real-time notifications for operations.

- Collaborate with Environment and Climate Change Canada’s Emission Research and Measurement Section and Transport Canada’s ecoTechnology for Vehicles Program to establish a standard test method to evaluate the range performance of fully-electric transit buses using a chassis dynamometer.

Update:

- A harmonized vehicle acceleration profile has been established and adopted in the next eBus procurement specification to improve energy efficiency.

Effective Battery Capacity (pp 58-59)

This section exists only in the technical appendix.

- Investigate lowering interior temperature set points without adversely affecting customer comfort;

- Investigate early activation of diesel-fired heaters and disabling electric heat;

- Future procurement specification to specify minimum useable battery capacity target and not advertised battery capacity; and

- Future procurement specification to seek opportunities to improve efficiency, such as through the use of light-weight materials, heat pump, etc.

Updates:

- Proterra useable battery capacity increased by 6%;

- Minimal useable battery capacity specified for next battery electric bus procurement specification.

HVAC System (pp 74-75)

This section exists only in the technical appendix.

- Develop strategies for eHeat management to increase in-service range, including reducing electric heating use and cabin pre-heating strategies;

- Develop a strategy to monitor and measure battery health and performance over the service life of eBus and electric vehicles;

- Work with partners, such as NRC, to develop models to more accurately characterize bus range in service;

- Work with OEMs to optimize acceleration and regeneration profiles to optimize energy efficiency in service; and

- Develop strategies to optimize energy usage out of service to reduce overall site consumption.

Contract Deliverables (p 77)

This section exists only in the technical appendix.

- BYD to complete four-post shaker testing of bus frame structure.

Charging System Performance (p 81)

This section exists only in the technical appendix.

- Charge systems have proven reliable and repairs are generally simple once parts are available. As the eBus fleet grows, it will be necessary to ensure that service providers have well-trained, local staff as well as common spare parts to minimize time to repair.

- Cable management needs to be improved and included in future charging cables. The switch to pantograph charging will alleviate this issue for the eBus fleet.

- Cellular communication is sufficiently reliable for small-scale charger deployments, but highly reliable wired communications systems will be required for critical charging infrastructure to prevent outages from affecting service.

- Charger software needs to be evaluated for interoperability/compatibility with the smart charge systems ideally as a qualification prior to purchase.

Average Days to Repair (pp 94-95)

This section exists only in the technical appendix. The update here was consolidated into “Corrosion Resistant Frame Structure” in the main report.

- Time studies to be performed on all planned maintenance work to identify time savings when compared to a diesel and hybrid-electric buses.

- For future procurements, a carbon steel frame coupled with an annual rust proofing program is not recommended.

Update:

- A stainless steel frame structure coupled with six years of in-service experience has been specified for the next battery-electric bus procurement.

Brampton Transit’s few electric buses (both NFI and Nova) are charged at the Sandalwood Garage and at overhead pantograph stations at the route terminal points. This, of course, limits the routes these buses can be deployed on, and requires enough time at the end points, but it does allow buses to run without going out of service at the garage to charge. It might also allow for smaller, less heavy batteries, as well.

I didn’t see anything about on-route charging points in this report, so I suspect the TTC is confident that it can somehow do it all at the garages, and not worry about the degradation of the battery performance over time.

Steve: I have a sense that early in the project, there were options like pantographs that some at the TTC didn’t know about. This is, after all, an organization that was unaware Vancouver had completed an eBus program proposal before the TTC had started theirs. Now that they are working with many other agencies and pans are part of the bus spec, I think they may change their approach in time.

LikeLike

I’ve heard the TTC might be leaning towards NOVA bus because of the interchangeable parts. The majority of their fleet is NOVA So this would make sense.

Steve: This would not surprise me, but also there is a question of splitting the order with New Flyer to have more than one vendor. We shall see. Given that this might be a joint procurement, whatever “ins” specific builders might have with the TTC could be diluted.

LikeLike

It would have been very interesting to include a trolley bus alternative.

