The TTC’s Strategic Planning Committee met on September 4 at 10:00am in the Board Room at 1900 Yonge Street, TTC headquarters. The agenda included a presentation on the 2025 projected results and the outlook for 2026. This includes comments on the Capital Budget and Plan which I covered in a previous article.

2025 Projected Operating Results

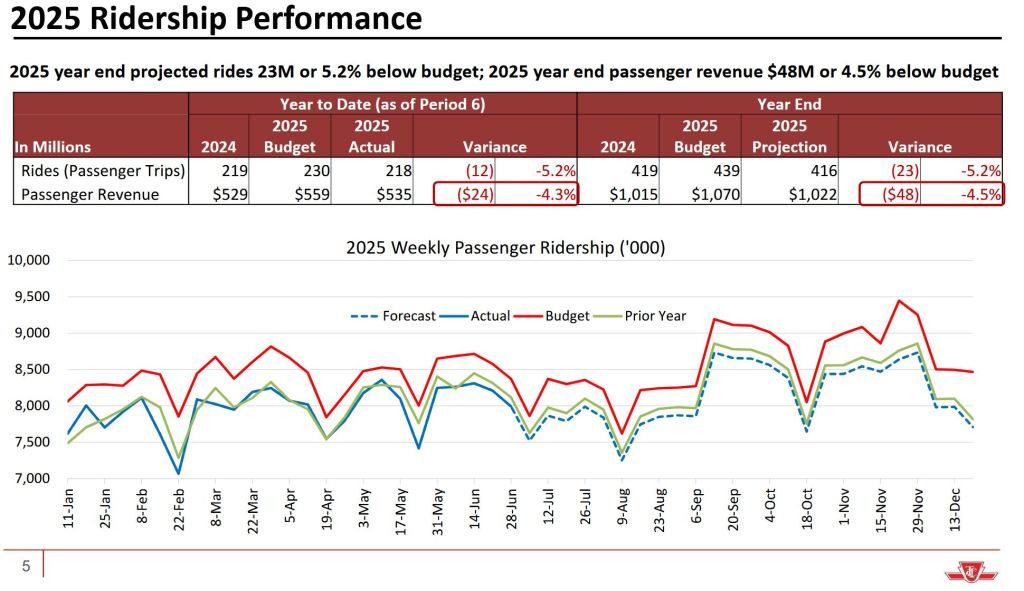

As of June 30, the TTC was running $17.7-million behind relative to budget, and this number is expected to rise to a $36.5-million shortfall for the full year.

This is due primarily to ridership coming in lower than projected partly offset by lower than budgeted expenses.

One item not mentioned in the report is that the TTC’s Operating Budget for 2025 includes a withdrawal of $51.4-million from reserves. There are several reserves for different purposes (one covers self-insured loses from accidents), and it is not clear how much headroom there is for further withdrawals once year-end results are finalized.

The City often finds “left over” money at year end from various sources, and some of this goes into reserves and/or to making the TTC budget whole. Whether this will be available in 2025 is not yet clear.

In any event, if future budgets assume substantial reserve contributions, they could exhaust the “rainy day funds”.

The 2026 Outlook follows the “more” break.

