This article is the third and last in my review of the April 11 TTC Board meeting. Apologies to readers for the long articles, but this happened to be an agenda with a lot of information that collectively gives a tutorial on the state of the transit system.

Updated May 6, 2024 at 11:30am: The section about farebox cost recovery has been updated to correct arithmetic errors in the original version, and a table is added to show the calculation.

Every quarter, TTC management produces a Financial and Major Projects Update, and this one covers the period to year-end 2023 including the financial results for Operations and a review of the Capital projects portfolio.

See: Financial and Major Projects Update for the Year Ended December 31, 2023

Within the Operating results are warning signals about the long return to pre-covid ridership, revenue and cost projections, and declining sources of funding including City reserves. On the Capital side, as is often reported, there is a very large shortfall between projected needs and known funding. This is compounded by long-running capital projects for fleet replacement, known and possible system expansion projects and the conflicts between political motivations and actual needs for facilities, fleet and future service.

Also included in this article are comparative figures for 2019, the last full pre-pandemic year.

2023 Operating Results

The operating results are summarized on the first page of the report.

Preliminary year-end actual expenditures indicate that total spending for 2023 will result in the TTC’s 2023 Operating Budget of $2.398 billion gross and $1.326 billion net to be underspent by $38.0 million net. Of this amount, $13.2 million is related to a lower-than anticipated COVID-19 impact, and $24.8 million is attributable to favourable variances primarily due to the deferred opening of Line 5 Eglinton and Line 6 Finch West. These under-expenditures are partially offset by the cost of Conventional service delivered 3% above budgeted levels, rising to 95% of pre-pandemic levels by year-end, significant cost escalation experienced on vehicle parts, and the implementation of additional Community Safety, Security, and Well-Being measures approved by the Board during the year.

A few key points here:

- Historically, the TTC recovered about 60% of its operating costs from the farebox, and a further 6% from ancillary sources such as advertising, commuter parking, bank interest and rent. For the 2023 budget, this recovery fell below 50%. Ancillary revenue also includes reimbursement of some Line 5 and 6 costs incurred by the TTC.

- There was a planned draw from the TTC Stabilization Reserve that was not required. This was intended, in part, to permit a lower fare increase than would otherwise have been needed. However, fare reductions are an ongoing cost and they cannot be funded forever from reserves.

- Because there is a $38 million year-end “surplus” (actually a lower requirement for subsidy than expected), the TTC is asking that the city add $10 million of this to the Stabilization Reserve.

- There is a draw and offsetting contribution to the Long Term Liability Reserve. Although $13.6 million came out of the reserve, $17.6 million went back in for a net contribution from 2023 operations of $4 million. This reserve is a provision against accident claims.

- Funding includes $353.2 million for covid effects, but 2022 was the last year where the TTC received provincial and federal contributions on that account. This cost is absorbed by the City, although it will be partly offset in future years by some of the Provincial “New Deal” funding.

- As noted above, planned expenditures to open Lines 5 and 6 were not needed, and this money was redirected to service improvements.

- When the TTC talks about service at 95% of pre-pandemic levels, this refers to vehicle and train hours. Because service now operates at a slower average speed than in 2019, this does not translate to 95% of pre-pandemic capacity as seen by riders as I detailed in a recent article:

- Expenditures are below budget primarily because of the deferred opening of Lines 5 and 6 offset by higher than planned service levels, rising benefit costs, and higher parts costs for streetcars and buses.

- Parts costs illustrate an aspect of the Operating Budget that is often ignored in discussions of State of Good Repair which includes a considerable amount of day-to-day maintenance than is glossed over in Capital Budget debates.

Declining Reserves

As noted above, the Stabilization Reserve has been used to offset some costs especially as subsidies from other governments dwindle. The projected level of the reserve goes negative in 2026 according to the following table.

- There is a budgeted draw of $25 million in 2024 to balance the budget, and a further $10 million in 2025. A key issue in recent years has been the combined effect of less-than-100% ridership recovery, nearly full service operation, and fare freezes or limited increases. This is not sustainable from reserves.

- There is a $15 million provision for emergency spending at the CEO’s discretion that was set up during the pandemic to allow quick reaction to the changing public health landscape. It is not clear why this should remain in the reserve projections.

- Similarly, the TTC is paying for its insurance deductible out of reserves even though this is an ongoing cost.