Steve: This has been very much a battery bus show from the outset with buses using garage charging, and hence the largest batteries possible, because the original proponent, BYD, is a battery maker looking for a market for their product. The TTC is now talking about pantographs as an alternative to plug-in charging, but in-motion charging under wire has not been discussed at all. Until this becomes common in the industry, and until it can be shown to be a cheaper alternative, I don’t think you will see any.

LikeLike

Since Mount Dennis took over the operation of the 945 Kipling Express, finding a Proterra bus on this higher speed suburban route has become more common. I do believe the lower mileage on this fleet has to do more with a number of them being sidelined than the fleet operating on slower routes.

Steve: Note that some of the stats cited are only for buses that actually go out into service. The same argument could also be made for BYDs which spent a lot of time in the garage.

LikeLike

Why is a deputy mayor allowed to work on behalf of lobbyists for ONE company? If his situation is that blatant; shouldn’t city council have a word or two with the press?

Steve: This happened back in 2017. DMW seems to be a Teflon man. I know that Andy Byford, who was CEO at the time, was disgusted and the then-chair, Josh Colle, wasn’t too pleased either, but DMW has the Mayor’s support.

LikeLike

What do these bus manufacturers offer to Ontario? Plants building and supplying chains?

Steve: There is only so big a market for Canadian bus builders, and the two major ones are in Manitoba (Flyer) and Quebec (Nova). The idea that we should pervert a major bus purchase because someone offers to set up a new plant to build vehicles of dubious merit would be a classic Ontario move, but it’s unlikely.

LikeLike

Wonder why No mention of high clearance issues with the BYD buses (or maybe I missed that part). They aren’t allowed inside Don Mills station anymore because of its height. I’ve driven them a few times and noticed they just barely squeeze under some overpasses. Pretty sure the TTC will not order any more of these. If they were silly enough to do so, on clearance alone not sure they would do well in the west end IMO.

Steve: Point 5 of the “must have” list is a maximum height of 340 cm (134 in), and this is included in the spec (see the section on the 18 year design life). The clearance problem with BYDs is not mentioned explicity, and according to their spec sheet, these buses are 134 inches high.

LikeLike

Wonder how the costs of trolley coach overhead plus maintenance compares to battery vehicle cost plus charging stations needed (or can the battery versions run all day and charge at night–with a lot of charging at the bus garage?) Will the batteries last 18 years? Trolley coaches cost a lot more than comparable diesels. This reflects gouging on motors and controls. Presumably, the motors and controls for battery-powered systems should be similar. Puzzled, Andy

Steve: The batteries will not last 18 years. They are changed out as a maintenance cost a few times during the life of the bus. Again, as I have said to many on social media, the issue is not to implement a “pure” trolleybus system, but to examine alternative ways to deal with charging including wire over well-used routes. Electric buses (including hybrids) cost more than diesels. It’s not the trolley poles.

The cost comparison on the TTC gets tricky because the charging infrastructure will be built and operated by Hydro who will recover their costs through the asset life converting what would have been treated as a capital cost by the TTC to an operating cost. Because of the difference between electricity and diesel costs, there is headroom to do this. It also leaves responsibility for a big electrical system in the hands of hydro so that the TTC does not have to scale up.

LikeLike

Back in the fall the TTC had a Nova LFS electric demo bus on property for about a week or so. I spotted them doing some simulated service testing along side a Proterra a few times. I was hoping there would be some mention of how they performed in comparison to the three models they currently operate. I guess the sample size was too small to compare fully.

LikeLike

A few thoughts from the Accessibility side of things, as this report glosses over the challenges that people with mobility devices have had with 2 of these models used.

ACAT barely used these vehicles, did not get any official physical review of these buses since early 2020.

I and many other actual day to day users of the bus routes these ebuses were on, have far different experience than this report states.

1: Proterra..

I’ve used these buses countless times, as they are on the routes I use frequently.

(It’s a laundry list here, so I’ll be as succinct as possible.)

2. BYD

Since there’s so few & you literally have to hunt them down & I just don’t have the time/energy to waste doing so, I only used them 6-7 times so far, but even those times were too many, to be kind & not completely lose my temper, I’ll just say, HELL NO.

