The TTC Board met on June 23. Among the items on the agenda were:

- CEO’s Report

- Financial and Major Projects Update for the Period Ended April 26, 2025

- Non-Fare Revenue Strategic Review

A major item on the agenda was the subway platform edge doors study. This is covered in a separate article.

There were overlapping threads in discussion of current results, the financial update, and the non-fare strategy all stemming from the 2025 shortfall between budgeted and actual fare revenue and ridership. Although some shortfall was expected thanks to the severe winter, ridership has not climbed to the budgeted level. An unanswered question is whether the TTC aimed too high in its expectations for 2025, or if there is an inherent limit in system growth that will occur over the year.

Midweek rides (Tuesday to Thursday) in Period 4 (roughly the month of April) were about 2% over the corresponding period in 2024, but overall ridership is about 5.1% below the budgeted level.

Fare revenue follows a similar pattern, although it is down by only 4.6% to budget because the average fare/ride is slightly higher than expected.

The use of various payment methods continues to evolve toward Presto with either a Presto card, app (“virtual card” below), or bank card (“open payment”). This chart only goes to week 17 of the year, and legacy media were still accepted for another month although they have dropped to 0.2% of all fare payments. In Period 4 about 46,000 tokens and 12,000 tickets were collected (about 2,000 fares/day).

Boardings continue to be below pre-pandemic levels across the system.

Note that a “boarding” is one link of a trip on a single route, with the exception that transfers are not counted as new boardings on the subway. A “ride” is one or more boardings paid for with one fare or card tap.

The lower recovery level on the rail modes is attributed mainly to the work-from-home pattern which is still felt by the transit system with the average day on Tuesday to Thursday being 6% higher than Monday and Friday.

Weekend demand is important and stands at about 60% of the weekday level (1.53 million/day vs 2.54 million/day). By extension weekend service is also important, although the demand is less concentrated in peak hours, and the high point falls in the afternoon rather than the classic AM and PM “rush hours”.

The main CEO’s Report contains more current data than the Metrics Report and states:

For the week ending May 30, the overall weekday boardings stood at 2.5 million per day and increased by one per cent from the same week last year. Weekday boardings by mode continue to be highest on the bus network at 1.2 million, followed by subway at 1.1 million, and streetcar at 245,000. Compared to a year ago, subway and streetcar demand, respectively, increased by six and four per cent, mainly due to an increase in downtown office commutes, while bus demand declined by three per cent.

There is no analysis of the degree to which ridership growth is constrained by the quality and quantity of service. Those of us who remember back before the pandemic will recall that the TTC was in a period of constrained growth. All surplus capacity had been consumed by new riders, but budgets, fleet size and subway capacity limited the amount of service and its attractiveness for new and increased riding.

Rider complaints continue to rank timeliness of service, missed stops, and vehicle operation as the top three concerns, and these outrank safety by a wide margin. This is not to downplay safety issues, but the TTC has severe problems with the dependability of its service which are probably depressing ridership recovery.

An updated Ridership Growth Strategy is expected later in 2025, and the mix of complaints indicates where they should concentrate efforts to woo back riders.

Service Issues

On time performance on the subway is not improving, notably on Line 1 Yonge-University, but the TTC does not break out the contribution of systemic delays (slow orders) from major incidents such as track level incursions, fires and other issues. Line 1 capacity is also running below the scheduled level.

On the streetcar and bus networks, on time performance continues to fall due primarily to construction effects, but also scheduling issues and congestion. Mid route supervision has been added on several routes from mid-February onward. This supervision is headway-based rather than schedule-based with the intent of evening out service.

The affected routes are: 506 Carlton, 512 St. Clair, 7 Bathurst, 24/924 Victoria Park, 25/925 Don Mills, 29/929 Dufferin, 100 Flemingdon Park and 165 Weston Road North. I will publish an analysis of their operation in coming weeks, and from a preliminary review of the data, the results are not promising.

EBus reliability continues to challenge the TTC. The footnote on the chart below is rather odd.

The main cause of not meeting target was due to lower service kilometres accumulated due to buses being out of service for repairs.

When a bus is out of service for repairs it neither accumulates service kilometres nor does it fail. It simply vanishes from the performance stats if it never leaves the garage. The failure rate of the fleet will look good with the lemons off the road, but the utilization will be poor with many buses out of service.

