Among the many reports (scroll down to the bottom of this document for links) coming to Toronto’s Executive Committee on March 9 is a short paper on Transit Network Analysis, three detailed demand projections and a paper about Growth Assumptions. Although this has the neutral title Population and Employment Projections, it is in fact a review of the effect of SmartTrack on development in the Greater Toronto Area. The main report is titled Commercial & Multi-Residential Forecasts For The Review Of SmartTrack.

The paper is authored by the Strategic Regional Research Alliance, or SRRA, whose primary focus is real estate market tracking and projection. This organization (or its principals) were involved in the reports leading to the original SmartTrack plan in now-Mayor Tory’s campaign, specifically:

- The New Geography of Office Location and the Consequences of Business as Usual in the GTA (Canadian Urban Institute, March 2011)

- A Region In Transition (SRRA, January 2013), and

- The Business Case for the Regional Relief Line (SRRA, October 2013).

A fundamental premise running through all three papers, and perpetuated in the SmartTrack proposal, was that downtown Toronto was more or less fully built-out, and that future commercial growth would occur primarily in two major centres outside of the city, the large area around Pearson Airport and an equally large area around Markham. The potential for additional growth within Toronto itself was regarded as low, and therefore major expansion of the rapid transit network would focus on the two big suburban nodes.

At the Mayor’s direction, SRRA was retained as a consultant to the planning work now underway by the City of Toronto. This raised eyebrows both at Council for the crossover from a campaign support role to consultant, and also at Metrolinx where SRRA’s principal, Iain Dobson, had been appointed to the Board during the latter days of Glen Murray’s term as Ontario Minister of Transportation.

Although there is reason to take the new SRRA report with a grain of salt, the document makes interesting reading including a shift in some of SRRA’s outlook compared to their earlier work.

Which Land Use Model is Toronto Actually Using?

This report is supposed to be background to the overall planning study coming to Executive, but its focus is exclusively on the effects of SmartTrack. There is little mention of the development effects of other initiatives including the Scarborough Subway Extension (SSE), the Eglinton Crosstown LRT. Also, in part because ST and the GO/RER proposal cover the same territory and share stations, it is unclear how much change to development patterns occurs specifically due to SmartTrack and how much to the two services operating in one corridor.

Other background studies examine ridership effects of various combinations of SmartTrack, the SSE and the Relief Line, and these clearly must have an underlying land use, population and job location model. How this was developed or relates to the SRRA study is not clear.

That said, for the remainder of this article, I will concentrate on the SRRA text and its underlying assumptions.

The Growth Model and Transit Oriented Development

The terms under which SRRA conducted their projections dictated that they estimated how SmartTrack would affect the distribution of future growth, but that the magnitude of growth would not be changed from the values used in other planning work. In other words, jobs and populations might locate differently, over time, thanks to a major new rapid transit line, but Toronto as a whole would grow at the same rate. This creates an interesting “winners and losers” scenario as we will see later. It also challenged the planners building the development model.

Good transit oriented development produces the densities required to support transit infrastructure. In some cases, RER and SmartTrack bisect low density, industrial areas. The forecasts in this report assumed that overtime TOD would occur at these higher order transit locations. This, in turn, leads to sustaining ridership for the transit projects.

The underlying condition in the scenarios of a single constant GTA employment and population forecast presented the consulting team with challenges. Simply moving growth around from one area to another depending on what transit solutions are put in place does not account for the impact of transit implementation on overall growth in the Region. Economic research strongly suggests that a transit improvement like SmartTrack will likely result in greater Regional growth than would have occurred without it. SRRA’s research from other cities indicates that effective transit tends to generate more growth when TOD is aligned with transit implementation. The consulting team recognizes that for the present exercise neither SRRA nor the City of Toronto were in a position to estimate the Region-wide productivity and agglomeration benefits that may result from SmartTrack, or how they may be distributed across the Region. [p. 4]

An immediate question and a topic familiar to readers of this site is this: to what extend is transit demand driven by development in the immediate catchment area of stations, and to what extent is it driven by feeder services? This is not a trivial issue as we can see at many locations in Toronto where high demand exists at rapid transit stations surrounded by little development. Moreover, trunk routes such as the four subway lines radiating out from the core accumulate ridership along the way from a combination of surface feeders and walk-in trade.

