Updated December 30, 2025 at 10:45pm: The description of proposed service changes on the subway has been amended to reflect that the headway changes on Lines 1 and 2 are already in place. They show up as “new” in the 2026 budget because they were not included in 2025.

The Toronto Transit Commission’s Operating and Capital Budgets will be considered by the TTC Board on January 7, 2026, and will go from there to City Council for final approval. This article discusses the Operating Budget, and my next one will deal with the Capital Budget and Plans for 2026-2040.

Through a combination of belt-tightening and accounting magic, some of which cannot be repeated in future years, the TTC manages to freeze fares for a third year, introduce fare capping, retain and improve overall service levels, and stay close to the City’s target of $91-million in added subsidy for the new year. This is roughly equal to the $90.8-million rise in Provincial subsidy for the operation of Lines 5 and 6.

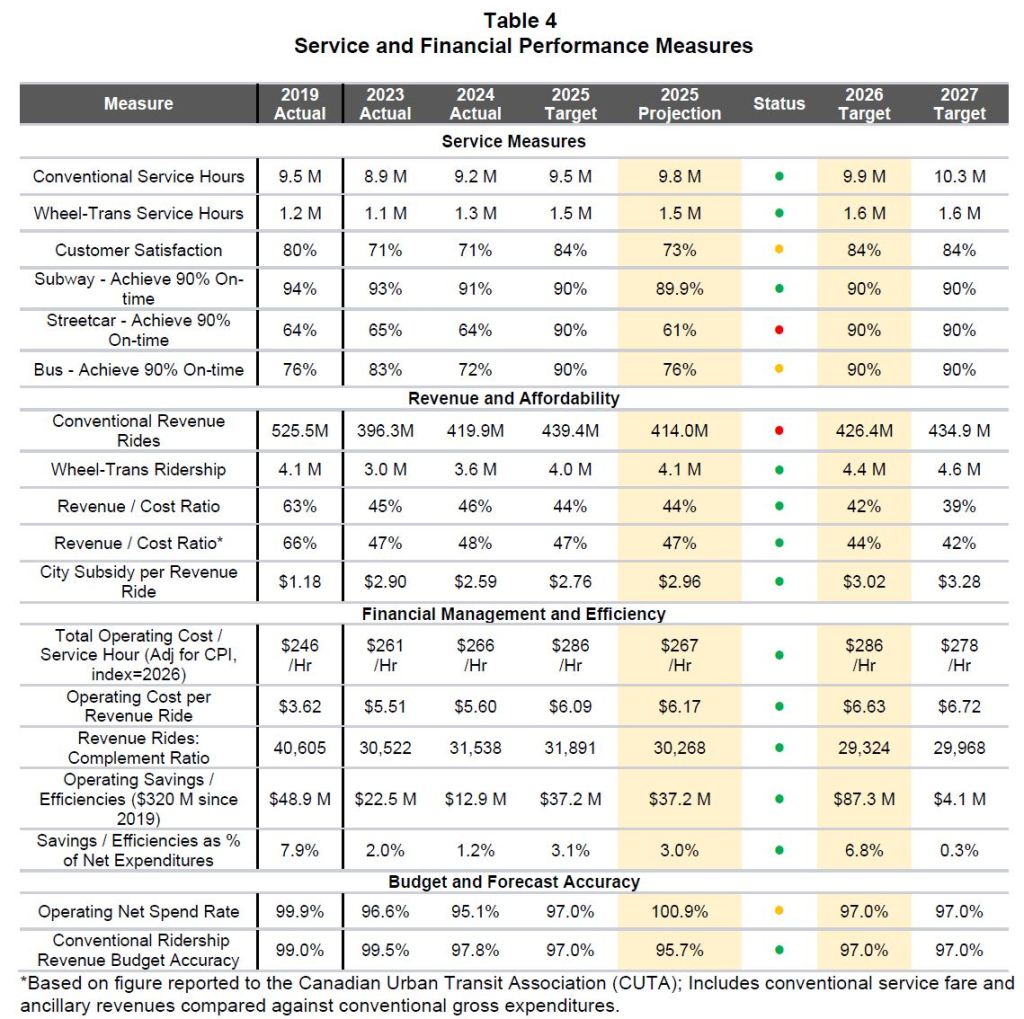

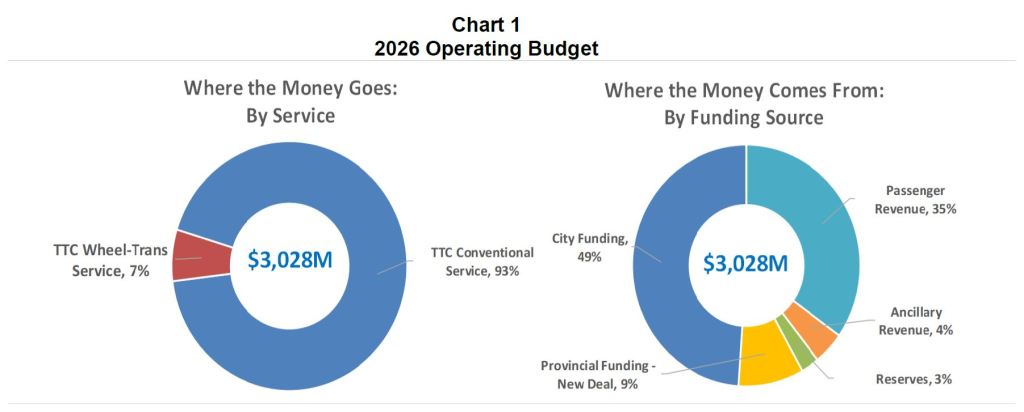

The pie charts below give a high level view of the budget. Note that passenger and ancillary revenues (fares, parking lots, shop rentals, advertising) account for only 39% of the total, and City subsidy is almost half. This is a huge change from the days when the City and Province each paid one sixth of the total, and the lion’s share of the remainder came from fares.

