Updated July 21, 2025 at 11:20am:

Despite the extensive catalogue of issues with the Green Bus program, the TTC Board wasted no time in adopting the report without debate on an enthusiastic motion by Commissioner/Councillor Saxe. There was a sense that they could not wait to get this item off of the table.

However it is likely to come up again at the Strategic Planning Committee in discussions of future service improvements and the resulting fleet size, and the City Auditor’s review of the program will land on Saxe’s Audit & Risk Management Committee agenda sometime in 2026.

In the meantime, the TTC needs honest reporting of the performance of its growing eBus fleet as more buses arrive. In the short term, they can paper over range issues by using these vehicles on blocks of work that do not tax their capacity (buses that are only in service for part of the day, and on less stressful routes). The disparity between charging capacity and fleet size discussed in the report will also affect availability, and “performance” metrics should include not just how far a bus can travel, and how reliable it is from failure, but also whether it is even available for service.

Meanwhile, major systems elsewhere in North America continue to hedge their bets on eBuses with parallel orders of hybrids as Toronto is now doing.

Vancouver has the advantage of an existing trolley bus network which allows them to design around in motion charging. See Coming soon: the first of Metro Vancouver’s next-generation trolley buses.

Original Article

At its meeting on July 17, the TTC Board will receive an update on its Green Bus (eBus) program.

This is a long report, and some key information is buried down in the appendices. It reveals, among other things, that:

- Delivery of the battery-powered eBuses is running late. This is an industry-wide supply chain problem.

- The TTC plans to buy 200 more hybrid buses as an interim step to allow retirement of their oldest vehicles.

- The reliability of the eBuses is below the originally hoped-for “long range” capacity and they are only achieving about 250km per charge. That is with a new battery, and the value is expected to drop as batteries age.

- Much of the TTC’s currently scheduled service cannot be operated with standard range eBuses, and planned change-offs will be needed to cover the span of service typical on TTC. This will add to mileage and operator hours.

- Charging operations at garages are constrained by a shortage of installed charge points compounded by limitations of electrical capacity.

- The problem of shorter range and limits on charging fundamentally change how garages operate for diesel/hybrid buses where refuelling is quick and is performed as part of routine servicing as buses come out of service.

- The need to shuffle buses between charge points and storage locations will add to staffing requirements at garages.

- eBuses cannot replace hybrids on a 1:1 basis because of the charging constraints.

- There is a possibility that the TTC will have to store new buses unused because of charging limitations.

- The policy decision to deploy eBuses at all garages simultaneously requires that maintenance equipment, staffing and training must be provided everywhere at once rather than a garage by garage transition, and that concurrent support for hybrids must also exist at all sites.

- On route charging (using charge points at key locations to permit buses to “top up” their charge) was considered early in the project, but was rejected for various reasons including a desire to be up and running quickly to secure special eBus subsidies. It is now treated as a possible option, but with implementation five years away.

- The comparative performance of hybrids and eBuses in the CEO’s monthly Metrics Report artificially understates the hybrid numbers and makes the eBuses appear to perform closer to hybrid buses than is actually the case.

- The TTC does not address garage capacity issues and, indeed, speaks of shifting the need for a 10th garage off by over a decade through a “garage enhancement” project. This scheme echoes other past budget juggling to shift major infrastructure requirements and their funding needs off of the current planning calendar.

- The report contains no discussion of the implications of technical limitations for the future of bus service especially in the context of any desire to drive up ridership with significant service improvements.

Overall, the report describes a project that has finally addressed the technical realities of eBuses, something that has been glossed over for years. Some aspects of eBus migration, notably charging capacity, time and garage management issues, are presented almost as new discoveries even though they are not new to the industry. Whether this is wilful ignorance or downplaying of problems on a high-profile project, the effect is the same. As with a few other major Toronto projects, the TTC is saved from some pitfalls because schedule extensions give them more time to deal with issues that should have been foreseen.

The project began in 2017 when, shamefully, the TTC Board under then Chair Josh Colle, allowed reps from BYD to pitch their wares in the guise of a “deputation”. This was “facilitated”, to use City Hall speak, by then TTC Board member Minnan-Wong with behind the scenes support from then-Mayor Tory. The video is still available on YouTube. The original hype from BYD, who hoped for a large untendered contract, is falling away, but the implications for the future of TTC bus service are only now coming out in the open.

See also: Is A TTC Bus Technology Gerrymander In The Works? [Sept. 5, 2017]

(Those of us with long memories will recall the combined efforts of TTC management, MTO “innovative technology” staff, the gas industry and Ontario Bus Industries to replace the TTC’s trolleybus system with “clean” natural gas buses on a sole-source contract. We have been here before.)

As the 60-bus pilot project wore on, BYD was only able to supply half of the 20 buses originally allocated to them. Proterra, now out of business, got 25 and New Flyer got the other 25. At the point I write this article (July 13 at 3:00 pm, none of the BYD buses is reporting a position on the vehicle tracking system. (14 of 25 Flyers, and 8 of 25 Proterras are active.)