This is related to the “last mile” problem for rapid transit network design. If there is poor collection/distribution service available at the ends of a journey, then residential and commercial locations are effectively not on the transit map. This is a particular problem for areas such as the district around Pearson Airport which has been developed on a high-capacity expressway network and presumes auto access for its work force.

SRRA is ambivalent about the relationship of a new ST service and development:

There is a clear need for further research and analysis of this potential impact of SmartTrack on overall growth in the GTA. Without effective investment and intensification surrounding stations adjacent to SmartTrack and RER, the Region may not grow as expected. The converse is also true: implementation of SmartTrack and RER may result in more growth than expected. [p. 5]

Where Will Growth Occur

SRRA notes that there are locations where growth is physically possible given existing land use and zoning, but the question remains whether it will actually occur.

There are zones such as Scarborough Centre, the Kennedy Corridor, Mississauga City Centre and others where there are few restrictions to developing a considerable amount of office development. There are numerous sites where office development is unconstrained by zoning, is economically feasible and where the community supports the concept of office development. However, the marketplace has not yet viewed these nodes as desirable. In many cases, new office buildings have not been constructed in over 25 years. With new high speed regional transit connections or the proximity of improved transit connections, these areas may see some office development in future. [p. 9]

A key word here is “proximity”, and this means very different things to transit riders and motorists. To a driver, a site is “close” if parking is available nearby, ideally integrated with the destination. To a transit rider, a site must be in a short walking distance of the transit station or have a frequent, reliable connecting service. Even with these in place, transit faces an uphill battle in the competition unless the auto option is degraded by congestion, lack of parking or a cost that is perceived to be uneconomic compared with the extra time for transit journeys.

At this point, I have to jump ahead a bit to a discussion of development locations and potential.

The growth of office space until about 1980 was concentrated in the Financial Core of the City of Toronto with almost no space in the 905 area. Since then, the 905 has seen the development of more than 65 million sq. ft. of space – equivalent to all the office space in Calgary and Edmonton combined. Two thirds of that growth has occurred in two 905 clusters: the Airport/401 corridor in Mississauga and the Markham/Richmond Hill nodes. A significant proportion of office workers in these two clusters live in proximity to the proposed SmartTrack/RER transit corridors.

The nodes as described in The Nodal Study are established areas of commercial employment in office space. They account for 75% of all office space in the Region. More importantly, they account for 95% of all new construction in the Region in the past 25 years. The expectation that employers will continue to view these nodes favourably and that they will accommodate new employment growth is very high. [p. 20]

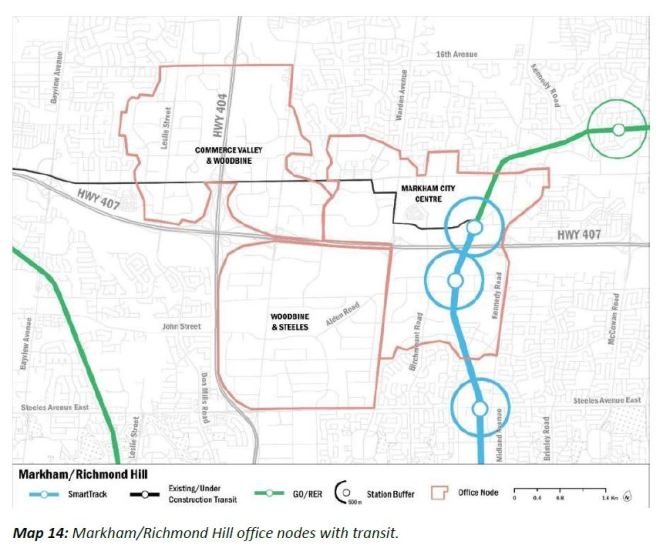

This map is fascinating on two counts. First, it shows where the major nodes are (and equally importantly where they are not), and it begs the question of just how well each of them might be served by transit.

