The TTC Board will meet on September 28. Various items of interest are on the agenda, but there is nothing regarding the 2017 budget or fares which will be dealt with at one or more future meetings (to be announced).

- CEO’s Report September 2016 Update

- Customer Satisfaction Survey

- Implications of Microtransit

- Surplus Land Review and the Future of Danforth Garage

Also in the agenda is a long (273 pages) report from KPMG reviewing the TTC’s Capital Program, project management and procurement. There is a lot to digest in this document, and I will leave it for another day.

CEO’s Report

The item on everybody’s mind this summer has been the weather, but its effects receive only tangential mention in this report which, for the most part, gives data up to the end of July 2016. On the subject of broken air conditioning units on BD Line 2:

The summer has also been marked by ongoing challenges with air conditioning equipment on T1 cars (Line 2). The exceptionally hot summer, combined with the age of the equipment, has led to uncomfortable rides for our customers and adverse publicity for the TTC. This is unfortunate given how hard everyone is working to transform the TTC’s reputation and to improve performance across the board. My rolling stock team has accelerated plans to completely overhaul this aging equipment, so as to avoid a repeat next year. In the meantime, a number of Toronto Rocket trains were deployed onto Line 2 to provide customers with a higher chance of a cool car. [p. 9]

This comment is immediately followed by an observation that the Customer Satisfaction Score sits an 80%, but the survey period for this only runs to the end of June (most of the data is from earlier months), and so the ongoing AC problems do not factor into this number.

A continuing failing within the reporting of “KPIs” (Key Performance Indicators) is that the TTC does not create, at least for the public, ad hoc KPIs to track problems like the AC issue on BD. There is a daily record of how well service performed the previous day, but basic questions such as “how many vehicles still have no AC” or “how many vehicles were unfit for service” do not appear where progress, if any, can be tracked. (Because the T1 cars run in pairs, there are actually three possible conditions: pairs with two “hot” cars, pairs with one car hot and one cool, and pairs with both cars cool. Ideally one wants as many of the last group and as few of the first in service.)

Service quality continues to be tracked as an on time measure at terminals, a factor which (a) the TTC does not achieve reliably, and (b) gives no indication of service quality elsewhere along a route. Short turns are measured by quantity, but not by time or location, and long-promised route-level statistics have yet to appear.

The report notes:

I am pleased to report that the long-awaited upgrade to speed control software will come on-stream by the end of this year and this will deliver substantial improvement to the number of delay incidents. [p. 10]

While this is pleasant news in the abstract, none of the many delays routinely reported in TTC eAlerts says anything about “speed control” failures, and so there is no indication of the proportions of delays and delay time that are actually caused by this factor.

Ridership, as previously reported, is down from budget but up marginally from 2015. This triggers some belt-tightening:

I previously reported that strict controls have been implemented on all discretionary spend. These controls remain in place and are helping to offset the revenue gap caused by the softening in ridership and the relentless rise in Wheel Trans trips at a greater individual cost. [p. 11]

A subtle factor at work here (which also shows up in the overall budget) is the competition for resources between Wheel-Trans and the “conventional” system.

The “increase” requires careful understanding. The increase cited, 0.2%, is in the rolling 12-month average of riding which is now the period September 2015 to August 2016. The month-to-month comparisons vary as the charts below show.

The big problem is that the budget aimed high, and the TTC has not achieved the expected number of rides, nor the revenue that these would generate. This begs the question of whether the budget was politically overoptimistic (at the time, it was described as a “stretch” target). The report notes that ridership has been running below budget for “17 of the past 18 months”. This is not a problem confined to 2016.

By contrast, Wheel-Trans ridership is running above budget. Although there are far fewer WT riders than on the conventional system, they cost much more per rider and almost all of the WT costs are borne by the City, not by the farebox. Underestimating WT ridership for budgets has a similar effect to overestimates on the conventional system – the projected deficit is smaller at budget time than at year-end, a politically advantageous situation when one is attempting to justify low taxes. Blame the problem later on mismanagement rather than on unrealistic expectations.

Presto continues to be a trivial part of the TTC’s fare collection, although its share is growing. In August 2016, Presto accounted for more than 500k weekly journeys, but this is out of a total that is routinely above 10m.