I will say: clearly wheelchair accessibility is an afterthought, clearly no one bothered to properly consult actual real life, wheelchair/mobility device users.

3. New Flyer (NFI)

Have gotten to use these buses a lot, as they often are on routes I use frequently.

I have been accused by many, of being a NFI fanatic, especially the older versions. NFI have always had great wheelchair area layouts & added bonus for those of us that also have low vision, they have a ‘tiger stripe’ (a bus driver friend from Hamilton coined this phrase) to guide you up the ramp.

These buses, did not disappoint in any way, wheelchair area is well done, ramp & entry is great, wide enough & no catching clothing or wheelchair joystick on anything, (still not as good as newer NOVA buses, but close)

The ride. It’s really, the only thing I can complain about, honestly, it’s a little rough compared to Nova Hybrids. The drivers braking & takeoff makes the buses lurch ROUGHLY, throwing you around a bit, it’s painful for me, but the elderly riders have nearly fallen out of their seats. I don’t know if it’s a new system for them, but it’s certainly an issue.

Also it seems like the stop announcements are far quieter in these buses.

In closing:

I well remember the meeting that DMW literally LOBBIED to have BYD ‘deputate’. As with Steve, I was there & saw Andy literally boiling with rage & Josh looked pretty pissed off too, as did several of the TTC staffers.

(I was sadly, not at all surprised at DMW’s antics & it felt like deja vu, from the crap that he’s pulled in the past & with things I’ve witnessed happen in Hamilton & their shady city council!)

All in all, I think that the TTC isn’t really evaluating all the metrics it should. I feel that, from talking with many TTC drivers, as well as my own experiences.

Drivers that I spoke with over the last many months didn’t feel listened to, didn’t feel that the survey was enough to get their honest opinions expressed or heard.

As a person with multiple disabilities, who is a full-time power wheelchair user, I have sent many comments & pictures to TTC, as have other people with disabilities, to no avail, we weren’t listened to. Even ACAT members that actually use the regular system in mobility devices, tried. (Most ACAT members are still full time Wheeltrans users)

TTC & Wheeltrans, are pushing hard on FOS [Family of Services], & want us to use the conventional system. These buses are supposedly the future, yet they seem to completely disregard the serious issues we are having.

(I read the entire report a few times, as I’m deeply interested in these kind of buses.)

Emily D Accessibility Advocate

LikeLiked by 2 people

Do we know what percentage of TTC bus blocks are too long to be operated by one battery electric bus (BEB) without it having to return to the garage to recharge? 200 km is nothing when city transit buses routinely drive 300, 400, or even 500 km per day. En-route charging seems to be a non-starter – there simply is no room at, say, Finch Station for the 40+ buses on the Finch East route alone to spend 5 to 10 minutes charging, not to mention the increase in layover time required would add the need for additional vehicles. I’m worried the TTC will have to have more buses to operate the current service level, which means there will be no buses available for expansion.

One thing I believe is the operating savings; the difference in cost between diesel and electricity in Canada has got to be amongst the highest in the world, which means Canada should really lead the world in electric vehicle adoption. 6 cents per kw/h (in Quebec) versus $2.00+ per litre of diesel or gas? No brainer.

Steve: In an earlier report, staff noted that the range of eBuses could affect scheduling and fleet needs, but has not quantified the effect, I suspect that they are waiting for definitive info on a range they should use for estimating.

LikeLike

Steve,

I’ve been receiving your TTC newsletters and always find them informative and well written. I appreciate the care you take with the proofreading as well as the content. Thank you.

Quick question: any idea when the 505 streetcar eastbound will revert to its normal route east on Dundas, north on Broadview to the Broadview subway? I live on Sumach Street just south of Dundas, and haven’t had the pleasure of a straight-through ride on the TTC to the subway for a year and a half. Or maybe it’s been longer than that.

Cheers

Steve: I believe that it will be at the mid-June schedule change, but that has not been confirmed yet. Frankly I think that the work on Broadview will be finished before then, but the May schedule change is already set. I’m just waiting for the memo with all of the details.