Scarborough Centre is intriguing because it is shown with two rapid transit stations on an east-west link even though what is currently planned is a single station on a north-south link.

Markham is a good example of a mismatch between rapid transit coverage and the scale of the area to be served. Most of the “node” is well beyond the immediate area of ST stations, and would be heavily dependent on transit feeders. Moreover, Markham will clearly draw employees from many directions, and ST would only be one contributing access route. The obvious role of the highway network cannot be ignored.

Three quarters of the Region’s growth in the past 25 years has taken place in these three clusters of nodes. Slightly more than 100M sq. ft. – 46% of the total amount of office space in the Region – is located in three areas:

1. The Financial Core and the Brick and Beam districts in downtown Toronto;

2. Airport Corporate Centre, Hurontario and Meadowvale nodes; and

3. Markham/Richmond Hill.The potential for growth in Airport Corporate Centre, Hurontario, Meadowvale, and Markham/Richmond Hill would improve as a result of investment in RER and SmartTrack. Effective ‘last mile’ solutions and changes in land use policy would need to be implemented. [p. 22]

Future development was projected onto the nodes shown above with the following results:

The effect of capped growth, of a zero-sum situation where population and employment stay the same regardless of the network configuration, show up in the much higher employment figures for “416 Other” and “905 Dispersed” in the “Without SmartTrack” scenario.

The chart contains a few surprises that should make planners and politicians wake up, and quickly:

- Large growth at the Airport is dependent on major new transit service. Whether this is SmartTrack or some other combination of services, the growth cannot happen without better transit (see below).

- Similarly, growth at the Lever site is entirely dependent on transit access. Again whether this is specifically from ST or from other services, notably GO/RER, transit is critical. This is an example of SRRA focussing on the effects of ST alone in an area where other transit services would make a contribution.

- The Financial Core is projected to have continued growth with only a slight reduction if ST exists thanks to redistribution of jobs, mainly to the shoulder areas such as Liberty Village and the Lever site.

- Eglinton & Don Mills shows considerable growth relative to its current level, although why so much of this would depend on the comparatively remote ST line is a mystery. Note that this model does not include a Relief Line up Don Mills which would make a major contribution to the attractiveness of this node.

- Growth at Scarborough Town Centre is low, below the levels in other competing nodes. This begs the question of whether the rosy future for Scarborough touted in the new Scarborough transit plan can actually be achieved, or whether the forecast transit demand increase comes from a continued as a bedroom suburb.

- Almost no growth is forecast for Vaughan Metropolitan Centre, even though it will soon be the terminus of a new subway line.

- Richmond Hill, the projected terminus of a Yonge subway extension, is not even considered to be a development node in this study.

A Problem of Model Granularity

Several areas where growth is projected used fairly coarse-grained zones for travel projections in earlier studies. This can work for car-oriented projections because the last mile problem is less important. However, if a large zone is treated as if all of its population and jobs exist at a central point, this can substantially misrepresent the effect of transit access as a component of travel times and the attractiveness of various potential services. In many cases, the demand model was adjusted to subdivide zones so that the location of potential development within the larger original zones could be more accurately modelled.

This is an important piece of fine-tuning that has been missing from many previous studies whose models were better suited to car travel, and which made virtue of necessity with fewer zones to stay within the then-current computing technology’s capabilities.

What Will SmartTrack Achieve?

The origins of ST are clear in a few statements:

By reducing trip times to existing or potential concentrations of employment, the speed and geographical reach of SmartTrack will increase the potential labour market for these areas, making it more likely that development will occur. These improvements in trip times were taken into account in determining development risk and the likelihood of intensification around stations. For example, through this effect SmartTrack is likely to lead to greater development in Markham/Richmond Hill and the Airport District because these areas are not currently well connected to the T.T.C. and downtown Toronto.

…

Service levels have not yet been established for SmartTrack. It was assumed that service levels will be expanded to match demand as required. The initial proposal of 15 minute service in the Mayor’s platform would be achievable over time with more frequency to accommodate demand. The consulting team assumed that the ‘surface subway’ concept would eventually be delivered – just as the current subway system opened with considerably less capacity or frequency than it operates on today. The assumption is that the line would be able to provide enhancements in service as development occurs. [p. 16]

One obvious correction is in order. The level of service on the Toronto subway system have been quite frequent since the lines opened.