2026 Operating Outlook

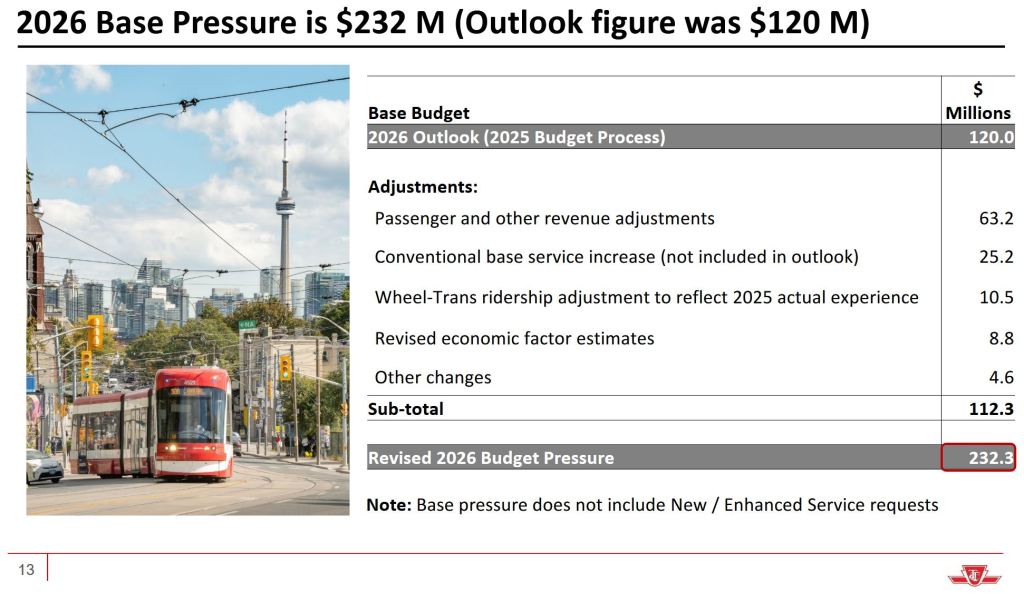

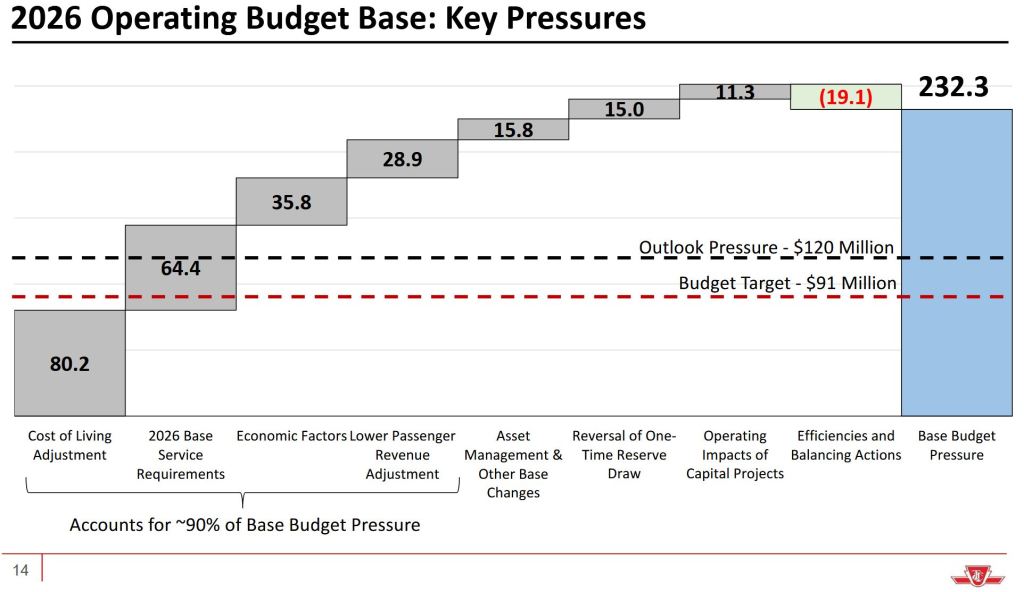

The 2026 budget starts out in a considerable hole thanks to the target set for the TTC by the Mayor’s Office: a net subsidy increase of only $91-million, and a target to find “efficiencies” of $17-million. The actual gap looking ahead is much larger. The original projection for 2026 was a $120-million requirement over 2025, but it is now $232.3-million. The major adjustment is for lower than expected fare revenue based on the 2025 experience to date. While the revenue situation could improve with the effects of work-from-office mandates, the effect of this will not likely be clear until sometime in 2026 well after the budget must be set.

This leaves proposed service improvements in 2026 out in the cold. The Mayor faces a clear divide between her desire to hold down tax increases in an election year and her advocacy for better transit. The debate at Council will be “interesting” as transit is not the only portfolio that will seek extra City funding.

This is broken down by budget component in the chart below.