The TTC continues to be unable to operate the scheduled level of service during peak periods on the two major lines.

This means that the actual capacity provided, on average, is below the claimed level. Given that these are monthly averages, there are likely days that individually are worse and some that are better, but the basic problem is that the advertised service is not reliably available. More frequently scheduled trains will not be possible until 2019 when the Automatic Train Control system is fully enabled, and the question will remain whether the scheduled service will actually be provided. (For a review of the King 504 route which suffers from similar problems, see How Much Service Actually Runs on King Street?.)

Streetcar and bus services continue to miss their targets for on-time performance and short turns, although some of the stats are improving.

On time performance is measured relative to the schedules, not to the headways, on the presumption that if vehicles are on time, the headways will take care of themselves. However, a six minute window (-1 to +5) gives much latitude, and on frequent routes allows departures from terminals in convoys to be “on time”.

Values in the short turn charts are not directly comparable because they are absolute numbers, not expressed as a percentage of trips operated.

Subway fleet reliability numbers present some oddities. Values for the T1 fleet are particularly “spiky” which implies a wide change in reliability over hundreds of cars in a very short time. Conversely, if there are only a few incidents actually counted, then a small change in that number could produce a big change in the charts.

As with so much TTC data, the problem is that they report averages without the underlying data. However, from the 2015 operating stats we know that the total subway mileage was 82,177,000 km. This translates to an average monthly value of 6.84m of which nominally half belongs to each route (actually a bit more for YUS than BD). If the target for failures is 300k for T1 cars (Line 2 BD), this implies that there should only be about 10 of them a month (3.42m km divided by a .3m target). The target of 500k for TR cars (Line 1 YUS) implies an even lower failure rate is the target.

What this means is that very few “failures” are actually being counted for the purpose of these charts, probably only those causing major disruptions, and so the values bounce around a lot. Riders, on the other hand, encounter delays quite commonly that might be due to minor problems.

For the surface fleets, the performance is considerably less rosy.

The older streetcars showed a considerable improvement in reliability through 2015, but the values fell back in January and have only modestly improved since. Of greater concern is the new streetcar fleet. This was considerably more reliable than the old cars early in 2016, but the numbers have fallen into comparable territory by mid-year. This suggests that either the recently delivered cars are less reliable and pulling down the average, or that the more-established fleet is starting to show problems.

On the bus fleet, reliability for 2016 is running ahead of 2015, and the report notes that garage staff are now concentrating on quality of repairs, and by implication not just patching up a bus to get it back on the road. The stats should also benefit from retirement of the worst of the older fleet.

An overall question here is “just what is a failure” for the purpose of these stats, and is it the same definition for all modes? I will pursue this issue with the TTC.

Major variances in expenses [pp. 47-48] show how budgeting cannot be an exact process, and that unexpected factors can have effects that some Councillors might erroneously call “out of control spending”. (For reference, $30 million is roughly the amount raised by a 1% change in property tax or by a 10 cent fare increase, and this puts the numbers below in a political context.)

- Employee benefits are down $10m from budget thanks in part to lower claims levels arising from fraud investigations. This is a good thing, and gives the TTC much-needed headroom in the face of a $33m projected shortfall in revenue.

- Labour costs are down by $8.3m from budget due to larger “gapping” than planned. This is a double-edged sword in some contexts. For example, a shortage of operators can lead to the need for more overtime (a “bad” thing) which can run headlong into attempts to control that cost area.

- Fuel and power are down by a total of $5m due to milder than expected winter weather (remembering that previous winters had been especially bitter).

- Accident claims are running $6.5m above budget notably due to one large settlement earlier in 2016. This is an example of a cost area where infrequent events can produce spikes that throw off attempts at uniform, controlled spending.

The CEO’s report presents a long list of projected variances in capital spending (budgeted vs actual cash flows) [pp. 56-60]. This is important in the context of the “Capacity to Spend” adjustment in the 2017 budget that implies that almost $1 billion in previously identified costs will not, in fact, occur. However, the vast majority of the underspending in 2016 is due to timing differences between the budget (itself drawn up in mid 2015) and actual performance on various projects. Little of the reduction is due to a reduced scope of work or unexpected saving (which itself could be due either to better than expected work conditions, or an original overestimate).