- Yonge subway, April 1954: 2’30” headway AM and PM peak (2’21” today)

- Yonge-University subway, March 1967: 2’19”

- Bloor-Danforth subway, March 1967: 2’27” (2’21” today)

The Mayor’s platform spoke of very high demand on SmartTrack practically from the day it opened, a demand that could not possibly be handled by a train every fifteen minutes. Indeed, we know from the recent demand studies that without frequent service (every five minutes), SmartTrack will not capture its supposed market because the penalty imposed by a long transfer connection negates much of its attractiveness in travel time.

As for being connected to the TTC and to downtown, one must note that both Markham and the Airport District are not in Toronto, and growth of their transit access, such as it might be, has been the work of local and regional agencies, not the City of Toronto or the TTC. It is somewhat ironic that a connection to downtown is now touted as beneficial because of the access to workers who prefer to live centrally with all the benefits of the core area. Whether they will choose to out-commute remains to be seen, but this will depend on very attractive transit access and travel times. For example, depending on the station location near Liberty Village (and whether there even is a station on the Weston corridor nearby), residents there will not have easy access to ST trains that would have given a one-seat ride to Markham or to the Airport. Then there is the small problem of getting from the ST station to the work location.

The SmartTrack stations do not serve this very large area well as they are located on the eastern edge of the area. Moreover, two stations are shown on either side of Highway 407, but only one Unionville station will actually be built reducing the coverage that it would provide. Milliken Station’s immediate area does not even reach the boundaries of the Markham nodes. This shows the vital role of the last mile local transit service as an important part of transit as a credible alternative to driving.

The Markham/Richmond Hill office cluster has developed around low cost land that is easily accessible by car and serviced by the intersection of the 404 and 407 highways. The pace of development has declined in recent years in common with other auto-based nodes in the 905. Employers indicate that this slowdown is the result of growing congestion. Employers said directly that a high speed transit alternative to connect to labour markets is extremely important to location decisions.

…

The key constraints to further growth in this node is the need for high order transit, and the provision of convenient connections to it in the low density environment. This connectivity is referred to as the ‘last mile’ solution. During the interviews for The Nodal Study, many employers indicated that, based on their knowledge of other global markets, dedicated transit solutions that connected high speed rail with minibuses and other technology-driven transportation (often jointly paid for by industry) would significantly improve the attractiveness of the area and overcome its dispersed nature. Several employers are already involved in these ‘last mile’ solutions in the Region.

The recent introduction of Bus Rapid Transit (BRT) on Highway 7 is an important step in meeting the ‘last mile solution’. York Region is aggressively pursuing new strategies which SRRA believes will go a long way in connecting this area to SmartTrack and RER.

SRRA has assigned growth to this dispersed employment cluster in recognition that the introduction of SmartTrack and RER can reverse the slower growth patterns of recent years, in combination with VIVA and a variety of technology-driven ‘last mile’ alternatives (on-demand buses, and web-based ride sharing as demonstrated in markets in other global cities).

With current ‘last mile’ solutions available to support the growth of employment in this area, SmartTrack and RER have the potential to increase transit use by employees at a much higher rate than exist today.

York Region provided SRRA with the results of a 2014 study on where people working in Markham lived. This study revealed that approximately 30% resided within 1 or 2 transfers to SmartTrack. This helped inform the additional growth forecast by SRRA.

Jitney and other services are the “mode of the moment” to deal with inaccessible suburban office and industrial developments, but they are only a stop-gap. Their capacity and frequency are unlikely to compete with direct service by rapid transit, and they will impose the inevitable penalty of a transfer connection for their journey segment. Also, these services tend to be time and location specific until demand builds up, and a funding mechanism that does not depend on a single employer evolves.

As for the home locations of workers, only 30% are 1 or 2 transfers from SmartTrack and only they can reasonably be tapped as a market. Moreover, just how far that transfer connection might lead (for example a subway trip connecting at Kennedy Station) is unknown. ST is only one part of a larger network, not the network itself.