The chart combines data for the three groups of pilot eBuses and the new “production” vehicles so we do not know which of these does the best. Comparable charts for diesel and hybrid buses show MDBF values capped at the target level of 20K and 30K kilometres respectively, but without showing what the actual numbers are. There is no way to know what the actual comparison between reliability of each vehicle type might be.

By contrast the rail vehicle stats show the month-by-month averages without capping, and all groups exceed their targets.

TTC has published misleading reliability stats for its bus fleet for several years.

Financial Update

The Financial Update contains more detail about TTC revenues and costs than is found in the CEO’s Report.

The summary of year-to-date and projected year-end results shows the variation in various revenue and expense accounts.

For the full year, fare revenue is expected to about 3% below budget for the conventional system, and provincial funding will also be down because of the delayed opening of Lines 5 and 6 which will get a special subsidy if ever trains actually run.

On the expenditure side, there is a projected saving on diesel fuel costs from the elimination of the Carbon Tax ($15.1 million for the period April-December 2025), offset by higher diesel consumption from added service. There will be a three-month reduction applicable to the first quarter in 2026, but after that, this one-time saving will end on a year-over-year basis.

Some lines show a variance in the year-to-date figures that changes or zeroes out by year-end. The reason for this is timing differences in spending compared to budget expectations.

Overall there is a projected $30 million shortfall, but $23.1 million of that is a contribution to reserves that offsets a planned draw of $51.4 million.

Non-Fare Revenue

One of the frustrations of attending TTC Board meetings is having to sit through debates when Board members who should know better by now advocate the pursuit of non-fare revenue as a way to offset subsidy calls. The amount of money actually available from this source is trivial in the overall scheme of TTC financing, but the belief that a pot of gold is just waiting to be mined is hard to shake.

Here is a breakdown of the income and associated cost of non-fare revenue for 2024.

Advertising is often cited as a way to squeeze more money out of the system, but the current situation has little room for growth. Many ad spots on vehicles remain vacant. The overall contract for advertising management with Pattison provides for revenue scaled to the number of TTC riders. Recovery to 80% overall is a key line where payments would go up, but the TTC has not yet achieved that. A further problem is that advertisers want new ad formats with animation, not static cards. Basically, Pattison cannot sell traditional on-vehicle ads. This raises the issue of what technology should be installed on new vehicles, or retrofitted to old ones, and at what cost.

There is even a proposal to broadcast ads on the subway PA system, as if we have nothing better to do than listen to ads while waiting for a train that might show up someday. No dollar figure is attached to this, although it would be ironic if the scheme finally resulted in PA systems that could be understood in stations and on trains.

Commuter parking is a money-loser for the TTC in part because the rates are set at a level to attract commuters to park-and-ride rather than simply driving all the way to their destinations. In a recent move by City Council, there is a proposal for the Toronto Parking Authority, who already manages the lots for the TTC, to take over all lots on City property (which includes the TTC). That would shift this item off of the TTC’s books and likely would end the cheap rates too. Meanwhile, the TPA will close several of its money-losing sites to other City uses, likely housing.

Other lines in this table do not necessarily represent areas for strong revenue growth, and they are small change in an overall $2.8 billion operating budget. Many revenue streams available to other transit systems, notably land development, tolls and taxes, are not available to the TTC.