LikeLike

As I have frequently said, the inability to charge on the move is a major mistake. Many extra buses will have to be purchased to substitute for the ones that are charging and/or deadheading back and forth to the charge point. Battery plus trolley charging allows for a limited network of overhead wires to charge the bus to run off-wire for the rest of its route. Typically the central part of a network has overhead wires, and the outer edges run off-wire.

This problem will get steadily worse as the batteries age and their charge capacity dwindles.

Perhaps someone at the TTC was reading the letters which I mailed to them, for lo and behold we see the following:

Having the pantograph required to accept twice the charge rate of the fixed charging ports (300 kW vs. 150 kW) is a specification that is required for charging on the move. 150 kW are used to charge the batteries while 150 kW are available to move (and heat) the bus. If the bus will never charge on the move, the extra capacity of the panto makes no sense. It is just wasted capability.

As any fan of the BBC show “Yes, Minister” will attest, no bureaucrat will ever admit to making a mistake. But quietly putting in the infrastructure to fix this is good enough!

LikeLiked by 1 person

This video is dated 2021/06/19… [Top 10 eBuses]

LikeLiked by 2 people

Hamilton is buying 177 brand new CNG buses. See lines 3 and 6 here.

Learning this caused me to shake my head in disbelief. Does anyone know why Hamilton is buying CNG buses? Is this another case of the triumph of lobbyist skills and (this being Hamilton) flat out corruption winning out over common sense?

LikeLike

Denzil Minnan-Wong is such a scumbag, anything he has a hand in should be questioned. How practical would it be to add a power return or ‘negative’ next to existing streetcar power wires. it would obviously serve only a handful of routes. but to top up the batteries is it possible? Or is this insane, I genuinely have no clue what I’m talking about. In my mind it seems like a good idea. Say like at St Clair West where you have many buses and an overhead supply of 800vdc.

Steve: There are two separate issues here. First, in order to do in motion charging, a bus has to run under overhead for some distance, or else sit somewhere under a charging station. Buses do not run along streetcar routes for any distance to speak of. Second, the streetcar system is not at 750VDC which is the standard for eBuses.

LikeLike

Great article, thanks Steve.

I was wondering if the TTC also looked at the impact that each bus might have on road pavement? Would lighter buses with smaller batteries, especially trolley buses, have significantly less of an impact on road surfaces?

Steve: I’m not sure that the extra weight of the batteries is enough to affect road wear. This doesn’t seem to have come up as an issue, although it would not really show up as a problem until a larger proportion of service on a route ran with eBuses all of the time.

LikeLike

I wonder why you did not say the same for streetcars i.e. Toronto cannot afford to tie the future of its streetcar fleet to a manufacturer (Bombardier) whose political connections outweigh their ability to deliver good products. You have double standards.

Steve: When Bombardier bid on the Flexity order, they had successfully delivered our TR subway fleet. The company’s reliability fell apart through a combination of lack of focus on their rail division with the folly of trying to become a major aircraft manufacturer, and by shifting part of the Flexity production to a plant in Mexico that was incapable of handling the work.

Alstom has a good reputation (although not universally), and for the 60-car add-on order they have repatriated some of the work from Mexico to their plant in Quebec. The Eglinton line’s fleet of Flexitys is all here waiting to run, and Alstom is supplying the Finch line.

For its part, BYD has been reported as having reliability problems in many cities, and they performed very poorly here.

LikeLike

To be honest, BYD is likely to win half of the ebuses order if BYD is able to modify their bus to meet the “Must have” specifications as there is no doubt that BYD will send lobbyists to persuade TTC and put a price lower than other manufacturers to attract TTC to buy. And the remaining order is for New Flyer.

Steve: I’m not so sure. Both Nova and New Flyer can pitch the “Made in Canada” angle. One of the “must haves” in a stainless steel frame with six years’ operating experience. That’s not a trivial requirement. Also, an award to BYD would have to get around the very public record of poor reliability.