The TTC will at best squeak by with the remaining money in the reserve for 2025, but must face the need to fund its operations from current revenues if it continues to deplete the reserve at this rate.

Key Indicators

Factors shown in the table below have significant effects on actual operating results compared with budget.

Ridership for the year is slightly higher than budget. This is the combined effect of a shortfall early in 2023 and stronger than expected growth later in the year.

The average fare is down very slightly from budget resulting in slightly less revenue than might otherwise have come from this riding level. Note that these figures do not include trips which evade fare payment.

The price of diesel fuel was less than expected, although total consumption was above budget because more service was operated late in the year.

Ridership has a different profile in the post-covid era with office workers averaging 2.5 days per week. This affects day-to-day crowding levels, but brings in less revenue than in 2019. The statistics about Presto card usage illustrate this change.

- “Commuter” riders dropped markedly and now sit at 56% of their former level.

- Single weekday riders have grown to 125% of 2019 level.

- Weekend riding is up compared to 2019. This shows that that there is an underlying demand for transit, but that total numbers are depressed by changes in work conditions.

2023 vs 2019

When looking at post-covid recovery and the state of TTC finances, it is worth comparing the 2023 results with 2019.

See: Financial Update for the Year Ended December 31, 2019 and Major Projects Update

Key Indicators

Ridership for 2023 came in just over three quarters of 2019, but the service hours operated are close to 95%. Considerably more service, measured in hours, was provided in 2023 per rider although this varies quite substantially by route and time of day over the system.

The average fare has gone up by about 1% per year. Combined with lower ridership, fare revenue has declined considerably relative to costs. Expenses have risen at a higher rate, and that is on a base of fewer service hours.

Traction power expenses have dropped due to the lower cost of power, and the substantially less service operated on the electric modes, subway and streetcar. Diesel fuel cost has gone up 40%, but the expense line only by 23% reflecting lower mileage operated and a shift in fuel consumption of the bus fleet.

“Covid costs” in 2023 is the difference between actual revenue and costs estimated to be the effect of the pandemic. With the end of special provincial and federal subsidies in 2023, this notional cost will be rolled into base costs from 2024 onward.

| 2019 | 2023 | 2023:2019 | |

| Ridership (millions) | 525.5 | 396.33 | 75.4% |

| Average Fare ($) | 2.25 | 2.36 | 104.9% |

| Operating Service Hours (millions) | 9.494 | 8.939 | 94.2% |

| Price of Fuel ($/litre) | 0.97 | 1.36 | 140.0% |

| Price of Electric Power ($/KwH) | 0.148 | 0.14 | 94.6% |

| Wheel-Trans Ridership (millions) | 4.12 | 3.04 | 73.8% |

Operating Results (Conventional System)

Passenger revenue (fares) is up slightly more, on a percentage basis, than ridership because the average fare has risen since 2019. Looking at 2019, every 1% of foregone fare revenue (through a freeze or below-inflation increase) was then worth about $12 million annually, but is now worth about $9.4 million. On a cumulative basis, fare revenue could be higher today had there been regular increases, but this was contrary to City policy during the pandemic. Any fare freeze or reduction is “baked in” to future year results because it permanently lowers the base on which further increases can build.

There are perfectly valid reasons for lowering fares as a matter of public policy whether for all riders (as in the two-hour transfer, or the regional GO-905-416 common fare), or for selected riders (as with the Fair Pass). Some pols will hold fares down to score political points, only to complain about transit becoming unaffordable in the City’s budget. We can’t have it both ways.

Updated May 6, 2024: The following paragraph has been changed to correct an arithmetic error in the original, and a table is added to show the calculation.

In pre-covid days, the question of the appropriate level of subsidy and fare revenue fixed commonly on the 2/3 fares, 1/3 subsidy split, the so-called Davis formula. In 2023, the farebox contribution was at 40.2%. The problem going forward is how high we are prepared to let this rise, an how that would be implemented. For example, fare increases could push up revenues to 50% of operating costs although this would have required fares in 2023 to be 24.5% higher (with no allowance for riding lost due to higher pricing).