Out at the airport, the situation is even more confused. The map above shows two SmartTrack stations, but (a) the SmartTrack Eglinton spur is no longer in the plan, and (b) the LRT line replacing it will turn north into the airport.

Road congestion has recently slowed down new construction. Employers indicate, however, that Airport Corporate Centre could continue to be a very attractive location with the direct high speed connectivity provided by SmartTrack. This node could accommodate an additional 100,000 jobs. [p. 29]

…

The data indicate, for example, that the two main terminals together will account for approximately 40,000 highly concentrated jobs by 2021, which will in turn enable public transit to serve the employment growth effectively. In addition to daily workplace transit use, SmartTrack ridership will also be augmented by passenger travel to the Airport. [p. 30]

Here we see both the conflict between auto-oriented development that has run out of capacity (the Airport Centre) and a mixed message about the relationship of SmartTrack to the Airport itself which has many jobs, but no SmartTrack station.

The conflict between planning for one line, SmartTrack, and planning for a network (the alleged goal of the new City network reports), could not be clearer than here. The airport authority itself recently released a study Pearson Connects which foresees the airport area as a major transit hub. In their map, the Airport Centre (which is only part of a much larger employment area) is served by the Mississauga BRT to Renforth Gateway (now under construction), not by the Eglinton line.

Factors Affecting Development

SRRA identifies a “Catch 22” associated with new rapid transit stations: if land around the station becomes more valuable, it may cease to be attractive to certain types of development.

Land values surrounding proposed stations are a factor in determining the relative locational appeal for further development. For much of its route, SmartTrack and RER run through lower value industrial land or lower density residential developed areas (downtown Toronto being the major exception). Higher order transit projects once they are under construction, generally cause land values to increase, in some cases dramatically.

If the land value increases to the extent that new development is not competitive and development does not occur, transit ridership will suffer. SRRA, in projecting development growth, assumed that public policy would create favourable market conditions at each stop. The solutions to land value accretion are beyond the scope of this assignment. SRRA assumed that land value accretion would not deter intensification and that its development potential would not be negatively affected by inflated expectations with respect to land value. [p. 17]

The hierarchy has three principal stages:

- Recycled industrial buildings such as the “Brick and Beam” districts east and west of downtown Toronto

- Commercial office space

- Residential (condo) development

An area can become uncompetitive as a commercial location because the land can more profitably be developed, and possibly more quickly, as condos. This pattern is obvious both at Scarborough and North York centres.

Past development patterns have been affected by the commercial tax gap between the 416 and 905.

However, for the purpose of forecasting growth, it was assumed that high speed transit and access to labour is now the number one competitive force, even though SRRA expects the tax gap to continue for the next 25 years.

It is clear that SRRA has not paid much attention to the Toronto budget process because the 416/905 gap will be eliminated by Toronto’s tax rebalancing strategy by 2020. The only remaining inequity will be in education taxes which are set by Queen’s Park.

In any event, the problem of accessing labour has to deal with where that work force actually lives, and that’s where a network of services comes into play. The core area is particularly attractive because it can be reached in so many ways, and this will only increase with the addition of GO/RER, SmartTrack, a Relief Line and improved streetcar services. Moreover, the core has the built-in advantage of short commuting times for those who can afford to live nearby. Single station additions to a planning node cannot achieve the same level of access, especially if they primarily serve riders arriving from only one direction.

The Financial District

The detailed review of the Financial District includes a major change of heart for SRRA analysis:

The close knit concentration of offices, connected by the PATH system, creates agglomeration benefits which drive the FSS and will ensure continued growth. The FSS accounts for approximately 70% of existing leased space in the Financial Core, and its growth has been consistent, absorbing an average of 450K sq. ft. annually for the past 20 years. If this trend continues, there will be adequate supply of space for the FSS to grow.

…

Because the PATH system has recently been extended to new construction south of the rail corridor, this node can accommodate about 65,000 new jobs to 2041. This was deemed to be adequate supply for growth of the FSS and related businesses over the 2011-41 period.