Customer Satisfaction Survey

The TTC’s Customer Satisfaction Survey is conducted by an outside company on a rolling monthly basis with quarterly reporting. Each quarter represents about 1,000 responses spread over the preceding three months so that, for example, the second quarter 2016 data give feedback from the period April to June 2016. The intent is to spread out the survey so that short-lived effects do not skew the numbers.

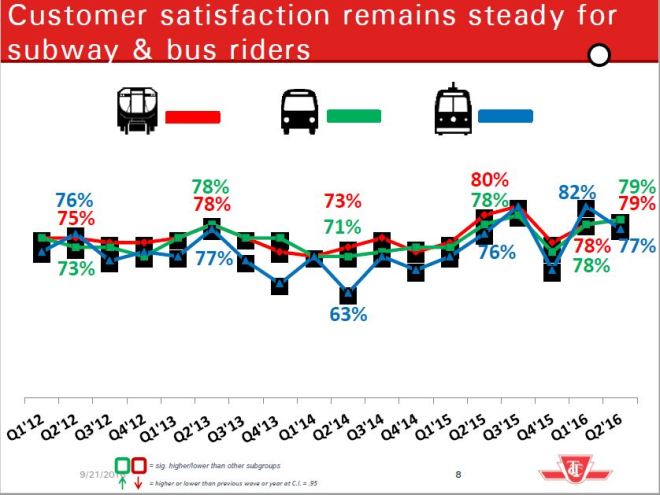

For the three-year period from 1Q2012 to 1Q2015 (mostly the “Ford” era), the overall satisfaction index wandered between 71% and 79%, but began to trend up in 1Q2015 until a particularly strong dip in 4Q2015. The TTC attributes that fallback to the withdrawal of extra service provided during the PanAm Games, but that effect was short-lived, and the index is back up to 80%. We do not yet know the results from 3Q2016 when the hot weather affected riders’ tempers, equipment reliably and especially the air conditioning on the Bloor-Danforth line.

Although the TTC did make some service improvements over the past year, these have been quite localized in space (specific routes) and time (off-peak vs peak) so that many riders would not be affected by them. No correlation is attempted in the survey to match up a rider’s most commonly used routes with locations where service has actually improved beyond the very coarse measure based on mode (subway, bus, streetcar).

The satisfaction index has consistently tracked lower for frequent users of the system than for occasional users. This could reflect the circumstances under which occasional users travel with trips less concentrated in the peak, and on routes where a rider chooses the service because transit actually “works”. How much of this is actually a “trend” and how much is just statistical noise is hard to say.

Riders of streetcars have a somewhat lower satisfaction score, although this is not consistently the case. Many of the values in the chart below are too close together to represent a real difference especially without qualifying information about why a rider might think service is better today than before.

Riders who use only one mode for their trip are, generally speaking, more satisfied than those who must transfer, but the values track fairly closely and the relationship occasionally reverses. This suggests that while there may be a difference in the two groups, it is small, and subject to statistical fluctuations on a similar scale.

The TTC prefers to concentrate on the rise in its overall index, but the breakdowns, even at this coarse level, suggest that “upward” is not a consistent trend. Although the overall index went from 79% to 80%, it fell for the following groups: occasional users (87% to 85%), streetcar users (82% to 77%), riders who use more than one mode (77% to 76%). Some of these changes could well be noise, but the TTC does not publish a band for these numbers. For example, if it turns out that the values are only accurate within ±3%, then almost all of the variation here would be statistically meaningless. (The range would be higher for the subgroups because “N” is smaller.)

A related question is the scatter in response values. If 1000 people all said they were “happy” with TTC service, this is different from a situation where only 300 give this response, 350 say they are “over the moon” about the TTC, and the remaining 350 say “TTC is a hellhole”. The existence of a large group of unhappy riders would flag a need to improve, not to pat yourself on the back based on the overall average.