New Flyer is supplying eBuses to the TTC, and of the fleet numbers 6000-6203, the highest number reporting its location is 6141. Fewer than half of the delivered buses is reporting a location. Nova Bus deliveries on a 136 bus order are slower, and only 6 buses are reporting locations. (See Appendix E later in this article for information on delivery progress.)

An important issue when considering reliability stats is that a bus that never runs never fails, and so does not contribute to MDBF (Mean Distance Before Failure) stats. These buses do, however, count as part of the TTC’s active fleet and inflate its apparent size including chest-beating claims to the number of eBuses Toronto has. Having them and operating them are two different issues.

When there are only a few trial vehicles in the fleet, how well they work has little effect on service, especially through the pandemic era when service was not running at 100% of former levels. The situation is much different as recovery to full service, notably on the bus network, is in sight, and both City Council and some TTC Board members talk of an aggressive increase in transit service to wean motorists out of cars and accommodate population growth.

The TTC has already reached the point where it must keep elderly vehicles in service to compensate for performance issues with the new fleet, and this situation will compound as more eBuses arrive. There is even a question of where to store all of these buses if they cannot be actively, reliably used. The planned order for hybrids does not simply buy time while supply chain issues are worked out and battery technology improves. It is an admission that the electric fleet plan is not working out and that service at current levels is threatened. Major service expansion is simply not possible.

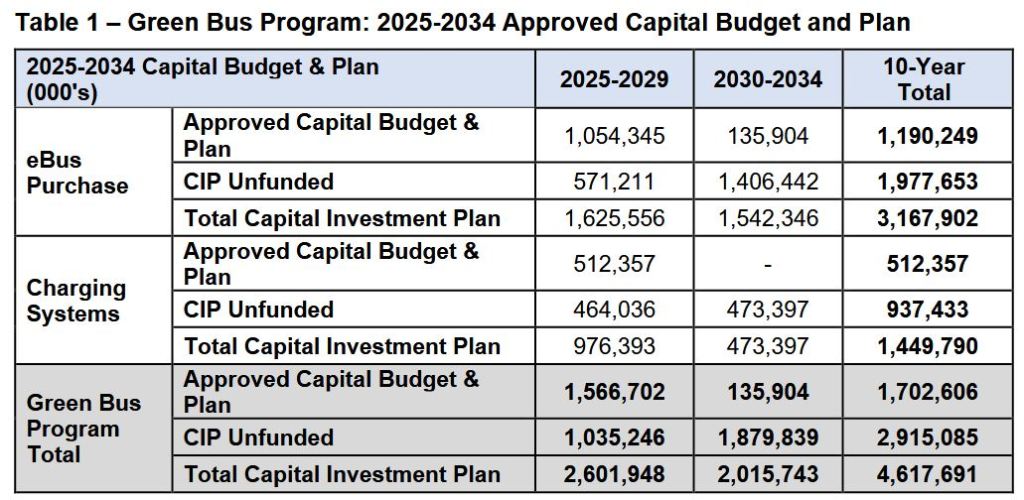

On the financial side, migration to eBuses is not cheap, and the project is funded only to about 37%. An important discussion nobody at the City or TTC seems willing to address is whether it is better to lower emissions by converting the fleet and all facilities to electric operation, or if buying and operating more buses to get riders out of their cars and improve mobility in the city should take precedence. Capital projects are seductive because they are often funded with “other people’s money”, but even the special eBus subsidies only go so far.

It is both ironic and sad that the electric streetcar system has many surplus vehicles thanks to service cuts, but also from a shortage of operators. The TTC plans to move to a six-minute service on three routes in Fall 2025, but may have to bus one line (503 Kingston Road) for want of streetcar drivers.

Peak streetcar service in July 2025 is 170 cars (on Saturday afternoons, not during the weekday peaks!), but the fleet will soon number 262 cars when the last of the new Flexitys arrives. 50 of the 60 new streetcars, 4603-4662, are actively reporting locations, and the highest of these, 4655, shows how close to complete the deliveries are.

In the rest of this article, I will explore issues with the eBus project and plans in more detail, but the last Appendix deserves to be here, “above the fold”.

A review commissioned by the TTC Board from Deloitte in 2023 flagged issues with “project management improvement in the areas of schedule, cost, scope, reporting, risks and issues, governance, and interdependencies management”. Of the 37 recommendations, 18 are closed and 19 are in progress.

An APTA (American Public Transit Association) peer review is planned to begin in September 2025, and the City’s Auditor General plans to review the eBus program.

It is quite clear reading through the report that the TTC eBus project is in trouble both because of external factors (industry conditions) and because the implications of the technology were not fully understood or appreciated. Moreover, the transition will require far more than buying some new buses and plugging them in. The TTC loves to claim that is a leader in the field, but this is likely only true in comparison with smaller systems that do not have the capacity. Within the industry, TTC is not at the front of the pack.

Continue reading