This node is well served by public transit. Only 25% of in-bound trips are auto-based. SmartTrack and RER will provide considerable new capacity for employees to access the core and continue its success. Both RER and SmartTrack will decrease travel times for some downtown workers and increase overall access to workers who live in lower cost communities outside of the core.

SmartTrack and to a lesser extent RER will provide residents in downtown Toronto with access to jobs in sectors other than the FSS in Markham/Richmond Hill, Scarborough and the Airport District, thereby increasing the attractiveness and growth potential of the condominium development in the downtown. [p. 25]

Only a few years ago, SRRA’s position was that almost all new development would occur in the new suburban nodes. Their earlier studies ignored the capacity available in what we now call SouthCore, and contrary to earlier claims, there is no office space crisis downtown. Moreover, there remains much developable land in the eastern waterfront that was not even considered as part of the future inventory. SRRA’s focus on Markham and the Airport skewed their outlook, and led directly to the claims made for SmartTrack’s role for suburban development.

As for access to jobs in these outlying areas, it is unclear why many of those living in downtown Toronto who moved there to be close to the heart of the job market and to live a downtown lifestyle would choose to commute out to the 905.

The Lever (Great Gulf) Site

This site on the east side of the Don River south of Queen Street has the potential to be the eastern anchor of a whole new “downtown” for Toronto that will stretch from Yonge to the Don, and then south into the Port Lands with Lake Ontario as the focus for the entire development. The site could be served by a SmartTrack station on the Lake Shore East GO corridor, but this would also be a GO/RER station, possibly a Relief Line stop, and steetcar/LRT service from the waterfront network and from Broadview Station. One way or another, the Lever site will have lots of transit.

The Lever Site was tested in The Nodal Study as a potential site with the high frequency, ‘surface subway’ style service proposed for SmartTrack. Employers told SRRA that they believe that this would extend their ability to attract employees from Markham, Scarborough and as far away as Etobicoke, giving them access to a large and diverse workforce. This was the basis of the belief that only a high speed, high capacity transit service, like SmartTrack, can provide employers with access to a strong, affordable labour pool. [p. 31]

SmartTrack could be part of the overall solution to access at the Lever site, but it is not the only component.

An important difference for a new development such as this is that there is no existing travel pattern. New commuting patterns and home locations will grow as a function of whatever transit is, or is not, in place when the buildings are occupied. Toronto talks a good line about “transit first” in the waterfront, but fails to deliver as we have already seen in the East Bayfront.

Don Mills, Consumers Road, Scarborough Centre

Again, earlier studies by SRRA had downplayed the potential role of developments within the 416 on the basis that newer areas outside the city would draw all of the growth, Now, however, they talk of future potential.

The potential of the three areas referred to as Don Mills, Scarborough Centre and Consumers Road has not yet been met. The common denominator is that no significant commercial development has occurred in these nodes for 25 years. In the case of Don Mills, several sites have been repurposed (office to retail, office to institutional) or simply been developed for residential uses, including single family housing fronting on Eglinton Avenue. Development in Scarborough City Centre has been dominated by residential condominium growth. Growth in Consumers Road stalled after plans to service the area with higher order transit were cancelled.

Employers told SRRA that these three nodes would be considerably more attractive with high speed connectivity to the residential and employment centres of downtown Toronto and the employment markets of Scarborough and Markham/Richmond Hill. As a result, the consulting team allocated a reasonable amount of office employment in these nodes, based on the assumption that SmartTrack would provide greatly improved connectivity. [p. 34]

At the risk of sounding skeptical, SmartTrack is nowhere near most of the potential development lands and will at best provide another link in the rapid transit network from which a rider must travel to access new developments. Meanwhile, SRRA ignores the effect of the Eglinton Crosstown LRT at Don Mills and the SSE at Scarborough Centre. As noted above, growth projected for STC is quite low.

Downsview, Vaughan and Points North

Development projections for these areas are not strong except at York University, and if SRRA’s numbers are to be believed, the TYSSE will not see much growth around it for years. This does not mean that it will be empty, but that the riders will originate primarily from feeder services, not from immediately adjacent development.