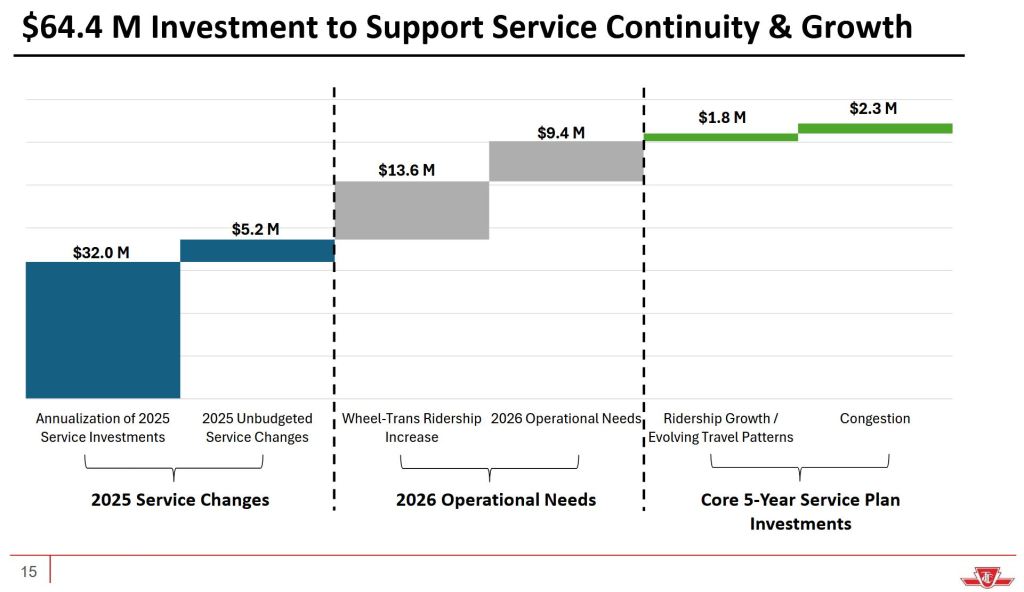

The $64.4-million above for “Base Service Requirements” is broken down in the next chart. Note that there is only a small provision for growth of service in 2026, and the big jump comes from annualization of changes already operating in 2025.

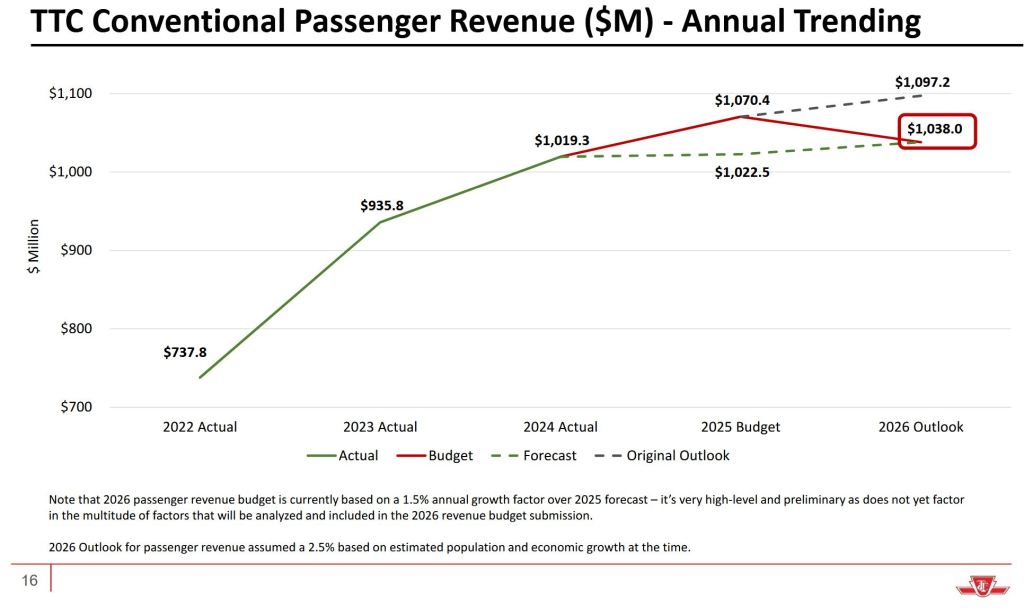

The projected passenger revenue for 2026 is down from where it might have been if the 2025 budget had been achieved. The figure shown here might be revised upward if there is strong evidence of growth from work-from-office mandates, but combined with any service improvements or fare adjustments, this could lead to problems later in 2026.