LikeLike

For perhaps the wrong reasons, the present political climate will probably deny BYD any part of the contract, despite the best efforts of the deputy mayor. Mayor Tory may even wake up long enough to decide that he doesn’t want to leave a decades long legacy of repair ridden imported buses to besmirch his ‘perfect’ record.

LikeLike

BYD is not gonna win the order. The TTC has already be plagued multiple times with bad, unreliable technology (SRT, Orion 3s, Orion VII hybrids etc). The new streetcar order has been an optics disaster with Bombardier barely delivering the entire order on time. No way TTC goes with unreliable manufacturers with a product littered with maintenance problems. NFI already has an order and if it turns out reliable like the Nova articulated order the other manufactures will be shut out.

LikeLike

Interesting fact about the Flexity cars, and possible the Line 1 cars, is that they are designed to run of 750 VDC. Their electronic controllers lets them run off 600 VDC. I doubt that the suppliers would make a totally new control system just for the 600 V legacy systems. With the electronic switching in the controllers they could run off a range of voltages. The charging circuits could probably run off 600 V, just not as efficiently.

I believe that in the original Transit City scheme the new lines would have been at 750 VDC and the St. Clair car would have run out of a barn along the new Jane LRT and switched voltages when they entered or left the LRT lines.

I don’t know what the life cycle time is for the TTC substation switching gear and transformers but it is probably significant Even so it might be to the TTC’s advantage to consider a plan to switch the overhead from 600 VDC to 750 over time. They would not need to do the entire system at once but start at one end and work their way to the other. As long as they kept the different voltages isolated from each other, they could do this.gradually.

Increasing the voltage by 25% would reduce the current draw through the system and also the power losses because of I-squared-R resistance loss.

LikeLike

Are those hybrid buses order are intended to replace the remaining 2006-2009 Orion VII hybrids?

Steve: Not sure. The TTC talks about getting rid of diesels, but there are more diesels and hybrids combined still active than the new buses can replace. I will have to check on this.

LikeLike

Can we not just go with New Flyer if these indeed performed as well as claimed? I have serious concerns about going with Nova Bus without a trial. Nova Bus has had a number of serious safety concerns in many cities including right here at the TTC.

In 2017, the TTC grounded all 153 Nova Bus’ articulated buses over serious unexpected acceleration and braking issues.

Steve: Which was fixed as the piece you link on the TTC’s own site says, with a software change.

In 2019, more than 600 Nova Bus vehicles were recalled in Quebec over serious steering issues.

I will not be comfortable going with Nova Bus without a trial given serious safety concerns with their various models. If we are going to give manufacturers a chance without a trial, then we need to give manufacturers with a better safety record a chance such as Mercedes Benz from Germany which makes fine electric buses.

Steve: And again there was a fix that has been applied. Meanwhile, TTC has been operating 255 Nova Hybrids, the very vehicles cited by this article, without problems. They have hundreds more Nova diesels.

LikeLike

Based on the meeting its clear NFI is scoring high on the ebus evaluation. Maybe I’m thinking too much into it, but the way Brad Bradford was asking questions regard to the stainless steel requirement, and wanting TTC to report back to the board prior to TTC awarding the contract looks suspicious. Like I said, I could be overthinking it, But its as if BYD or Proterra got into his ear, similar to DMV earlier about BYD and the Ebus trails. Considering Ben Case responded satisfactory about other manufacturers having an opportunity to bid on future contracts, even after the Electric bus is awarded, Brad still didn’t seem satisfied with the response. Ben Case is clearly in a situation where buses need to be ordered to get federal funding, so Brad messing around with that may harm funding.

I suspect TTC will split the electric order to two manufacture just like they are doing with the new Hybrid order. NFI should get part of this order based on the evaluation.

Steve: My understanding is that Bradford’s concern was that an order of this size be reported out to the Board if only for information. The requirements for stainless steel frames and operating experience should knock some vendors out of the running early in the process, and it would be suspicious if they somehow got past that hurdle.

There is already delegated authority to management to make the award, but there is a Board meeting mid-July, about the same time the award will occur, assuming funding comes through. Given the size of the order and the option for add-ons included in the RFP, some public visibility on this award would be worthwhile. This is, after all, supposed to be a public agency.