Although the Spadina Subway Extension is nearing completion, the development potential is affected by two unrelated issues. Primarily, there is no significant office development along the corridor or in adjacent areas. As reported in The Nodal Study, interviewees who have toured the area are not enthusiastic about the area as an office location. Secondly, the amount of developable land surrounding the subway extension is limited in some cases to development by other uses. Any significant employment growth will most likely occur at York University, the major beneficiary of this transit project.

Although Downsview will be accessible by three subway stops and a potential RER stop, it has little market appeal beyond the specialized interests of the aerospace sector. Development of the area is constrained as a result of height restrictions related to the runways at Downsview. Attempts to attract commercial development even in locations where there are no height restrictions have not been successful. SRRA did not apply any additional growth in Downsview because it is being targeted for the aerospace industry and adequate provision has been made for this sector.

SRRA forecast some additional growth in the Vaughan Metropolitan Centre (VMC) consistent with the stated objectives of the secondary plan for VMC of 6,500 new jobs by 2031. A primary barrier to office development in the VMC is that expectations for land value greatly exceed the office market rents that could be earned at the location. It is also challenging to establish the conditions on the ground (such as appropriate parking standards) that will induce tenants to locate there. [p. 39]

Are we looking at the Emperor’s New Clothes in the Spadina extension corridor, or is SRRA out to lunch with their projections? If wrong here, what about elsewhere?

Everything Else

We finally come to the leftover areas in the GTA which, because of the zero-sum constraint on allocation of jobs and people, lose out in a scenario where SmartTrack soaks up development potential.

The consulting team also addressed the growth potential of the many dispersed office buildings throughout Toronto and the rest of the GTA. These dispersed buildings collectively account for 25% of the Region’s total inventory. Most of these office buildings were built as a result of very specific employer needs in industrial areas and are not clustered with other office buildings. For example, Allstate Insurance is located in Aurora in an area mostly devoted to industrial uses. In Toronto, the TTC’s operational headquarters on Bathurst Street is another outlier. Buildings like these were typically built before 1980.

SmartTrack will attract development that might otherwise have occurred in this dispersed area and may also attract employment from existing dispersed buildings. In the event that higher order transit is not provided to office nodes with potential to be served by higher order transit (described above), the pattern of dispersed development – that is, individual buildings built in industrial areas or arterial road locations, will likely continue, with adverse impacts on the community, both from a congestion and an environmental perspective. This is reflected in the forecasts for the scenarios without SmartTrack. [p. 40]

Tax Increment Financing

There is a lengthy section examining the scope for property value uplift around stations, but this is little more than a collection of maps with circles drawn around stations. There is no estimate of the value that might be captured, and as with the rest of this study, SRRA ignores uplift that could occur due to factors including GO/RER and other rapid transit projects.

Conclusion

It is unclear how much of the SRRA study actually affected the detailed model constructed by the University of Toronto for simulation of future travel flows. Obviously the addition of any new route to the network can trigger changes in development patterns, and this becomes a more complex problem when multiple new routes are added in a short period. The benefit a district might get from one project (e.g. a new subway to STC) may be overtaken by other districts becoming even more attractive.

The background material detailing the land use models for demand simulations have not yet been published. SmartTrack will be one part of a larger network, and its benefits for development will vary depending the final location and number of stations, the parallel role of GO/RER, the service plan, and competition from other transit routes.

As a background paper to a transit network study, the SRRA document is interesting, but sadly lacking in a wider view of the evolution of a network.

It’s exciting to see that McCowan is getting a BRT. If it does, it would go north to Markville Mall passing near our home.

LikeLike

Wow, the more we learn about ST, the less sense it makes. It was initially touted as an easy to build and cheaper alternative to a DRL that could also serve a much longer route … now it looks like a difficult to build and expensive solution that runs through a lot of deserted land, not exactly desirable for a high density rapid transit service.

Even a study that set out to prove the ST is necessary yields contrary results, and they have to tout weaknesses as strengths. (“Nobody actually lives near the ST stations, but that’s a good thing, because it gives room for growth!”).

