Updated July 1 at 11:0 am:

- The section on 2016 budgets has been corrected to show the then almost completed TR train delivery and the proposed T1 replacement project. These were conflated erroneously in the original text.

- In the evolution of pricing for T1 replacement trains, I erroneously omitted a major change in cost estimates from a report in November 2023 which saw a roughly 50% jump in the cost of new trains. The text of the article has been modified accordingly with changes noted by text strikeouts and italics. My apologies for the error.

TTC’s need for a replacement Line 2 fleet has been known for many years. The “T1” cars were delivered between 1995 and 2001, and they will hit their 30-year design life through the latter 2020s. These cars are often talked of as if they will all be over the hill in 2026, but there actual range runs out to 2031. The important issue is to start deliveries of new cars so that the oldest and least reliable can be retired before they affect service.

Some of the T1s were originally used on Line 4 Sheppard, but they were displaced with the shift to Automatic Train Control on Line 1 Yonge-University-Spadina. Sheppard trains run on ATC to reach Davisville Carhouse even though Line 4 itself is manually operated. This change added to the surplus T1 fleet.

When the Scarborough Subway Extension was expected to open in 2026, the extra cars would have provided initial service there, but this is no longer possible because they will age out of use before the line opens.

In the 2018 Capital Budget, presented in the last months of Andy Byford’s tenure as CEO, there are three related items:

- Purchase of 372 new subway cars (2018 to post 2026)

- New Subway Maintenance Facility (Property acquisition)

- Line 2 resignalling (ATC)

The new subway MSF would be on property southwest of Kipling Station, the former CPR Obico Yard, and this has been purchased by the City. At the time, the Relief Line trains were expected to use Greenwood Yard and displace part of the Line 2 fleet, hence the need for a second yard. Moreover, if the new trains were in six-car units like the TRs on Line 1, Greenwood Shops would not be suitable as it was designed for two-car sets.

The clear intent was complete replacement of the T1 fleet starting with design and prototypes, then production deliveries roughly in line with the projected T1 retirement dates.

An “Ooops” In Funding Advocacy?

Updated July 1 at 11:00am: This section has been revised in light of the November 2023 report which used a much higher unit cost/train for the T1 replacements than all previous estimates. If there is an “ooops”, it lies in the use of a lower cost estimate for new trains for an extended period with a very recent jump that increased the unfunded portion of the project. The original estimate would now only cover the cost of replacement trains for Line 2 at its pre-pandemic level of service, but not any expansion/extension trains.

For many years, the plan for new trains required 62 trains (372 cars), a one-for-one replacement of the T1s, to re-equip Line 2 Bloor-Danforth and 18 trains to provide extra trains for service improvements on Line 1. Of the 62 trains on Line 2, 55 would provide the existing Kennedy-Kipling service, and 7 were headed for the Scarborough extension. In the most recent iteration, there are 55 trains for Line 2. The 7 SSE trains are combined with the 18 Line 1 trains to give 25 trains for unspecified future needs.

The full history is tracked later in the article.

Between the 2023 and 2024 budgets the project went from 80 trains for $2.487 billion in 2023 to 55 trains for $2.4-2.5 billion in 2024. Materials produced in support of the purchase and of lobbying efforts to gain federal funding are quite clear that only 55 trains are involved, not 80. This effectively raises the price per train by 50 per cent.

The following text is no longer appropriate, but has been left as a matter of record. Apologies for the error.

Conversely, if the real intent is to buy 80 trains, then pitching the needed subsidy as being only for the Line 2 trains misrepresents what is really happening. This would be an order both for the Bloor-Danforth line’s state of good repair and for accommodation of future extensions and growth.

The TTC has yet to produce updated demand projections for its subway system in a post-covid environment, and it is unclear how many trains will be required to address demand growth and expansion.

Meanwhile, a call for one third federal funding for a 55 train project at $758 million misrepresents the scope and purpose of the new trains. The scope of the planned TTC order is shown below, but with all of the cost allocated against Line 2.

However, elsewhere the plan describes the purpose of this investment as:

Purchase of new subway trains to replace the aging T1 trains, meet ATC requirements and align the fleet with ridership growth forecasts [p. 44 of the 2024 15-Year Capital Plan].

There is a fundamental discrepancy between the claimed need for and funding of new trains between 2023 and 2024 budgets. If the pricing for an 80-train order in years 2023 and before is correct, then the available City and Provincial funding would pay for the 55 Line 2 trains.

The Capital Plan and Shifting Priorities

The 15-Year Capital Plan landed with a thud when it was introduced as part of the 2019 budget. Unlike previous versions of capital plans, it included everything the TTC thought was necessary whether money was available to fund it or not. The price tag was a big shock, over three times the size of the conventional capital plan. This has since grown to four times as the appetite for capital projects goes up, but funding does not.