Fare Changes

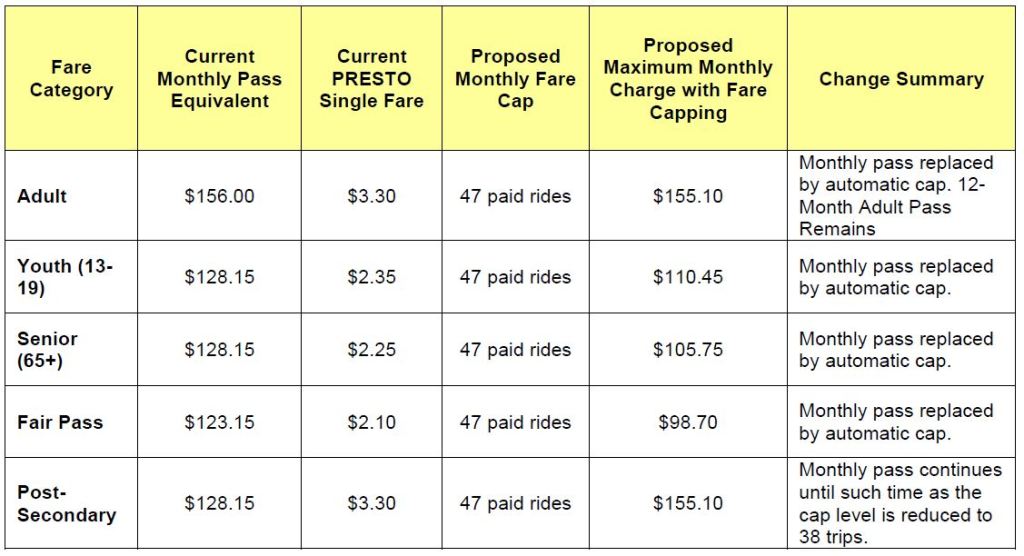

For riders, the biggest news is the fare freeze and capping, to be introduced in September 2026 with a view to further improvement in September 2027. The Adult fare cap is close to the price of a monthly pass, and so riders who already buy passes will see only a small change in their cost. However, the benefit of a capped price will be available to all riders without an upfront payment for a pass.

Youth, Senior and Fair Pass fares will be capped at the same ratio, 47 rides, and this is an improvement over the current higher multiples of 54.5, 57 and 58.6 respectively. Frequent TTC riders in these classes will see reduced costs.

The odd group out here are Post Secondary students whose pass is priced at the same rate as Youth and Seniors, but who pay the full Adult fare if they do not have a pass. This creates a situation where a pass is cheaper than capped single fares. The policy issue here is whether the Post Secondary single fare should be reduced to the Youth level and the monthly pass eliminated.

If the fare cap is reduced to 40 in September 2027 (a decision subject to the 2027 TTC Board and City Council), this will be equivalent to a 15% reduction in the monthly pass cost.