When is John Tory going to admit that this plan is a turkey, allow Metrolinx to build a proper RER service with 15 minute headways, and focus on building a proper subway where people actually live and work now, and more and more appear every year? I mean a downtown subway on King or thereabouts that runs not just to Pape, but up Don Mills to at least Eglinton, and west to Dundas West. I be that sucker would be crowded from Day 1, not like the Sheppard street boondoggle, er, subway, built for future development, right along side one of the biggest highways in the world.

LikeLiked by 1 person

But don’t forget the TTC only ran 6 car G trains for a number of years before going to full 8 car trains. The capacity of a 6 car G train is around 65 to 68% of a new TR train. While the capacity was not as great then the frequency of service certainly was. Perhaps they are confusing capacity with frequency.

Steve: Yes, I omitted that because they talked about both capacity and frequency. In any event, the difference between a 6 and 8 car G train is a heck of a lot less than the difference between 5′ and 15′ headways on SmartTrack which is the point of comparison. (Similarly 4 vs 6 car H trains on Bloor.)

Is this report implying that government has to build transit to make the existing outside office nodes more desirable so the developers and/or employers can do better financially? Are they willing to change their development pattern to make it more serviceable by transit? Is it the responsibility of the city of Toronto to build transit to make 905 sites more desirable or should this be left to Metrolinx and the province?

Steve: This has always been the bizarre part about SmartTrack, the degree to which it exists to serve locations in the 905 and make property there more valuable. One wonders for whom SRRA is actually working.

The whole idea only makes sense with the premise that downtown is “full”. Now they have discovered SouthCore, although it’s not like it appeared overnight, and, presto chango, there’s lots of room downtown now. This is the quality of work we get from someone sitting on the Metrolinx board.

LikeLiked by 1 person

“the difference between a 6 and 8 car G train is a heck of a lot more than the difference between 5′ and 15′ headways on SmartTrack”

ITYM “…a heck of a lot _less_ than…” since the factor is 1.33 vs. 3.0

Steve: Ooops … yes … that’s what I meant to say. I will fix the comment.

LikeLike

The trouble in my mind with the Eastern Waterfront is that it’s not on the way to anything. I guess the Great Gulf site can be served by a station on SmartTrack/RER and/or the Relief Line, but the Port Lands and such would have to be served by a spur for any kind of high-capacity transit to work. Maybe the area is vast enough for this to still make sense, but in any case the planning would have to be sort of independent from anything else.

Anyway, the moral of this post would seem to be that (as everyone who thinks about this sort of thing knows) putting offices at the ends of transit lines mostly doesn’t make sense. From both transit planning and real estate perspectives, it’s most efficient for offices to go downtown and housing at outlying stations. This is why Scarborough Centre, the Spadina extension, are more obviously condo locations than office locations.

I don’t get the “Catch-22” concern. Why would land be expensive if you can’t build something on it to justify the cost? In expectation of future demand or zoning changes? Some kind of prisoner’s dilemma where everyone expects everyone else to build first?

Steve: The eastern waterfront LRT line makes sense in the context of planned development on the Port Lands. The residential component will be mainly along the water and nearby areas to the south of the (relocated) Gardiner and west of (roughly) the line of what is now Munition Street. This gives a doglegged line that comes east on Queens Quay, crosses the existing Parliament Slip (which will be partly filled in), connects to a new Cherry Street (west of its current location), crosses the Keating Channel on a new bridge, and then runs south on New Cherry to the north side of the Ship Channel. A branch/extension is proposed running east on Commissioners to Leslie, but that’s rather vague and decades in the future based on likely development. The main issue is to get transit to a large area of new housing.

The Lever site can also be served by an extension southward of Broadview to Lake Shore where a Broadview car could meet up with service coming east on Queens Quay & Lake Shore. This is all a bit vague right now because the area is being redesigned around the updated Gardiner/DVP interchange plans.

No one line can serve all of the new housing and office development to come in the eastern waterfront because it is too large an area. This is not territory for a “one stop subway”.

LikeLike

The decline in ridership is a direct result of the service cuts that Rob Ford imposed. The amount of damage that man did will take years if not decades to undo.

LikeLike