NFI has a clearly superior bus in the evaluation. As for others, including Nova, it will depend on what they bid. Even though Nova did not have a bus in the trial, the TTC is already quite familiar with their products and support as a vendor. I would be more suspicious of lobbying if either BYD or Proterra got a big order based on their performance.

This procurement is also supposed to have an option for other agencies to add on. Somehow I doubt they would be too happy if the TTC’s contract went to an inferior vendor.

LikeLiked by 1 person

How do they arrive at this conclusion:

1.886M tonnes GHG saved over 1.512Mkm = 1.25 (approx) tonnes GHG per km saved !?!?!

Even if they’re assuming including 1 car off the road for each passenger, it couldn’t come anywhere near that (although, that would be ignoring the fact that you would be “saving” the same amount in an ICE bus).

Steve: The salient point in the report is here:

It appears that somewhere “kg” have become “kt”. Also the comparison is with “clean diesel” buses which will only be part of the fleet to be replaced, and the saving versus hybrids will be lower.

I will pursue this with the TTC.

LikeLike

With regards to Kevin Love’s question, Hamilton is one of the few (only?) jurisdictions in Ontario that kept going with CNG after the sales pitches of the 90s. Union Gas (Enbridge) has a filling station at the Mountain Garage, and out of Hamilton’s current fleet, about half of the buses are CNG (the rest are diesel or hybrid). There’s quite a few buses that are >12 years old, and we still have a couple relics that see service every so often (2007 NFI hybrids for instance). The fact that Hamilton already has the infrastructure and probably has a competitive contact with Enbridge (hence the full-wrap “carbon-negative” CNG arctic bus) makes it far more likely to choose CNG buses. The HSR, even with multiple rounds of Metrolinx group buys, was the only agency to specifically choose CNG buses.

Pair this with a council where many councillors represent suburban and rural voters (after all, the City of Hamilton borders Milton, Guelph, Cambridge, and Brantford), and the priority for transit spending is rather low. Cheaper buses (standard engine) and cheaper fuel (CNG has less energy than diesel, but it’s quite a bit cheaper) are an easier sell to budget hawks on council. Frankly, if the planned BLAST network and other improvements are fully realized (including better cycling infrastructure and much better GO service), the additional emissions from CNG buses can be offset by getting drivers out of their cars. Only time will tell.

LikeLike

According to my research, BYD has successfully built the stainless steel frame bus (BYD C9C) in 2016 and meet the EU standard. And they have already built stainless steel frame buses for EU market. It looks like BYD can meet all the “Must have” specifications. So unfortunately, it is almost certain that BYD will win the bid if TTC would like to purchase buses from two manufacturers.

http://rd.baosteel.com/zypt//en/ability/see/abilityDetailsBSSF9/1/1c6e6e8d804d4a41a3293c23b8e62960

Steve: The URL you provided does not work. Please provide links re stainless steel frame buses in Europe. BYD’s sites are silent on this issue. What’s more, it is well known that the North American market wants this feature, but that is not what BYD supplied.

They have certainly not met the reliability requirement.

LikeLike

I know that people on this site have already awarded the contract to New Flyer and Nova Bus but I just want to state that someone from Mr Rick Leary’s office has confirmed that he will be choosing the top two performing companies from the trials which means that Nova Bus is not being considered.

Steve: If this is correct, then the TTC is conducting a bogus request for proposals.

I suspect this message was left by a BYD-loving troll who usually posts under a variety of aliases, and often with less than civil language.

LikeLike

There are a couple of items that have not been addressed here that need some answers:

1) What is the effect on the global environment from the extraction of the items needed to make Lithium Ions batteries, namely the mining of Lithium and Cobalt. How is its effect on the climate measured? Also, what is the effect when almost all internal combustion powered vehicles are replaced by EVs?

2) What is the effect on the power grid from charging all the buses overnight.

3) What is the net effect of CO2 reductions from charging the bus batteries, especially if a lot of rapid charging is done which is usually 15 – 20% lower in efficiency than slow charging.