Transit priority decisions were a very expensive shell game involving the timing and cost of transit projects. Until Premier Ford uploaded four major expansion schemes (Ontario Line, formerly the Relief Line, Eglinton Crosstown, Scarborough and Yonge North) in 2020, there simply was not enough money on the table to pay the City’s share for everything. Also competing for funding were SmartTrack stations, Eglinton East LRT and Waterfront East LRT, not to mention additional streetcars for service expansion, and bus replacements and migration to an all-electric fleet.

The 2019 plan shifted the purchase of new subway cars to post-2028. In its place was a 10-year life extension program for the T1 fleet stretching it out into the 2030s. The scope of the Line 2 ATC project was also adjusted because the T1 fleet cannot be modified to run with ATC signalling.

This achieved a reduction in capital requirements in the short term, but gambled on the viability of the T1s and the old block signal system on Line 2 surviving reliably into the late 2030s. This scheme was short-lived, but it served a purpose of reducing the TTC’s apparent capital requirements to make room for other projects, notably John Tory’s SmartTrack.

Both the provincial and federal government made commitments to some projects based on political considerations and the then-stated priorities of Toronto Council. One casualty of the proposal to defer new trains for ten years was funding for that project. For a time, it went from a “must have” to a future need.

By 2020, the plan included a proposal to buy replacement trains in the 2026-2030 time frame depending on funding, and deleted the life extension program for the T1s.

Ontario signed on for its share of a new fleet. Add-on orders will furnish trains for the Scarborough and Yonge North extensions that will cost less than they would as small, free-standing buys.

Replacement of the Line 2 fleet cannot proceed as a single project. The signal system dates from the 1960s and uses old technology. This presents both a maintenance and reliability challenge for the TTC and limits the frequency of service to what is possible with conventional block signals. That design holds trains further apart than an automatic train control system using “moving” blocks that can allow trains to pull closer together based on their speed and fine-grained location of their positions. Although new trains can be manually operated with old signals (as occurred on Line 1 during its transition to ATC), new signals require new trains.

By 2021, the new yard at Kipling had been pushed beyond the capital plan’s 10-year horizon. The Relief Line would have used TTC subway cars, but was replaced by the Ontario Line. Metrolinx claimed, falsely, that the OL would use newer up-to-date technology than the TTC would have provided. (This was a case of contrasting a brand new line with the oldest of TTC subway vehicles, signalling and operations.)

Originally the pressure for the Kipling yard came from using part of Greenwood Yard for the Downtown Relief Line, but the Ontario Line has its own Maintenance and Storage Facility at Thorncliffe Park. Trains for the Scarborough extension can be fitted within existing yards and spare tracks, but any service increase beyond pre-covid levels will trigger the need for a western yard. (A separate northern yard is under study as part of the Line 1 extension to Richmond Hill.)

Greenwood Shops, like the B-D line, is 60 years old and in need of overhaul and upgrades. Part of the original plan for a Kipling facility was to free up space for this work at Greenwood by reducing demand on the yard and shop space. However, with the deferral of Kipling, the Greenwood upgrades will occur while the yard is stuffed with the existing fleet and working through the transition to new trains. This saves money on a new yard at the expense of operational complexity and probably a longer period for upgrades than would otherwise be needed.

Federal Funding for T1 Replacements

The federal government has not yet committed funds to the T1 replacement project. Their current proposal involves a permanent transit fund available country-wide beginning in 2026. Whether the Trudeau government will still be in office to make any payments from such a fund is in some doubt.

Transit systems, not just Toronto’s, would like to pre-book payments from this fund so that they will be sure of the case flow in a few years and can launch major projects such as the T1 replacement now. The feds have been silent on that request although the TTC claims that discussions are underway.

The Federal Permanent Transit Fund (PTF) is set to provide new funding in 2026. Early commitments of funding under the Permanent Transit Fund (PTF) are needed this year, by opening up the intake process for critical in flight projects such as new subway trains. This is a request being made by all major transit agencies1 (STM, TransLink), and the Canadian Urban Transit Association2. Even if federal funding does not flow before 2026, having a firm approval of funding to be allocated from the PTF program will allow the TTC to launch the procurement. [Backgrounder, p. 2]

Even assuming that the fund will exist when it is needed, booking projects against it has a downside in that money earmarked for the subway cars will not be available for other projects. There is also a basic problem that the fund is thought to be too small, but that is a separate matter depending on government priorities well beyond the next election.

Local priorities can have their own effect in misdirecting spending. The SmartTrack Stations program will build five additional GO stations (East Harbour, Liberty Village, Bloor-Lansdowne, St. Clair-Old Weston and Finch-Kennedy) at a total cost of $1.689 billion of which $585 million comes from the Federal government and $878 million from the City. This arrangement came into effect in April 2018, the period when the TTC downplayed the importance of new trains thereby making room for John Tory’s signature project. A few years later, priorities changed again, but the federal money was already committed to SmartTrack.