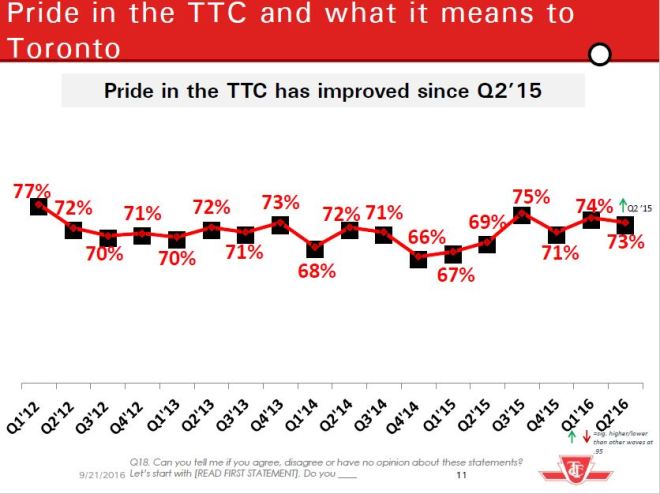

One chart purports to show that “pride in the TTC” is going up. I will leave it to readers to decide whether this is true. Yes there has been a recovery since late 2014, but the number is still only in the midrange of values through much of the survey period.

An intriguing value is the “pride” subdivided by travel mode where bus riders have the highest scores. This index tracks somewhat differently from the overall satisfaction numbers, and we see that it actually declined for all modes in 2Q2016. Yes, there is an increase relative to 2015, but it remains to be seen whether this will be sustained.

In all of the mode-based charts, it is important to remember that some riders use more than one mode, and therefore their experience is a compound effect of travel on each of these, as well as the transfers between routes. Given that the count of modes used totals 148% of the respondents (see the “behavioural” breakdown at the end of this section), it is tricky to assume that their opinions on any of these questions reflects their travel on one mode.

The presentation contains several charts [pp. 15-19] purporting to show improvement in most subcategories such as “wait time” over the period 2012-2016, but there is neither any numerical value associated with each category, nor an indication of whether the change has been one of gradual improvement, or a sudden jump. Indeed, it would be possible for a value to have been higher sometime in that period than it is today, but the effect is masked by how the data are presented.

The demographics of the respondents show the age ranges, types of trips and fare payment methods used. Note that these are based on the sample population without adjustment for actual TTC demographics or frequency of use so that except where survey values are subdivided (e.g. by frequency or mode), there is no indication of the relative proportion of TTC riders who are affected by some factor in their use of the system more than others.

Tickets and tokens remain the primary method of fare payment for just over half of the respondents, with Metropasses at about one quarter, but we know from other TTC reports that over half of the trips taken on the TTC use Metropasses for payment. Similarly, the proportion of respondents citing “Presto” as their payment method is considerably higher than the actual proportion of trips paid for with that medium.

Less than half of the “most recent” TTC trips taken by those surveyed were for work (43%), although the proportion of respondents who are employed was higher (64%). This is a very important statistic showing the importance of non-work based service both in time and in location, and the degree to which a commuter focus in TTC planning and in political emphasis might not match the lion’s share of TTC demand. Similarly, only 48% of the trips were taken during the peak periods with the remainder during the daytime or evening. One might argue that this demand could rise if only the TTC would serve it better.

There could be a skew in these numbers depending on the time of day when calls are most likely connect with willing respondents. For example, if more surveys are done in the evening, then fewer of the “most recent trips” are likely to be early in the day.

Implications of Micro-Transit

With the continuing sense among some members of the TTC Board that the city is overrun by nearly empty buses running at great cost and little benefit, the question of how ride sharing services might participate has come up at the Board. A brief review by staff notes a variety of factors based on a review of experience elsewhere:

- microtransit services could transport people in ‘hard-to-serve’ areas, to connect with TTC services;

- microtransit could replace large buses on transit routes with low demand and reduce the fleet requirement for large transit vehicles;

- microtransit services could replace private automobiles for some travel;

- microtransit services — if operated on a large scale — could increase traffic congestion, thus degrading the performance of Toronto’s major arterial roads;

- microtransit vehicles could create operational conflicts with TTC vehicles through actions such as picking-up and dropping-off passengers on busy arterial roads;

- large-scale microtransit operations could attract ridership away and revenue from busy TTC routes which, in turn, could result in the need for increased municipal subsidy to support the continued operation of less-busy TTC routes or the high-frequency of transit service offered in major corridors. [pp. 1-2]

What is missing in this analysis is a review of the actual size of the market that any form of microtransit might serve, and the degree to which this could be done more cost-effectively with existing or improved quality of transit.