4) What is the effect on road maintenance from the running of EV powered vehicles that are heavier than similar sized internal combustion powered ones.

5) EV powered cars have no effect on the traffic congestion problems. They just switch the prime energy source from hydrocarbons to electricity. How is the electricity generated? Fuel cells are even worse because there are a lot more power losses in the creation of “Green” hydrogen fuel.

Perhaps you can find the physical space to put charging stations up for lines like Rosedale in Rosedale Station but can you do it at Finch Station, Kennedy Station, or Kipling Station. I sincerely doubt that. They would be farther ahead to install trolley-bus overhead along major routes and then let the buses switch to battery power at the ends of the lines. I was in Europe a few years ago and there were a lot of trolley buses with battery power to operate in areas where the installation of overhead was not warranted.

LikeLike

Are the 68 60-foot hybrids intended for replacement of existing artics or to grow the artic fleet?

Steve: They are for growth as far as I know. The existing artics are not due for retirement for a few years yet.

LikeLike

Talk about bad luck. TTC suffers from supply issues with the LRT order, now NFI is saying they have to slow production due to supply issues. Can’t TTC ever catch a break?

Steve: Well, this is a problem that is likely to affect all manufacturers, not just NFI, and not just eBuses.

LikeLike

Yes, the TTC can catch a break but it needs to stop ordering from unreliable manufacturers like Bombardier whose train business has since run out of business due to sheer INCOMPETENCE. If NFI cannot deliver, then we should order from BYD and Nova Bus.

Steve: Bombardier did not go out of business, their product line was bought by Alstom. Bombardier’s problem was that it wasted a huge amount of capital and managerial effort trying to compete as an aircraft builder while its train business, assembled from several companies merged into Bombardier, withered.

If NFI has problems getting computer chips as the article Ernie linked says, this will not be just for one supplier. The global automotive business faces this problem.

Meanwhile you cannot get around the fact that BYD has been producing unreliable vehicles not just for Toronto, but for other cities.

LikeLike

I find all the BYD problems interesting – here in London, they’ve partnered with Alexander Dennis (who make the double decker GO buses). AD provide the bus, BYD provides the batteries. Works quite well, apparently!

Steve: What is notable about both BYD and Proterra is the number of problems that are external to the electrical system such as body construction issues, or relate to poor vendor support. Partnering with an established builder has advantages, provided of course that they are not trying to get into the market themselves. Both New Flyer and Novabus were already building hybrids and were probably not interested in BYD’s battery technology.

LikeLike

Alexander Dennis is actually a New Flyer company. I think New Flyer had to pair up with BYD in the UK initially because New Flyer’s battery electrical technology wasn’t ready back then. I imagine that New Flyer wants to have more control of its own battery technology, so it will not partner up with BYD for its North American buses or for future buses unless there’s a severe battery shortage that only BYD can fill.

LikeLike

Are these bus requirements maybe too much? I think only Nova Bus and New Flyer are able to meet the bus requirements and even then, I think they’ve only theorized that they could build a bus with such features. I don’t think they’ve actually built any buses with such large capacity batteries and three different ways to charge it.

Steve: I don’t think the intent is to have three charging systems on buses, but if pantograph style chargers were used at garages, they could be the same units as on-road charging at terminals. The only other variant would be on-route charging under wire, but Toronto is unlikely to implement that. Frankly I think that the TTC’s plans and requirements were strongly coloured by what was available at the time the trials started. It will be interesting to see if their view of a future system evolves.

LikeLike

I wonder how much current a pantograph can handle, particularly if the vehicle is sitting still and charging (for example, hot spots because the contact is always in one place).

Once we’re talking about charging in the hundreds of kW range (I assume) a dedicated charger with intelligence and safety features built in seems like a much better approach than a very high capacity overhead line feeding a pantograph.

Steve: The pantograph chargers are intended for a stationary location, not under a contact wire (of which two would be required). The area of contact is much larger than a pan-to-wire seen for streetcar operations.

LikeLike