Toronto is using scarce transit funds, regardless of their source, paying over $300 million per station for what should be a GO Transit project.

Shifting priorities have delayed other projects and/or changed their scope, and federal money that might have been scooped if projects actually were underway sat on the table. Some of this is now rolled into the overall transit fund, and it will be up to Toronto to actually launch projects to use whatever has been allocated. Toronto will have to actually decide what it can afford within available funding rather than assuming other governments will always shell out, and that they will keep funding “commitments” alive while Council dithers about whose ward gets the next transit project.

Evolution of the Proposed Purchase

The replacement of the T1 fleet is a high priority for the City and TTC. Two documents in the Board’s June 2024 agenda covered this in some detail:

There is a major change between past year budget presentations on the subject of new trains and information in these reports.

Updated July 1 at 11:00am: This change was first reported in November 2023 when the estimated cost of new trains was substantially higher than in all previous reports:

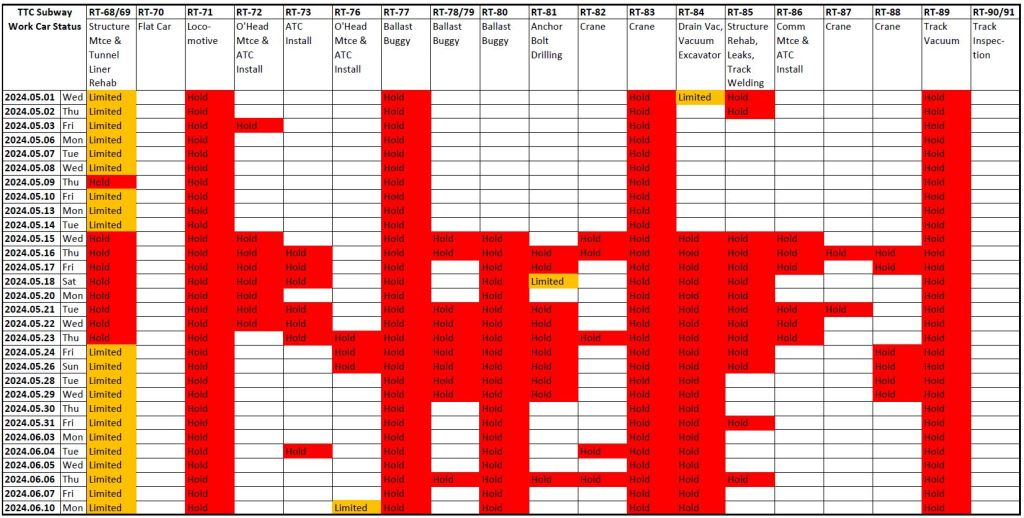

The table below summarizes the information.

Updated July 1 at 11:00am: Estimated cost of 62 T1 replacement trains in 2016 added. Updated pricing from November 2023 added.

| ($ billion) | T1 Replacement Trains | Line 1 Growth Trains | T1 Life Extension | New Trains (Total) |

|---|---|---|---|---|

| 2016 | $1.737 (62) | |||

| 2019 | $0.068 (*) | $0.430 | $0.720 | |

| 2020 | $2.270 (62) (**) | $0.500 (18) | $0.710 | |

| 2021 | $1.742 (62) | $0.501 (18) | $2.243B (80) | |

| 2022 | $1.600 (62) | $0.720 (18) | $2.320 (80) | |

| 2023 | $1.718 (62) | $0.769 (18) | $2.487 (80) | |

| 2023 (Nov) | $2.222 (55) | $1.010 (25) | $3.232 (80) | |

| 2024 | $2.4-2.5B (55) |

Notes:

- (*) T1 payment in shown in the 2019 budget is a downpayment that would be made at the start of the procurement contract.

- (**) The value of the T1 replacement shown in 2020 is high because this assumes the contract would not start until much later in the decade, and includes inflation.

Two things have happened:

- 7 of the 62 Line 2 T1 replacement trains have become Line 1 growth trains. These were originally trains for Scarborough, but responsibility for them has shifted to Metrolinx. However, the TTC has not reduced the total order size to compensate for this.

- The background information on the replacement trains talks only of the 55 Line 2 trains, but uses the full $2.4-$2.5 billion cost reflecting the revised unit cost from the November 2023 report.

In fact about one third of the train order would be used for Line 1 growth, but the total dollar value is erroneously claimed to be only for the Line 2 trains. This is a deeply misleading presentation.

The remainder of this article looks at the history of the T1 fleet and the shifting plans for its replacement including the budget and fleet plans for Lines 1 and 2. For an extensive discussion of subway fleet history, see Transit Toronto’s site.

Continue reading