Getting back to 60% would be even more of a stretch. New riders would contribute some toward this, but only if the cost of providing service did not rise proportionately.

| Actual 2023 Fare Revenue | $935.8 million |

| Actual 2023 Expenses | $2,330.5 million |

| Farebox Recovery | 40.2% |

| Revenue for 50% Recovery | $1,165.3 million |

| Increase Needed vs Actual 2023 | 24.5% |

Conversely, if the City’s policy is to increase service faster than demand to encourage riding, then the farebox recovery is going to fall. How low are we prepared to let this go? If we spend more on service but keep fares unchanged, there will still be a point where fares will have to rise in step with whatever the new proportion (say 1/3) might be. They cannot stay frozen forever.

A further problem is that major new lines add to costs without corresponding revenues, especially if most of the demand was already riding the TTC. For example, the Vaughan extension provided a faster trip for York Region riders most of whom were already taking the TTC and contributed no new revenue. Should other riders pay higher fares or forego service improvements to pay the added system costs as new rapid transit lines open?

In the short term for Lines 5 and 6 this problem has been skirted by the province picking up new operating costs, but the issue of transit operating costs remains. It affects provincial programs such as the GO-TTC fare integration and the pending service increases on the GO network generally.

The City’s financial situation does not line up with some of its claimed goals for transit’s future.

| Item ($ million) | 2019 | 2023 | 2023:2019 |

| Revenue & Reserve Draws | |||

| Passenger Revenue | 1183.8 | 935.8 | 79.1% |

| Ancillary Revenue | 76.8 | 86.8 | 113.0% |

| Reserve Draws | 22.7 | 13.3 | 58.6% |

| Total | 1283.3 | 1035.9 | 80.7% |

| Expenses | |||

| Departmental Labour | 1063.6 | 1165.6 | 109.6% |

| Departmental Non-Labour | 227.1 | 289.5 | 127.5% |

| Employee Benefits | 311.8 | 395.3 | 126.8% |

| Diesel | 80.9 | 99.5 | 123.0% |

| Traction Power & Utilities | 84.7 | 72.0 | 85.0% |

| Other Corporate Costs | 136.3 | 124.2 | 91.1% |

| Sub-Total | 1904.4 | 2146.1 | 112.7% |

| Covid Costs | 21.7 | ||

| Reserve Contribution | 17.0 | ||

| Total | 1904.4 | 2184.8 | 114.7% |

| Subsidy Funding | |||

| Base | 621.1 | 796.0 | 128.2% |

| Covid | 352.9 | ||

| Total | 621.1 | 1148.9 | 185.0% |

| Farebox Cost Recovery | 62.2% | 42.8% |

Major Projects Update

The Capital Budget contains a plethora of projects ranging from the mundane such as repaving bus yards to complex, long-running work such as replacement of subway signalling systems. When this existed in hard copy, it filled two large binders. This is far too much detail for decision-makers to absorb, and in particular because many of the small projects actually form a larger, interdependent set that must be undertaken as a unit.

There are three capital plans with different purposes, and this can be confusing to the casual reader:

- The current year’s Capital Budget. This covers spending planned for the current year including carry-overs from the previous year for work that did not advance as much as expected. This Budget is fully funded from various sources.

- The Ten Year Capital Plan. This covers anticipated spending for the coming decade, although individual lines might only be partly funded. The span corresponds to the City of Toronto’s 10-year planning horizon. Historically, gaps in funding have worked themselves out either with new money coming available, or existing project allocations being shuffled to plug the holes. This bit of municipal budget magic worked for many years when the holes were fairly small.

- The Fifteen Year Capital Investment Plan. This document covers just about everything the TTC would like to undertake whether it has funding or not. When this first appeared in 2019, it was a major shock to the TTC Board and to City financial planners because its total cost was much larger than the approved 10-year plan. The difference lay in showing everything that was needed, not simply what had survived the approval process at Council.

In all cases, the projects in these plans lie with the TTC.

Other agencies including Metrolinx, Toronto’s Transit Expansion Office and Waterfront Toronto carry some projects on their own books. For example, SmartTrack, a $1.5 billion project (including $585 million in Federal contribution) is carried in the Transit Expansion Office budget, while the GO expansion and Ontario Line projects are on Metrolinx’ books.

To consolidate and focus the view of large capital projects, the TTC groups them into “portfolios”, and within these, into collections of related works. Some of them, notably the Capacity Enhancements for Lines 1 and 2, have very long timelines stretching out to 2041 because there are many sub-projects such as expansion of key subway stations that will occur over time.