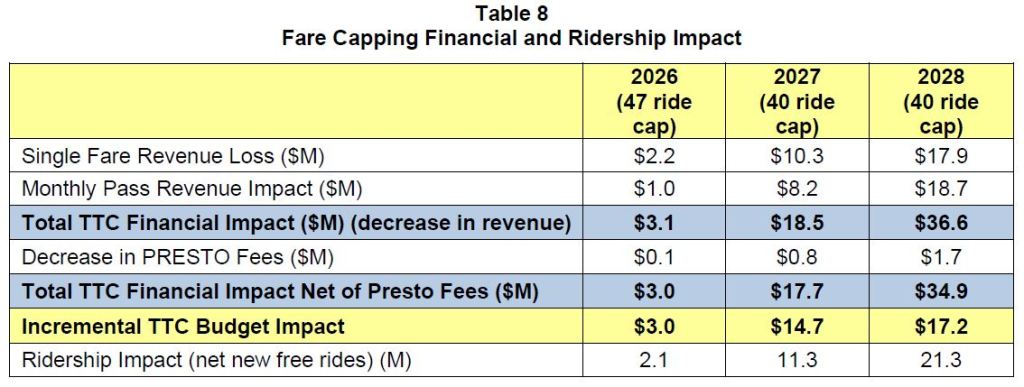

The anticipated cost of fare capping in foregone revenue is $3.1-million in 2026, $18.5-million in 2027 and $36.6-million in 2028 assuming that the 40 fare cap is implemented in September 2027.

All of this occurs with the hoped-for greater riding and extending the benefits of fixed transit costs to more riders. However, fare freezes and reductions cannot go on forever without also discussing the TTC’s ability to retain and improve transit service. A large “SALE” sign attracts few customers if the shop window is half-empty.

Service Changes

The service budget increases by 2% measured in service hours “to address congestion, adapt to changing travel patterns, deliver world-class service during the FIFA World Cup” with an expected ridership of 426.4-million in 2026 compared to a projected 414.0-million in 2025. Note that this is still lower than the original 2025 projection of 439.4-million. The budget does not explain how much of this increase will show up in more frequent service as opposed to congestion adjustments and the one-time bump for FIFA.

One specific change mentioned in the budget is the restoration of peak service on Lines 1 and 2. For reference, here are the current peak service levels and the levels operated in January 2020. Line 2 is already operating at the 2020 level, and Line 1 would only improve by 6% (measured as trains/hour) in the AM peak. The controlling factors in peak service levels are the signal systems and the fleet sizes which prevent service improvements beyond the 2020 levels.

Updated December 30, 2025 at 10:45pm: The “restoration” of peak subway service appears here because it is a budget-to-budget change even though it was actually implemented in late 2025. This does not represent net new service compared to year-end 2025.