Major Projects Status

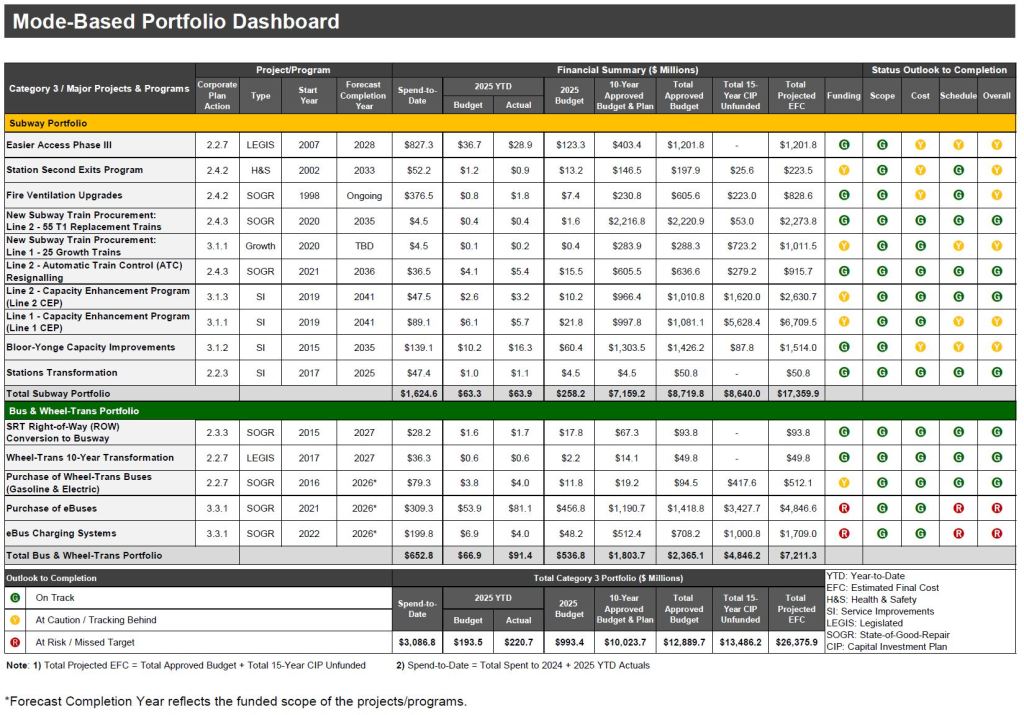

The Major Projects report tracks the status of large projects within the TTC’s capital program. There is a detailed capital plan containing a long list of items that are primarily “state of good repair”. The items reported here are a subset of that plan.

The troubling column in this dashboard, as it has been for several years, is the large proportion of work that is unfunded, notably:

- $7.1 billion for capacity improvements on Lines 1 and 2. This is separate from signalling and purchase of additional trains. It covers the cost of increased station capacity to handle future demand, power and ventilation upgrades. Note that this does not include any money for Platform Edge Doors. The largest items within this project are the provision of a new maintenance facility for Line 1 trains to handle the planned larger fleet, and upgrades to existing facilities at Greenwood for Line 2.

- $723.2 million for 25 additional trains on Line 1 to allow operation of more frequent service than was possible with the old block signal system. Note that this is separate from new trains for the Yonge North (8) and Scarborough (7) extensions which are on Metrolinx’ books.

- $4.4 billion related to the purchase of new eBuses and associated charging systems.

Specific projects are detailed in the report, and readers interested should browse there for more information. Items at caution or risk include:

- The Easier Access Plan is intended to make all subway stations accessible. This project is running late for several reasons, and completion of all stations except Old Mill is anticipated by the end of 2026. Two stations with particular problems, Greenwood and Museum, required the removal of the original contractor. Overall costs are under pressure due both to market conditions, labour shortages and complexity of the work.

- The Second Exits Program still has five stations to be addressed. Construction is underway at Dundas West (UPX connection) and College. Detailed design for Summerhill is in progress. Greenwood is going through neighbourhood consultation, and Dundas awaits a “development opportunity” that can provide a new link into the station.

- The Fire Ventilation Upgrades address the aging condition of fans in the subway tunnels many of which are due for replacement, and some are affected by capacity changes planned for stations.

- The plan for additional trains for growth on Line 1 is at risk due to funding constraints. This could require the extended line to operate with less than ideal service due to a train shortage.

- The plans for capacity improvements touch many aspects of both lines. Not only are there funding problems for these projects, but some work could be constrained by “the unavailability of the TTC Operations workforce and work cars”. This is an example of how some projects assume that staff and equipment needed to carry out the work are just sitting there for the taking, rather than building the added capabilities and costs into the base budget.

- The Bloor-Yonge expansion project is subject to change as the joint venture works through the design phase. Funding and design for platform doors is not yet included.

- Projects to purchase new buses for both the conventional system and for Wheel-Trans are not fully funded and this could affect fleet quality and availability in the medium term.

- The eBus charging system project is also underfunded, and it is possible that it will not keep up with the rate of arrival of new buses.