Subway

The Capacity Enhancement programs include three major groups with one each for Lines 1 and 2, and a separate project for the expansion of Bloor-Yonge Station.

The Bloor-Yonge project is fully funded based on current cost estimates, and preliminary work for utility relocation is now in progress. The bid process to select a builder is underway, and major construction work will begin in 2026. See the TTC’s project page for details.

The Capacity Enhancement programs have several components, and these are not fully funded. They include:

- Line 1:

- Modifications to 11 stations to increase capacity with St. Andrew, St. George and Dundas as three pilot sites. Preliminary design for the expansion of King Station concourse and provision of an additional exit was at 30% design in November 2023.

- Upgrades to traction power supply to accommodate more frequent service. This includes Orde, Yonge, Granby and Davisville substations which serve the original Yonge-University line. Upgrades are also planned along the TYSSE between Wilson and Vaughan.

- Upgrades to fire ventilation to allow for higher numbers of riders in stations and tunnels. Design work for St. Clair West Station, Markdale and Lytton Emergency Service Buildings is in progess.

- A new Maintenance & Storage Facility to store and maintain 34 trains.

- Addition of a siding between Rosedale and Bloor Stations.

- Line 2:

- Modification of Greenwood Yard to expand capacity and to accommodate the replacement fleet for the current T1 trains.

- Provision of a storage track at Warden Station.

- Station capacity improvements include

- Spadina Station streetcar platform extension. Work on this is underway in conjunction with the excavation for an adjacent condo development.

- Power improvements include

- Lansdowne substation upgrade

- Feeder and ductbank upgrades at several sites

The proposed new MSF for Line 1 is substantially larger than the provision included in the Yonge North extension design. Although that evolved with the relocation of the YNSE to the rail corridor, the capacity has not changed with a total of 12 trains, two of which would be stored in the terminal station. That made no provision for service growth to allow operation of 100 second (1’40”) headways using the Automatic Train Control on Line 1. (Pre-pandemic service operated at 2’20”, a limit imposed by the old signal system, and current peak service is every 3’10”.)

Although Ontario is paying for the Yonge North extension, that project does not include the new MSF for Line 1 even though many of the additional trains it will house are required for extended and improved service.

On Line 2, the TTC had a plan to build a new MSF west of Kipling Station on the former Obico Yard property which the City now owns. The Relief Line using Greenwood Yard has change to the Ontario Line with its own MSF at Thorncliffe Park. This reduces pressure for a second Line 2 MSF is lower, and that project is now foreseen in the 2040s as part of Line 2 service improvements after conversion to ATC.

The Automatic Train Control project on Line 1 is substantially complete with only project close-out work remaining. The Line 2 project is at the specification stage that will lead to a Request for Proposals. It is unclear why the TTC would tender this work and potentially equip Line 2 with a different vendor’s product than on Line 1. Systems with multiple different signalling technologies do exist, but this adds a level of complexity the TTC could avoid.

The New Subway Trains (NST) project is currently not fully funded while Toronto awaits confirmation of a share from the Federal government. This is bound up in changes to the funding mechanism where, beginning in 2026 and assuming the program actually survives that long, there will be an annual funding allocation that is not project based, unlike current arrangements. The City and TTC seek assurance that they can “pre-book” money from this fund to cover the Federal share and commit to the NST project in 2024.

The proposed NST order is based on the Line 2 replacement requirements (see note below), but has several add-ons assuming that funding becomes available.

- 55 trains to replace the existing T1 fleet on Line 2.

- 25 trains to handle growth on Line 1.

- 17 trains for growth beyond 2032.

- 15 trains for Metrolinx extensions (Richmond Hill and Scarborough).

These numbers assume a return to at least pre-pandemic service levels and growth beyond that exploiting the new ATC system for more frequent service. The actual rate of growth over coming years is difficult to predict depending on the changing patterns of office and school commuting.

(Note: The existing T1 fleet is 370 cars, or 61 6-car trains, more than is required for full Line 2 service. This is an historical anomaly from a period when some T1s were intended and used for service on Lines 1 and 4. Later, they were foreseen for use on the Scarborough extension. The T1s cannot be retrofitted for ATC operation, and combined with the delay in building the SSE, the T1 replacement project was trimmed to meet existing Line 2 needs. Cars for the extension will be funded from the SSE project.)