There is a basic assumption by microtransit advocates that this market is quite large, but no analysis of which parts of Toronto might actually fit the target, or whether this would be an all-day or off-peak only operation. In other words, just how much of the TTC’s system could even viably be replaced by this type of service, as distinct from extending the reach of transit to areas now without service (which are comparatively few). For example, the idea that the bus fleet might be reduced assumes that there are routes where even the peak service does not require a full-sized bus. If, for example, there are enough people riding the Rosedale bus to justify a full-sized vehicle during peak periods, then replacing it with microtransit in the evening does not reduce the fleet size.

This brings up the basic question of where the boundary might lie between “micro” and “regular” transit, and how the transition between these services might be achieved. This has implications for riders who live on the outer part of the transit network where one could argue “full sized buses” are not needed 18 hours/day. Should they be forced to transfer at a local microtransit hub in place of a through run by their regular bus route?

Would the operating cost be subsidized as part of the transit network in much the same way that taxis operating for Wheel-Trans charge riders a TTC fare, but receive much more for the trip? Would microtransit operators be free to dispose their fleets based on presumed levels of demand or would they be required to maintain a contracted “service quality” in terms of response time even at off hours? Could they supplement “TTC” trips with fares obtained through their own dispatching system? How long a “last mile” trip would be provided with such services, as opposed to a relatively short hop (if there actually were one) to a “mobility hub” where conventional transit service is available?

Would microtransit services be an integrated part of the transit network including funding and fares, or would it simply be a local taxi-like service? Would the responsibility to fund the service, including quality guarantees, lie with the public sector or with private operators? In effect, how much of the “public” function of transit including funding would actually be shifted?

These may sound like a lot of bureaucratic objections, but the real question is simple: what is the appropriate structure of the transit network and service regardless of who actually drives what vehicles. Is a review of microtransit intended as a way to improve transit’s accessibility and attractiveness overall, or is this simply a diversion from the basic need for better bus service?

Surplus Land Review and the Future of Danforth Garage

The agenda includes a report on surplus property that tells us almost nothing about what might be available for redevelopment on the grounds that all of the information, even a list of properties used by the TTC (whether owned by the TTC itself or the City), is in the report’s confidential appendix. All we know is that there is a total of 309 properties with no breakdown of their status.

Were any of these to be declared surplus to TTC needs, the report notes:

Multiple properties outlined in Attachment 1 generate revenue for the TTC by way of lease and/or air-rights agreements. Any transfer of these properties would require an offsetting increase to future TTC operating budgets. Furthermore, the redevelopment of TTC property may have an impact on TTC’s capital and operating budgets due to the nature of the development of the property. [p. 2]

The issue of development on transit properties comes up quite regularly, but the discussions tend to be quite vague and based on an assumption that “there’s gold in them thar hills” without any real numbers or sense of scale. This contributes to the ongoing premise that TTC budget problems can be covered by asset sales rather than addressing basic questions about the TTC’s role, scope and funding.

Meanwhile, one specific property, Danforth Garage, is reviewed in detail because there was a specific request from the Board to do so. Although this site is no longer used as a garage, it has several other functions notably as the central office for crews on the BD subway (Line 2) and the Collectors Group, including parking for those who arrive and leave outside regular TTC service hours. TTC Plant Maintenance uses about 1/4 of the old garage building “for the storage of materials, equipment and tools”. These functions could be relocated, at some cost, but the property is not just sitting there vacant. The report concludes:

In summary, until it can be determined how the TTC operations functioning out of this facility can be alternatively accommodated, this site will not be considered as surplus to TTC needs. [p. 6]

This will likely not please those who have been agitating for redevelopment, and I suspect that the Board will direct staff to review this in more detail to determine the cost-effectiveness of relocating the site’s current functions.

