On December 1, 2015, Toronto’s new City Manager, Peter Wallace, presented an overview of the state of the City’s finances to the Executive Committee. This was by way of an introduction to the 2016 budget which will launch on December 15. Wallace’s talk can be viewed on YouTube, and the slide deck from his presentation is on the City’s site.

Wallace’s approach to the budget is a breath of fresh air on two important accounts. First, he believes that the proper roles for Council and for the City Staff are policy and implementation, respectively. Second, he begins the budget cycle without the now-familiar annual exercise of wrestling the “budget gap” down to zero before Councillors even have a chance to review the numbers. These combine to place responsibility for choices and options where it belongs, at Council, rather than having a back-room hatchet job done by staff without the tradeoffs and options ever surfacing for public debate.

The City Manager is quite clear: decide what kind of City you want and then figure out how to pay for it.

Moreover, Wallace is very clear that the City has been living a charmed existence thanks to very strong revenues from the Land Transfer Tax, and because a large and growing backlog of unfunded capital projects has not been included in the City’s financial planning.

Politicians depended on staff telling only good news so that tax cuts and other giveaways could proceed without arousing questions of where the money will come from, or what might not be built without the lost revenue. That was certainly the case through the Ford era and the early part of John Tory’s mayoralty, but this extends even back into David Miller’s term. The concept of “below the line” budgeting was used to keep some capital requirements off of the books in hopes of major contributions from other governments, and to make the City’s long-term exposure look less dire to maintain a favourable bond rating.

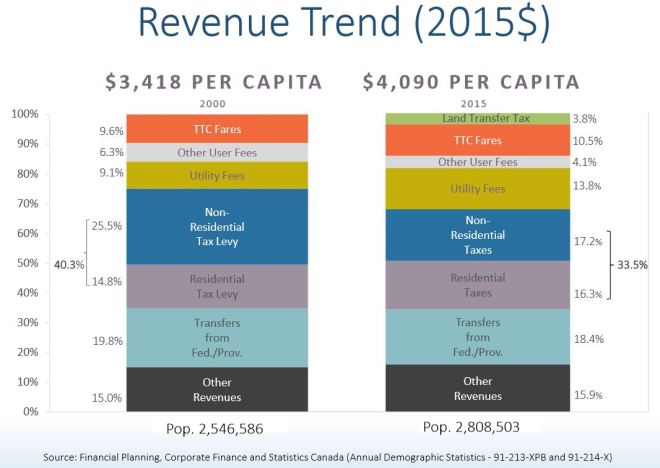

From 2000 to 2015, the total City revenue per capita has grown by 19.7%, and the City’s share of the region’s economic activity has stayed at the same level (in other words, the City has not become relatively a larger or smaller part of the regional economy). What has changed is the proportion of income received from various sources.

TTC fares as a proportion of the total have risen from 9.6% to 10.5%, Utility Fees have gone up by about 50%, and Other User Fees have fallen. The property tax which formerly accounted for about 40% of City revenue now is only 33.5%. Most of this reduction comes from lower non-residential taxes (about which more below).

Land Transfer Tax may only account for 3.8% of total revenue, but that is out of a very large total and it represents several hundred million dollars annually.