Not included in the list below are major ongoing programs for SOGR work such as track replacement and escalator renewal.

Easier Access Program

The program to make stations fully accessible has been underway for many years and will not finish by the provincially mandated date of January 1, 2025. The table below shows the expected dates for remaining stations in the plan. For additional details, see the Project Status Report.

Notes:

- Old Mill Station has been delayed due to negotiations on property requirements. A report recommending expropriation is going to Toronto Council’s next meeting.

- (3) Warden EA Contract will provide accessibility from drop-off PPUDO to concourse (first elevator) and concourse to subway (second elevator).

- (4) Islington (EA/Re-dev) work will provide accessibility from new street entrance (ramp) to concourse and from concourse to subway platform (elevator). Accessibility from new bus terminal to concourse will be provided with an elevator as part of the re-development.

- (5) Warden Station will become accessible once construction of the temporary bus terminal is completed under the re-development contract.

Fire Ventilation & Second Exits

The TTC has an ongoing program to improve fire ventilation and add second exits where they do not now exist. This work is not fully funded, and some components, notably a second entrance to Dundas Station, are some time in the future.

At Eglinton Station, new ventilation equipment was installed as part of the Line 5 Crosstown project, but testing and commissioning has been “delayed due to unavailability of the Toronto Hydro permanent power and delay in fabrication of portal doors”.

As State of Good Repair projects, design is underway for replacement equipment at Russell Hill ESB, Dupont Station and both Spadina Stations (Lines 1 and 2).

Second exit work is in various stages as shown below for the remaining single-exit stations.

Bus & WheelTrans Portfolio

The lion’s share of the major project list for buses is driven by fleet electrification and by the move to a twelve-year replacement cycle. Between the vehicles and garage facilities, this is close to a $5 billion project stretching out to 2040.

The project is not fully funded and this threatens the TTC’s ability to actually complete the conversion and refresh its fleet on the planned timeframe, let along increase the fleet if there were any desire by Council for substantial service improvements as part of their Net Zero plan. In the short term, there is a Federal Zero Emissions Transit Fund (ZETF) for electrification, but if this is folded into the general national transit fund starting in 2026, the City will be faced with deciding which projects most critically need available federal funds.

Some buses will be released by conversion of Eglinton and Finch West to rail corridors, but these are intended for service growth elsewhere assuming Council ever approves running better service.

Another issue about which I have written before is that the existing fleet has many more spares for maintenance than the scheduled service requires, although some “spares” are elderly and don’t get out much. If the fleet is refreshed and its average age drops, then more buses will be available provided the budget includes money for operators to drive them and mechanics to maintain them. There is also a mismatch between the planned 12-year replacement cycle and the TTC’s Asset Management Program which includes a 12-year overhaul for buses leading to a 15-year replacement cycle.

Funding shortfalls also affect the program to convert and upgrade garages for electric fleets.

The SRT right-of-way conversion is now at 60% in the design stage, and the Transit Project Assessment is underway. The TTC hopes to receive a Notice to Proceed late in 2024. Significant issues include property requirements for some points of bus access to the corridor, as well as the need for a barrier between the GO Transit rail corridor and the bus roadway. Project completion is planned for 2027.

The list below does not include the cost of ongoing maintenance and overhaul of buses.