It is a shame that the City so often leaves information entirely hidden in confidential attachments. Surely a redacted version of the properties list in the Danforth Garage report could have been released, for example.

Even though I pass the garage’s Coxwell entrance on foot several times a week, I was surprised that 874 staff nominally work through that facility, albeit many for only parts of the day. While the property in question may have some redevelopment potential, it might also be somewhere the TTC could consolidate *additional* positions to expanding office space on site, especially given the notorious condition of Davisville HQ.

In the alternative, a land swap could have been considered where part of the land could have been leased to TPA for parking and Coxwell Station gain frontage on Danforth through development of part of the 25 space lot at 1612 Danforth. But instead the back of the bus loop has been prettied up with a mural which totally makes up for the narrow alley one must trek through now…

LikeLike

I do agree, Danforth will be up for further study, those developers are drooling over that property. lots of development mid high rises happening along the Danforth between Donlands and Main Street. And to note, TTC also said there’s no space available at the Greenwood yard to house what is currently done at Danforth. I thought TTC would have taken the opportunity to entertain the idea of getting funding to expand Greenwood yard to accommodate all the functions Danforth currently has. Especially moving the operators to Greenwood Yard which would make more sense. I’m sure the developers are lobbying to get Danforth and TTC wouldn’t have to worry about the contaminated soil and/or water which will be a win-win.

If TTC is hell bent on keeping Danforth, just use it as a temp or satellite garage which would be a better excuse. Or has the TTC dropped that idea of temp garage, seeing as how ridership hasn’t come to fruition?

Also I’m still not buying the excuse the TTC is giving for A/C issues on the T1s. The H5 and H6 were older and still had working A/C. 25-30% of them weren’t failing. You don’t have a bunch of A/C units breaking down by surprise, they should have anticipated the interval between failure was increasing and acted on it. It’s not the first time TTC had 20-15 year old trains. TTC clearly has a preventative maintenance problem, don’t blame the train if you can’t properly do the upkeep. If they don’t have the funding then say it, but don’t insult the customer with the ridiculous excuse that they’re 20 years old. It’s not like they got to 20 years overnight.

Steve: The TTC is already short on garage space because they have continued to expand the fleet while not expanding garages. During the Ford era, the project for a new garage in northern Scarborough was deferred to push that capital expenditure off of the books, but it didn’t remove the need. Now they face a chronic shortage for coming years, and even that won’t be completely undone when new rapid transit lines open in the early 2020s. The fleet plan originally included a reduction in bus requirements thanks to LRT conversions, but some of that is delayed (later opening dates) and some has disappeared entirely (lines that will never be built).

Moving the operators to Greenwood is a difficult for a few reasons. First is simply having some place to put the functions now carried out at Danforth, but also there is the relationship to the nearby Coxwell Station and the on-site parking. Greenwood Yard is not as close to Greenwood or Donlands Stations as Danforth is to Coxwell Station, and this would increase the travel time between the office where work is dispatched and the point where operators take over trains. One might say, well, yes, but couldn’t that be designed into redevelopment either at Coxwell/Danforth or some other location. The trick is actually getting it done.

A further subway problem is that both Greenwood and Davisville are stuffed full of fleet and staff for which there is not adequate space. The TTC has been contemplating a new subway yard southwest of Kipling Station, but that is years away, the property is not yet in TTC’s hands, and the construction project is not funded. This is the sort of thing that happens as year after year an organization makes do.

As for Danforth as a bus garage, the biggest problem is that it’s an old building originally designed as a carhouse and since converted to non-garage uses. Putting it back into shape for short-term use would be a throwaway cost, and would reintroduce diesel buses to a site where they have been absent for years, not exactly the sort of thing neighbours would welcome.

The TTC and Toronto badly need a plain-spoken review of industrial property requirements for transit across the city. Property is becoming harder to get, and co-existence with adjoining uses brings political challenges.

LikeLike

I really don’t understand what exactly they are trying to solve by now designating certain services as “microtransit”. How does that really differ from “lightly patronized”. What kind of vehicles would be involved. The last time the TTC flirted with smaller buses, it was the thirty-foot Orions that proved to be a pain in the ass, especially if there was an unexpected surge in ridership (they were taken of 33 FOREST HILL and 82 ROSEDALE, for example, because they could not handle the 3:00 surges of kids going home from school).