- The “at risk” component of the Presto program relates to support for cash fares and machine readable transfers. The full program is supposed to finish in mid-2026, but Presto/Metrolinx has missed completion dates before.

I’ve said for years that the ttc needs to have a separate capital program for improvements (modernization, performance, capacity) as the state of good repair budget basically mops up all capital spending, but doesn’t actually improve, modernize or improve capacity.

State of good repair seems to mean – fix what we have, and if we can’t, replace it with the same or a similar thing (sometimes a worse thing)…it never really means improve the thing when we replace it (unless there is no other choice), and it absolutely never means replace a thing early to get any improvements (ie modernization, performance, capacity, lower operating cost, etc)…the only time we escape from this cycle is when there is capital from other sources that is earmarked, or the mayor/council push for something, or when the citizens start to riot and stars align (wifi)…

A capital program that was layered on top of the existing budget and had its own funding would allow for ensuring these types of improvements get piloted, and then mainstreamed when it makes sense…

Steve: The Capital Budget used to have discrete sections where you could see the major improvements separate from SOGR, but that got polluted over the years as other agencies, mainly the Province, stuck their oar in and started dictating priorities. Another problem is that Council embraces policies as a “one of”, such as eBuses, without seeing how this fits into and can disturb other spending plans. They are abetted in this by management who don’t day “but…” partly to play ball, and partly because they have not thought things through either.

LikeLiked by 1 person

Why are there no costs associated with Advertising? Does this just mean that Pattison does everything from installing to maintaining and just sends the TTC a cheque for the net? Sounds like a bit of a perverse incentive to me, if so. Is there a report on this specifically – something like a statement of account from Pattison? And like the orphan oil wells, are they responsible for cleaning up if they abandon an ad site?

Steve: Yes, Pattison workers are responsible for installing and changing out the ads. The capital cost of installing new technology like digital signage is split between the TTC and Pattison, but the breakdown is not in a public report. See TTC Digital Signage Program Implementation Update from December 2024.

LikeLiked by 1 person

Since there is a shortage of trains for the Yonge-University-Spadina and Bloor-Danforth lines, why not move the trains from the Sheppard Stubway on to those two lines? There is no point in running empty trains on the Sheppard Stubway which can be better utilised on those two lines.

Steve: There is no shortage of trains for either line. Peak scheduled service is 56 trains on Line 1 YUS and 42 trains on Line 2 BD. Restoration to full pre-pandemic service would require 65 and 46 trains respectively. They own 76 train sets for Line 1 and 61 train sets for Line 2. The trains on Line 4 are permanent 4-car sets and cannot be used on Line 1.

The issue of running more service on Lines 1 and 2 is a question of budget, not of available equipment.

LikeLike

Thanks Steve. While there’s a LOT of cost/money with the TTC, we should always try to remember what Newman and Kenworthy wrote in their Cities and Automobile Dependence book, that transit costs tend to be in one easy big target/budget, whilst the costs of cars to the public tend to be buried in all sorts of other budgets, and not as a line item. (And yes, cars are costly for their owners too, and are at times very helpful, and marvels of tech prowess, but….). So in Globe of Jan. 10/96, a statement from Vancouver’s senior planner that Vancouver realized that ‘the public subsidy enjoyed by the private automobile amounts to $2,700 per automobilee per year, or about seven times the amount we subsidize public transit”. vtpi.org may have more on this topic, which we tend to be in ‘caronic’ denial about as this is Caronto, OntCARio, with dominant ‘carservatism’, especially under Mr. Ford.

And the dubious quality of all the large expansion projects for me suggest that maybe they’re trying a different way to ‘bankrupt the system’ – these projects aren’t good value for the billions, and oh, Suspect Subway Ext. is now about double the c. $5B, but what’s a few billion, anyways?

Having a return of the Vehicle Registration Tax at about $500 per vehicle I’m pretty sure would involve Mr. Ford invoking the notwithstanding clause and otherwise bash TO around again, but his transport studies of where bike lanes may be removed failed to have enough tunnel vision to see massive capacities of existing subways as a fast travel option (usually) for tens of thousands of people an hour, but these subways have only been around for a half-century, so can’t expect awareness can we?

LikeLiked by 1 person