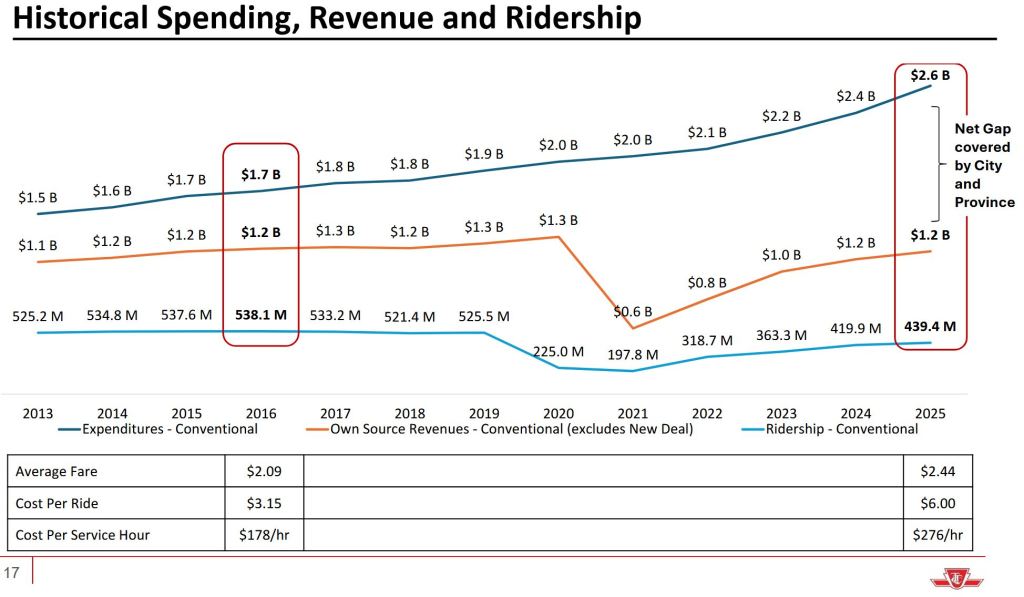

A look back at the past decade shows the profound effect of the pandemic on the revenue/expense balance at the TTC. The average fare has risen from $2.09 to $2.44, or 16.7%, while the cost per ride has nearly doubled from $3.15 to $6.00. The gap between expenses (blue) and fare revenue (orange) has permanently widened and this cannot be closed without major changes in service and fares, neither of which are politically desirable. This would also run counter to Council’s policy of encouraging transit use and keeping costs to riders down.

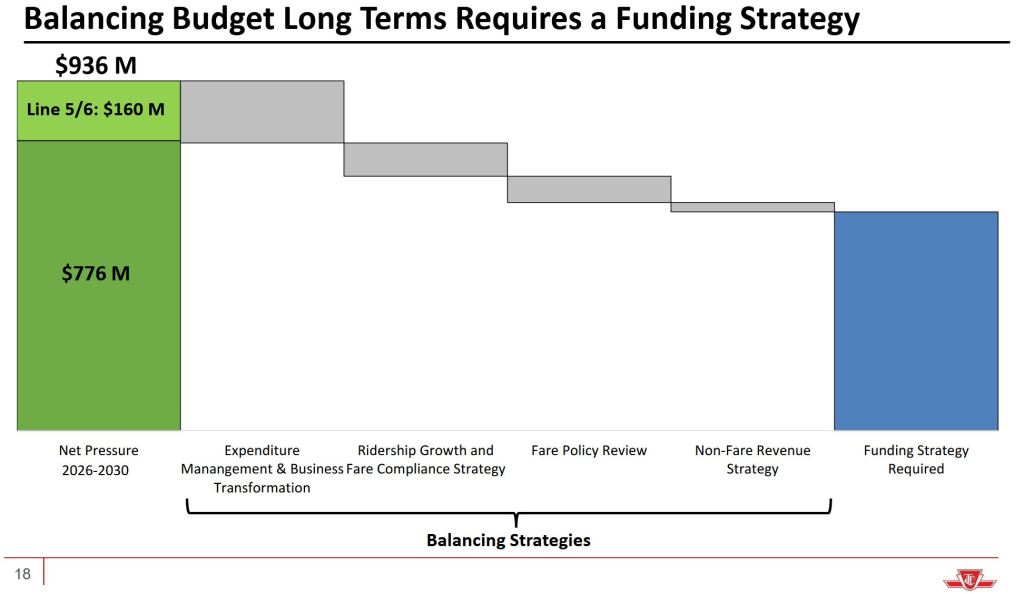

The following chart oulines TTC management’s approach to “solving” the revenue problem. First they project a total pressure over 2026-2030 of $936-million including new costs for Lines 5 and 6. Note that Ontario’s guarantee of operating subsidies for these lines only runs for a few years.

Very troubling is the idea that “Ridership Growth” and “Fare Compliance” are lumped together. They are very different aspects of transit policy. Coupled with a “Fare Policy Review” these show a reduction in the funding gap. However, it is no secret that both service improvements and the likely fare initiatives such as capping will not generate a net profit, even though they may generate more riding. Both are policy options to attract riders to transit and their cost should be treated as a investment in mobility, just as construction of new rapid transit lines is seen as an economic benefit.

In any event, the lion’s share of this shortfall remains, and it will be a drag on any proposals to significantly increase service. [Note that this is a TTC chart and the absence of specific amounts is their choice.]

Come 2030 we will also be close to the opening of the Scarborough Subway Extension and the Ontario Line. It is not yet known where the operating costs and subsidies for these will fall.

Great work. No free lunch. We are all going to have to pay more for transit for liveable cities. Where is Ottawa in the mix? What is the net cost of fare inspectors ?

LikeLike