On the other side of the coin, would microtransit vehicle serve areas that are now sparse with service but have substantial densities. Large swathes of areas off Yonge St. north of Eglinton, for example, have limited access to regular transit, although it is assumed that this affluent stretch can rely on cars.

I’m really getting the sense this is a canard of a debate.

Steve: It’s the Deputy Mayor off on one of his schemes to justify spending less on the TTC. However, I think it’s worth at least reviewing what the market actually is (a notable omission in the report) to determine the magnitude of change and benefit (not necessarily the same thing) a shift to microtransit would involve.

LikeLike

The link to the Surplus Land Review points to the Customer Satisfaction Survey.

Steve: Thanks for catching this. Fixed.

It’s noted that:

By going to the CTRES page, we can get a list of the surplus properties, and leased/licenced properties.

Steve: Link please?

They have 19 listings of “surplus” properties, there are 8 that explicitly mention Metrolinx or the TTC:

There are an additional 88 listings of leased/licenced properties.

What part of this is really “confidential”?

LikeLike

The surplus-properties list is here.

Steve: That’s the list of already declared surplus property as opposed to property used for transit, but not yet surplus.

LikeLike

Does Micro-Transit promise another paradigm shift? Like UBER? Why wait for a micro bus, call instead. Systems can use calling patterns and history to determine whether a car or minibus required today. Micro could use bus lanes and help justify a much more extensive system of bus lanes. Customers might get to work by a different route everyday. Why route everything via cramped subway, some could go direct. Even big buses could run ‘flexible routes’, going where clients are instead of fixed route and headway. No end to the possibilities. TTC owned? Or contracted against a specification? Can taxis apply? Is it the end of taxis? We only need ONE ‘system’. Even suggesting walking last (or first) mile when congestion is bad; quicker for customer and releases a vehicle.

LikeLike

I did some research and found out that only a high school diploma is required to become a fare inspector. Two buddies of mine have PhDs and one makes about $65k/year and the other about $70k/year. I have a Masters degree from U of T and I only make $60k/year. Do you think that the TTC is overpaying our fare inspectors? I am not making a statement one way or the other but asking for your opinion. Also at “at least $100k/year” per fare inspector, the TTC would be better off asking Toronto Police to do the fare enforcement and that would also increase compliance as people respect police officers with guns as opposed to fare inspectors or special constables. Security guards in the private sector only make anywhere from $30k/year to $45k/year and so having the private sector do fare inspections is an option worth considering. I am NOT saying that all jobs at TTC be taken over by the private sector but I do believe that cleaning and fare inspecting jobs be privatised.

Steve: Don’t forget that the number I quoted includes benefits which add a substantial chunk.

LikeLike

When someone says “a {position} costs {organization} ${x}/year,” I usually assume that figure includes not just salary + benefits (+ employer taxes/fees like CPP, EI, WSIB, etc.) but it also includes a pro-rated fraction of the personnel/management cost of that employee. So 20 fare inspectors would add (for the sake of argument) overhead of 2 supervisors, 10% of an HR position, 5% of a payroll position, etc. And of course those (say) 2.5 (cumulative) extra positions would all cost salary + benefits + employer amounts too, on a higher base pay.

And it’s likely even worse in this case, because for every person you have writing tickets, you need a certain amount of resources to _collect_ those tickets. I’d actually be surprised if they’re making more than k$50/yr in base salary.

LikeLike

Traffic density basically works against much of your possible “paradigm shift”. Union Station has 125,220 average weekday ridership. Assuming the best case scenario that this is distributed evenly over 19.5 hours (subway operating hours) that’s 6422 passengers. Now assuming you have 10 seat mini-buses, that’s 643 mini-buses per hour (assuming each is completely full). If each is 3.45m long, that’s 2.218km of lane space, which is roughly 4 lanes from Spadina to Yonge. That’s just one station worth of passengers under optimal conditions. It doesn’t matter which route you take to work every day if they are overcapacity.