| Line | AM Dec 2025 | AM Jan 2020 | PM Dec 2025 | PM Jan 2020 |

|---|---|---|---|---|

| 1 Yonge University | 2’30” | 2’21” | 2’30” | 2’36” |

| 2 Bloor Danforth | 2’20” | 2’21” | 2’30” | 2’31” |

Ridership

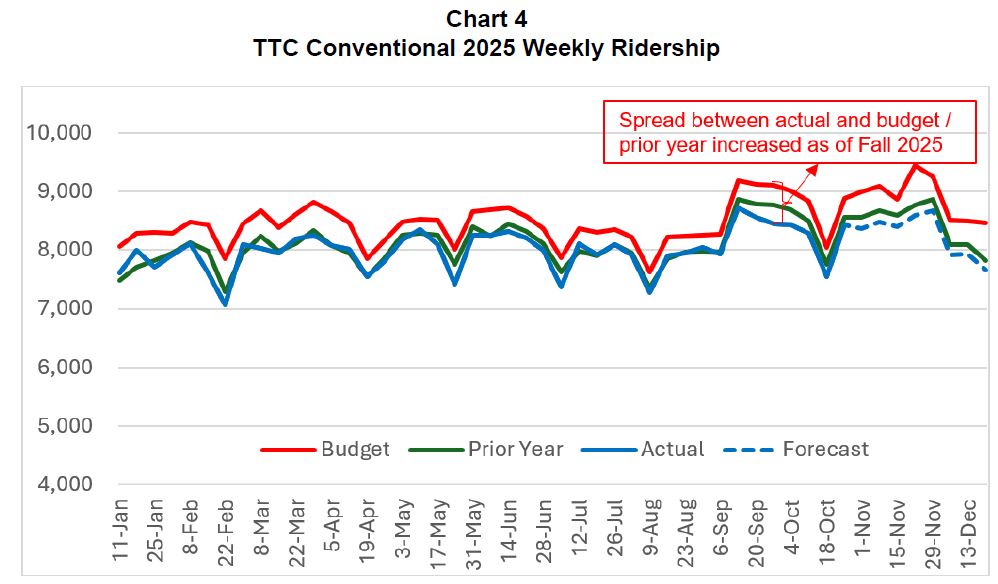

Conventional system ridership has not done well against budget projections in 2025. The budgeted value (top line, red in the chart below) has been consistently above actual counts (blue at the bottom). 2025 numbers closely tracked 2024 values (green) until the Fall when they fell lower. The shortfalls are attributed to a combination of undue optimism about the effect of return-to-work commuting and the loss late in the year of foreign students.

Projections for 2026 are less aggressive and, for budget and service planning, the “medium” increase will be used.

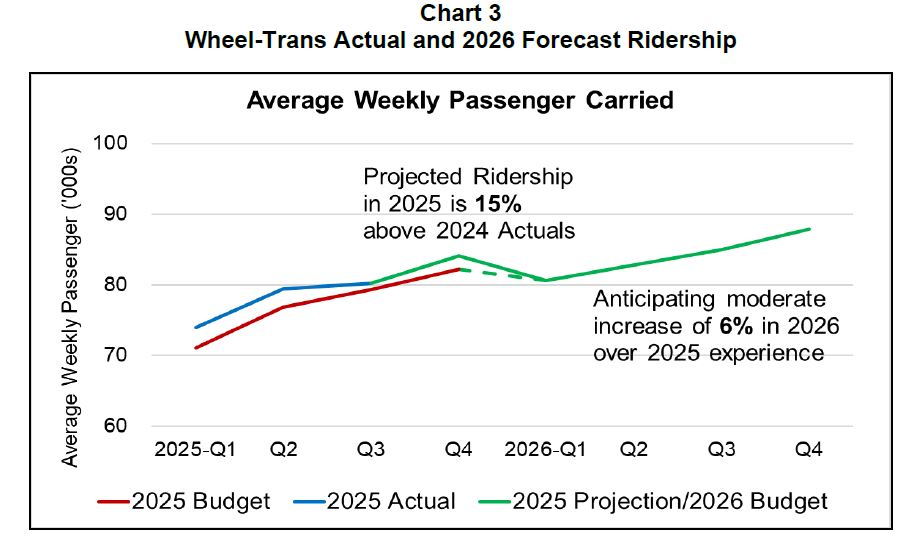

Wheel-Trans demand is strong and more growth is expected there in 2026.

The issue of future demand affects both the operating and capital budget planning process, and there have been conflicting indications of where the TTC thinks this is headed. In the short term, they expect little growth, but a recent Major Projects Update claims that current projections will accelerate the need for extra capacity on Lines 1 and 2.

Line 1 – Capacity Enhancement Program:

- This program provides for the expansion of Line 1 capacity by achieving headways of up to 100 seconds, enabling the movement of up to 39,600 passengers per hour at peak hours. […] Headways of 100 seconds by 2037 were based on pre-pandemic projections. The updated ridership demand forecasts will require headways to be achieved earlier (2035). Full schedule and scope impacts are currently being evaluated. [p. 23]

Line 2 – Capacity Enhancement Program:

- The ridership demand forecasts have been updated and are under review, extending to 2051, and will require the target headways to be achieved earlier than previously planned (135 seconds by 2028, 130 seconds by 2029, 125 seconds by 2030, and 120 seconds by 2037). Full impacts are currently being evaluated and will be outlined in a detailed report to the Board. [pp 20-21]

How this fits with overall system demand, fleet and service needs is not explored in the budget. As the chart below shows, TTC riding has not yet returned to 2019 levels. The “flip side” of that observation is that the pre-pandemic era was noted for overcrowding on many routes and spawned expansion plans such as the Bloor-Yonge project. Toronto should not wait to be back at 2019 and its capacity problems before planning for growth.

Metrics and Targets

The TTC has several metrics to track their operation and associated targets. Notable among these are Customer Satisfaction and On-Time Performance. Although the TTC is working internally on new metrics, these have not yet appeared. A major problem with the concept of “on time” is that it has more meaning for internal purposes than to riders on most routes where service is frequent, but erratic. It is reliability, not the schedule, that matters especially when considerable variation is allowed by TTC standards.