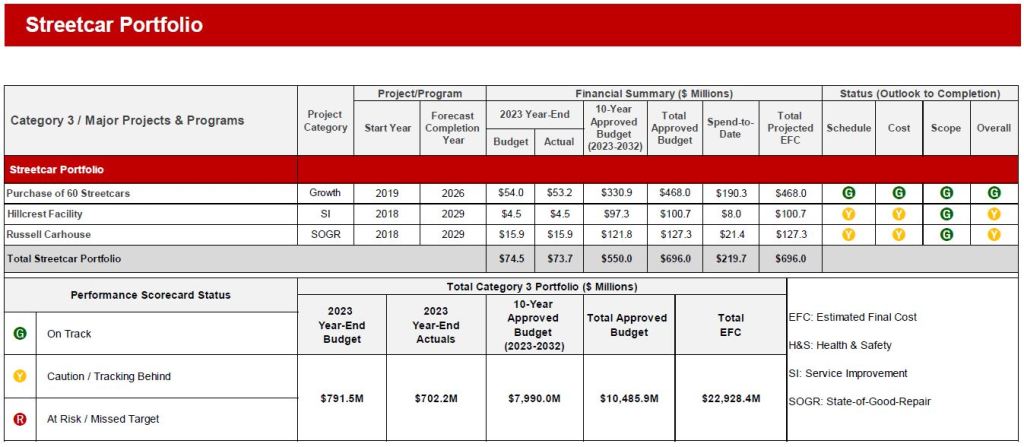

Streetcar Portfolio

By comparison with other parts of the network, the Streetcar portfolio has few projects and a relatively modest cost. The largest item is the order for 60 additional cars for which delivery is now in progress and expected to be complete in 2026.

Related work includes renovation of Hillcrest and Russell to provide a new operating carhouse at Hillcrest for about two dozen cars, and to upgrade Russell to maintain the Flexitys with their roof-mounted equipment (a similar expansion was already done at Roncesvalles).

Harvey Shops at Hillcrest was designed for high floor cars with undercar equipment, but the TTC no longer has a fleet of such cars. A study of the future uses for the Hillcrest complex has been underway for a few years, and among the options is to increase streetcar operations from that site up to its maximum capacity. This would allow more of the central routes to be operated from a carhouse close to the lines as well as relieving pressure on other sites. Due to timing of the work at Hillcrest, TTC is considering additional overnight service as a way to reduce storage demands at Russell and Roncesvalles.

An issue across both carhouse projects is funding to complete the work.

As with other modes, the streetcar portfolio does not include ongoing capital repairs for the fleet or infrastructure.

Network-Wide Portfolio

Three projects are in this group, and all three have a sense of never reaching a conclusion.

The Presto project seeks to integrate Presto’s fare technology with the TTC, and yet there are still TTC requirements that Presto agreed to as part of the deal to adopt their system which have still not been fulfilled. This was discussed in a report at the February 28, 2023 Board meeting which itself was a refreshing change in the detail it presented about Presto’s shortcomings.

Although a good deal of the Presto system is paid for through the service fee paid by TTC, some aspects of the project are handled by the TTC directly. A major outstanding item is the support for cash fares and machine readable transfers. Metrolinx expects to resolve this issue by 2025. The second phase of mobile wallet support, which required reader upgrades, is to roll out in July 2024.

The VISION vehicle location system has various components still in development or testing. One of these is a yard management system to assist with locating and dispatching vehicles from yards. It currently has problems with the accuracy of vehicle locations. The completion date for this aspect of the system is now late 2025.

There are plans to integrate VISION with the City’s Transit Priority system “pending agreement with the City of Toronto’s provider”. An equally germane question will be the actual functionality and degree of priority that TTC vehicles will have especially for situations where they are not operating on official routes and schedules.

Other planned functionality includes monitoring of operator performance including early terminal departures. It is not clear whether this might entrench the TTC’s view of a service metric as the basis of the software design.

The SAP ERP project will migrate much of the TTC’s legacy management systems into a unified whole under the SAP Enterprise package. Major subsystems are still in the development and implementation stages as described in the report.

Projects Omitted from the Major Project List

Although the Major Projects account for over half of the total capital plans, this is in part due to very large future expenditures for vehicles and facilities. Much ongoing State of Good Repair work gets less attention, but is essential to the continued operation of the transit system.

The pages below from the 2024 Budget show the entire $48 billion 15-year Capital Plan with more granularity including the degree of funding available and allocated to each project. Only one quarter of the list has funding.

2023 vs 2019

Back in 2019, the Major Projects list was shorter than it is today mainly because projects to increase system capacity were not yet in the plans.

ATC for Line 2 was not yet on the list, nor were new trains for that line nor for extensions.

Bus costs were lower because fewer vehicles were included in the project, and the mix of hybrids and battery buses did not yet include ramping up to all electric purchases early in the program.

The LRV project was still in the final stage of delivery for the original 204 cars.

The total cost of these projects to completion is only $7.3 billion, far less than the December 2023 list, because only approved and funded projects are included in the 2019 list.

I note that they say they have funding ($30.6 million) for “Waterfront Transit” – all “Funded” but I doubt this is nearly enough for the QQE LRT and the work at Union Station. What are they trying to say?

Steve: That’s for design work.

LikeLike