If you want an idea of the cost of “micro transit” just look at Wheels Trans. It’s a point-to-point service that runs “minibuses”. There isn’t a one-size-fits-all solution to transit because different people have different needs and ability to pay.

LikeLike

It would be interesting to see what the market for a dial-a-ride type service might be … one way to do it initially would be to take all the buses that run on less than 15 minute service in say Etobicoke and auction off the rights to serve those stops … I would structure it in the following way …

All stops on the routes being replaced would continue to exist and a specialized presto machine would be added to the stop … the way it works is you scan your card and select a destination (from stops that are within the original route, or are near to the stop) … the priority would be close stops that are major connectors.

The contract would be flexible in two ways, one would be the service levels (% of trips served within X minutes from the presto tap) – ideally this would be significantly better than the 15+ minute service that the ttc was previously providing. The second one would be cost to the TTC … this would be a fix priced contract for 1 month … with the original contract in each area being given for 6 months to allow for the kinks to be worked out … as long as the contract over a year is less than what the TTC was spending operating the vehicles to begin with … then they come out on top … market place economics over 6 areas would allow for competition.

Companies would make money by the short nature of the trips and by pooling riders along a route, or using whatever optimization they feel is necessary as long as they hit their contracted targets … they would also be able to operate their vehicles as cabs or uber style vehicles at their own determination … or provide bigger vehicles on routes if that would be more beneficial for them …

If the auction goes badly, we know there is no market for this … or nobody is willing to take the risk on these low use routes.

Steve: The first problem with your model is that there are very few services in Etobicoke that have service every 15 minutes or worse in the peak period: 30 Lambton (20′), 80 Queensway (30′), 145 Downtown Humber Bay Express (30′). Since the fleet size is a function of peak requirements, very few vehicles would be saved during that period, although there might be some off-peak services that would convert to dial-a-ride evenings or weekends. That doesn’t save buses, only changes the mode, and complicates the operation of the transit network.

A related question is whether the dial-a-ride service would be part of the TTC fare system so that, for example, one could transfer to and from regular routes, use passes, etc. If so, then the TTC (and hence the City and other riders) would be paying the full cost of the dial-a-ride trip.

I am sure the folks on The Queensway would be thrilled to learn that they would be getting dial-a-ride all of the time rather than “big buses” especially considering the developments now underway on that street.

LikeLike

The only way I can see making ‘dial-a-ride’ work with the TTC is offering a Uber co-fare, let’s call it UberTransit. A normal Uber fare has four main components: base fare, price per minute at low velocity, price per distance at high velocity (in London, UK it’s £0.32/min below 18kph and £1.75/km above 18kph), and finally the surge pricing multiplier.

It’d work similar to UberPool, but allow them to access TTC bus stops.

LikeLike

The test plan that George Bell proposes strikes me as being inevitably a failure.

To take 80 Queensway as an example, there are either two or three buses assigned to the route during the day, and one in the late evening that runs only to Humber loop. The busiest part of the route is east of the Humber and along Parkside Drive anyway, and you’d probably want to run that as a bus route. So west of Humber loop, you’re talking one bus.

Traffic along The Queensway can be good, but it can be bad as well. To respond anywhere along the route to a call from a stop, you’d need maybe two vehicles. But if these two vehicles are busy, and a third call comes in, how do you service it? The demand is not high enough to warrant a fleet of vehicles, but it’s also random enough to be very hard to serve effectively with even two vehicles — at least in an ‘on demand’ mode. Once you switch to a mode where you run along the street, you’re back to scheduled line-haul service, which is what you were trying to get away from.

If you allow this on-demand service to travel off The Queensway, and putatively solving the last mile problem, you need to have quite a fleet of vehicles ready to go at any time, because some of the time they will be navigating residential streets and taking time to drop off or pick up, and won’t be available on the main street.

Oh, we can use automated cars! say the techno utopians. Well, we don’t have them right now, and I really wonder how maintenance-free automated cars will be, even just to keep them clean and the batteries charged up. Suddenly we need a large space available for maintenance and charging of these vehicles, and they’ll need good road access because they’ll always be coming and going….

LikeLike